Record quarters for these two recruiters, but which is best?

12th July 2017 13:12

by David Brenchley from interactive investor

Share on

Unemployment rates in many developed markets – and some emerging ones – are at historically low levels. In the UK, despite a tough economic backdrop and with Brexit on the horizon, unemployment is at its lowest since 1975, 4.5%, on Office for National Statistics data released Wednesday.

That's helped recruiters, and and both reported record quarterly figures this week.

In a short but sweet trading update this morning, Walters said total net fee income for the past three months increased 16% in constant currency year-on-year, or 25% actual, to £86.3 million.

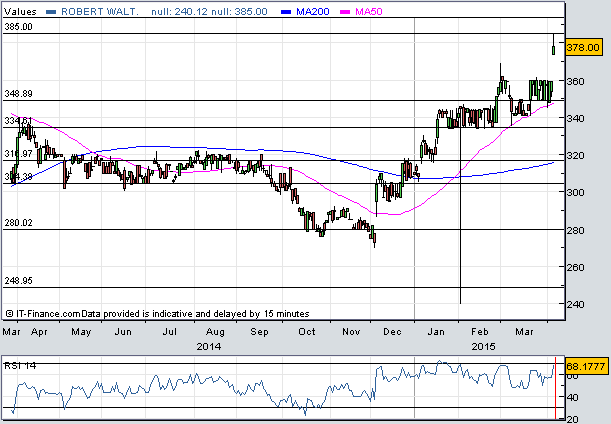

That caused shares to surge as much as 9% initially to within reach of levels not seen in almost two years.

It follows peer PageGroup's update yesterday, which also included record three-month profit of £182 million, 8% up in constant currency and 16% actual. Its share price ticked up, too, but only by 2%. They are currently trading down on Monday's close.

While UK net fee income was up 13% - with strong activity across financial services, commerce and IT in London – and Europe was stellar at 30% actual, Robert Walters' growth was led by other international regions.

In North America, Brazil, the Middle East and South Africa, net fee income was up 112% actual, or 86% in constant currency. While North America did best, Brazil also delivered impressive growth, albeit from a low base. Group net cash more than doubled to £18.4 million.

Boss Robert Walters hailed "another record performance" as his firm continues to benefit "from our international footprint and the breadth of recruitment solutions we provide". He said pre-tax profit for the full-year should be ahead of current market expectations.

Accordingly, broker Panmure Gordon rejigs its forecasts for 2017-2019. Pre-tax profit this year is lifted 10% to £32.9 million, with 2018 and 2019 up to £36.1 million and £40.3 million respectively.

PageGroup also saw strong growth across the pond, up 14% in constant currency, and has a strong balance sheet, with net cash of £87 million. The strong performance was despite Easter falling into Q2 this year rather than Q1 in 2016.

CEO Steve Ingram did speak of uncertainties that face the business, and the industry as a whole. Predcitably, these include Brexit negotiations and political uncertainty in the UK, elections in Germany and ongoing problems in Brazil.

Walters made no mention of these, but it will be interesting to see if he refers to them and the impact they are likely to have on the business at first-half results in two weeks' time.

Panmure made no change to expectations for PageGroup's full-year numbers.

Forecast earnings per share (EPS) for 2018 of 35.6p puts Robert Walters on an attractive price/earnings (PE) ratio of 12.6 times. That's a big discount to PageGroup, which trades on 16.5 times EPS estimates of 28.8p, PE of 16.5 times), and is despite superior earnings growth and potential, according to the broker.

A target price on Robert Walters of 500p suggests implies upside of around 11%. "Given its relative valuation and momentum the shares could easily breakthrough 2015 highs" of 478p, says analyst Adrian Kearsey.

A 450p target on PageGroup points to downside of 5% from 475p currently – also near multi-year highs. While its relatively high PE looks unexciting, the free cashflow yield is more compelling at a forecast 5.6% for 2018.

"Since the business refrains from M&A, has a low capital intensity and the balance sheet is unleveraged, all free cash is available to distribute to shareholders," Kearsey explains.

"Therefore, over the medium term, free cash flow will equal dividend distributions. As a consequence, it is relevant to view the FCF yield as a proxy for a total dividend yield.

"With another special dividend pending, we believe this methodology will increasingly resonate with investors."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.