Best bond funds of 2017

14th July 2017 09:19

Our two winners aim to produce high income for investors and protect investors' money when markets fall. Andrew Pitts and Holly Black look at this year's top performers.

Best sterling bond fund

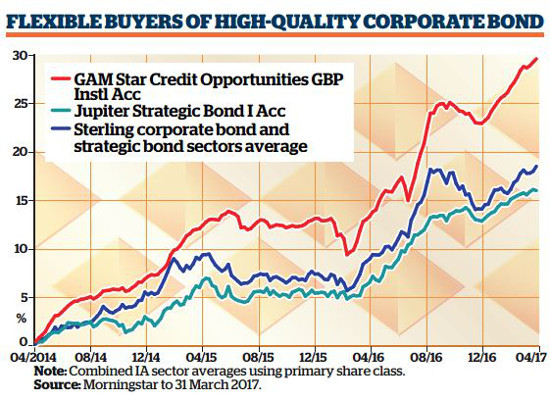

GAM Star Credit Opportunities GBP

1-year return: 14.3%; 3-year return: 29.3%

The fund aims to produce a high income for investors, primarily by investing in bonds from high-quality and investment-grade companies. But, reminiscent of a strategic bond, the fund also has the flexibility to move further down the investment rating scale in order to deliver a higher return. Currently the fund, which has £651 million in assets under management, yields around 4.7%.

Managers Anthony Smouha and Gregoire Mivelaz look for companies that are doing well and which are unlikely to default on any of their debts. If they can find such a business and it has issued junior debt, then they are able to get a higher yield without taking on meaningfully more risk than if they had bought its senior debt.

A Money Observer Rated Fund for the past two years, its list of top holdings is dominated by financial institutions, including bonds from , , , and . Recently Smouha and Mivelaz have also been adding to their holding of senior debt from Tesco. The average coupon in the portfolio is just shy of 7%.

The managers argue that being a smaller fund lets them take advantage of smaller debt issues that larger funds might not be able to participate in, but they may not be able to say that for much longer - the fund's assets under management have more than doubled from £296 million a year ago.

Highly commended Sterling bond fund

Jupiter Strategic Bond

1-year return: 8.9%; 3-year return: 16%

A Money Observer Rated Fund since 2013, can invest across investment-grade and high-yield corporate bonds and government bonds, as well as using derivatives to help provide protection if bond prices fall. It currently yields 4.1%.

Ariel Bezalel has been manager of the £3.7 billion fund since 2012, with the help of assistant manager Harry Richards and a team of analysts.

The team pick their investments based on their view of the global economy, working out how much risk is appropriate to take, and which sectors and countries offer the best opportunities taking into account factors such as inflation, interest rates and economic growth.

They like companies that are paying down their debts over time, which helps improve their creditworthiness and pushes their bond prices higher.

Currently, some 43% of the portfolio is in corporate bonds issued by companies including US telecoms firm BellSouth and Newmont Mining, and a further 31% is in the bonds of governments including Australia and the US.

Best Global Bond Fund

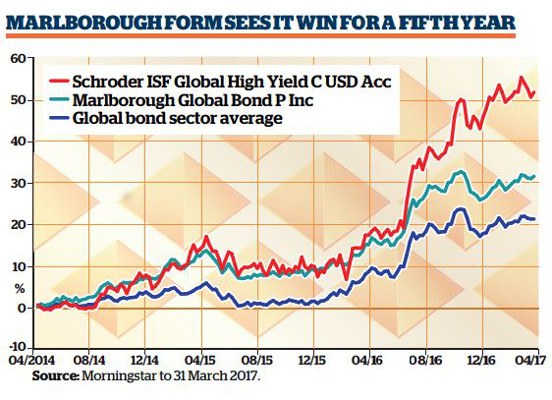

Marlborough Global Bond

1-year return: 14.8%; 3-year return: 31.7%

The fund set a record when it landed the title of Best Global Bond fund in our awards for four years running between 2012 and 2015. It has also been a Rated Fund since 2013. Now it is back for a fifth award win, after a year's hiatus.

At the helm is Geoff Hitchin, who has run the fund since he helped with its launch in 1987. He was joined by co-manager Nicholas Cooling in 1999.

Although the highly commended Schroder ISF Global High Yield fund has outperformed spectacularly over both one and three years, the panel overruled the statistics with a qualitative view in this case, favouring the broader-based, more conservative Marlborough fund.

Hitchin and Cooling have a cautious approach to investing, which aims to capture the gains when markets rise while protecting investors'money when they fall. Investing in government and corporate bonds across the globe, the portfolio has 446 holdings, which means the largest holding, , accounts for just 0.54 % of the portfolio, maximising diversification.

The £236 million fund currently yields 4.5%. Almost a third of the portfolio is in the UK, a quarter in the US and 17% in developed Europe. In terms of the credit quality of the bonds it invests in, the greatest proportion of holdings - 35% - are in BBB-rated investment grade bonds.

Highly commended global fund

Schroder ISF Global High Yield

1-year return: 31.1%; 3-year return: 51.8%

A newcomer to the Money Observer Rated Funds list in 2017, the fund invests at least two-thirds of its assets in bonds which are not investment grade - the rating being determined by an agency such as Standard & Poor's. It is a "best ideas" portfolio that aims to find the most attractive high-yield opportunities across the globe in order to deliver a high income. Currently the fund, which has £2 billion of assets under management, has a meaty running yield of 5.65%.

Almost two thirds of its assets are in the US, across government bonds and those of companies such as construction equipment rental business BlueLine Rental and internet services provider .

Outside of the US it invests in the bonds of firms including steel company ArcelorMittal, perhaps best-known in Britain for its construction of the red Orbit structure by London's Olympic Park. The fund has the freedom to use derivatives.

Best ethical bond fund

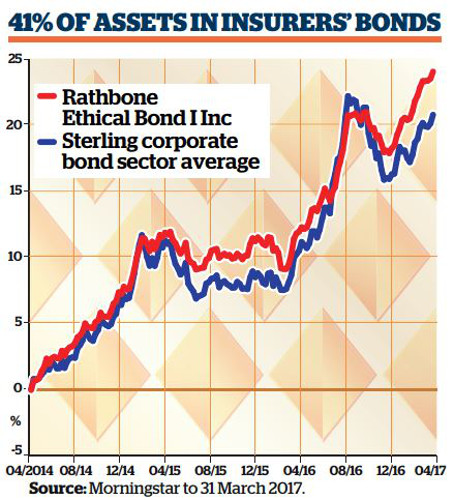

Rathbone Ethical Bond

1-year return: 10.9%; 3-year return: 24.4%

A third-time winner in our awards, the has been managed by Bryn Jones since 2004. The £654 million fund invests using both negative and positive screening to make investment decisions.

Negative screening criteria include alcohol, tobacco, gambling and animal welfare, while the fund looks for those businesses with good environmental policies, which invest in their communities and are strong on human rights.

The fund team work with Rathbone's dedicated ethical team, identifying corporate bonds that look attractive and then analysing them according to the fund's ethical criteria. Jones says his process focuses on the "four Cs plus" of character, capacity, collateral, covenants and conviction.

Some 41% of the fund's assets are currently in bonds issued by insurers including Royal London and , and a further 26% is in those issued by banks such as TSB. Jones is cautious on the current outlook, with politics and interest rate expectations influencing the bond market.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise.The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks