Two AIM companies in rude health

1st July 2017 16:07

The grand tour I took across England at the end of May is becoming a distant memory, but before I file away my notes from the day, some observations about , a company that, judging by its febrile share price, is giving investors the jitters.

I arrived at Portmeirion to meet Dick Steele, the company's chairman, straight from Churchill China's AGM. Since the two companies make tableware in the same city, it's impossible not to draw comparisons.

One sells a frame and one sells a picture

Both make plates in very hot factories, but the plates aren't at all alike, and they're sold to different customers.

customers are restaurants, and its objective is to show the food off, framing it either in a blaze of white or in an abstract pattern. Portmeirion's plates are the pictures, adorned with flowers, wild animals (the Americans love pictures of game), or Peppa Pig. Putting food on the plate obscures Portmeirion's artistry. At home we slide our best china from the dresser only on special occasions. At Restaurants plates get a fearful bashing so Churchill's plates are bigger, stronger, more functional, and cheaper.

Design v. tech

Portmeirion has found prosperity in brands, augmented last year by the £17 million acquisition of Wax Lyrical, a Lakeland manufacturer of scented candles and diffusers. It's existing brands though are mostly brands of tableware. Botanic Garden, remains the big one, earning about $30 million (£23 million) of revenue a year. Spode Christmas Tree is popular in the USA and brings in over $10 million. Steele says a Sophie Conran branded contemporary tableware range is "getting there" with annual sales of about £6 million.

Portmeirion's designers operate in a basement adorned with prints and littered with drawing tablets a few steps from the factory. They finesse the established designs and create new ones in the expectation of more blockbusters.

While the emphasis is on the creative elements of design at Portmeirion, the emphasis at Churchill China is on the technical elements, incorporating colour and texture into the production process as efficiently as possible. While I didn't see robots at Portmeirion, I did at Churchill.

Admirers from afar

There's an element of bewilderment at both companies when confronted with the other's success in what they perceive as hostile markets.

Perhaps lacking the brand power of Portmeirion, Churchill found it impossible to compete with cheap imports in supermarkets and department stores, which is why it's focused on the hospitality market, which is growing and results in repeat business.

At Portmeirion, Steele wrinkles his nose at the thought of selling plates to restaurants. Until quite recently Churchill China would have sold you any colour of plate as long as it was white. It's a really tough business, he says, because price is nearly all that matters.

Portmeirion's luxury product commands high margins, hence the importance of design, although Portmeirion too aims to reduce its reliance on retailers, by selling direct through its websites and factory stores.

South Korean conundrum

After a decade of growth, though, Portmeirion's record has taken a knock. Were it not for newly acquired Wax Lyrical, revenue would have fallen in 2016, and profit fell marginally despite Wax Lyrical's contribution. Portmeirion sells in three big markets, the UK, the US, and South Korea, and it's in South Korea, the smallest but perhaps the biggest market for its biggest brand, Botanic Garden, where the company is experiencing a large reversal of fortune.

Botanic Garden has grown in popularity in South Korea since it was introduced in 2000 because it's made in Britain, which carries a cachet, and the company has refined the range to include a much wider range of bowls, which Koreans use more. Portmeirion expects the pattern's popularity to endure, but what if it doesn't? Could 'Made in Britain' be a South Korean fad?

Steele backs the brand of course. Revenue in South Korea has fallen from £15m in 2014 to less than £10m in 2016, but the company explains political and economic uncertainty there has reduced demand for luxury goods, and stock leakage from India, where Portmeirion experienced a dramatic but unsustained upsurge in demand in 2015, may have reduced sales through its sole South Korean distributor.

In the relatively untroubled US and UK markets, Portmeirion distributes direct. In the Far East, though, the company uses distributors. Having lost some faith in its original distributor, it's reduced its dependence by appointing others.

Somewhat ruefully, I think, Steele describes these events as a "learning process", but it's costly because Botanic Garden is made in Stoke, and the factory is running way below capacity.

Ceramic Valley

Standing in a courtyard overshadowed by the ruins of what I imagine are mills, or factories long since disused, Steele reflects on the decline of the Potteries. Many firms folded because the industry could not compete with cheap Chinese imports, but Steele believes they were also mismanaged. Portmeirion benefited, it bought Spode and Wedgewood out of administration. He describes Spode as the best deal he was involved in.

As well as their distinctive businesses, the survivors have a common competitive advantage: their location. They still buy much of their equipment, like Portmeirion's new kiln, from local suppliers. Portmeirion and Churchill China are part owners of Furlong Mills, which supplies all of Portmeirion's clay and most of its glaze. While the skilled workforce employed in the region has declined in number, and the number of companies producing tableware has too, the survivors have grown and increased output in recent years.

Having created an Enterprise Zone, business leaders and politicians in Stoke-on-Trent hope the region will become a centre for advanced ceramics. Dubbed "Ceramic Valley", the zone includes potters like Portmeirion, Churchill China, Steelite and Emma Bridgewater.

Different folks, different strokes

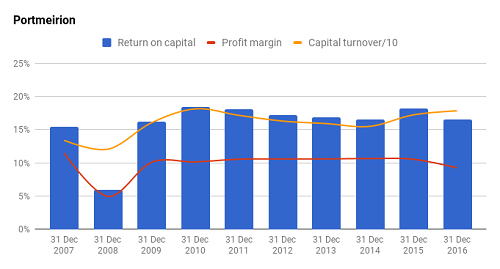

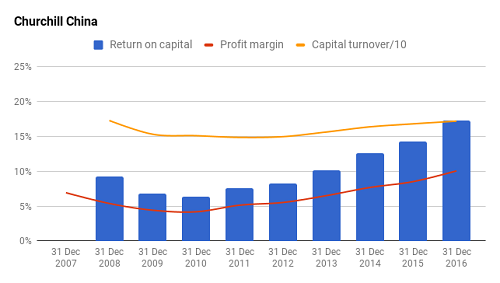

Despite their differences, Portmeirion and Churchill China have arrived, in financial terms, at an intriguingly similar position. In the year to December 2016 both companies, by my calculation, made an after tax return on capital of 17%. Operating margins were 10%. While Portmeirion's figures have been stable over the last decade, Churchill China's have continuously improved.

The figures describe firms in rude health. Whether you prefer one or the other depends on how contrarian you are, as Portmeirion shares trade on lower multiples of current earnings, but there are signs growth may be faltering.

There doesn't have to be one winner, though. They don't like each other's niches, but both potters seem comfortable enough in their own.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise.The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks