These are the top sectors fund managers are investing in now

17th July 2017 12:18

by David Brenchley from interactive investor

Share on

Financial stocks have had a lot of press since the election of US president Donald Trump, with many commentators claiming they are now more investible. Trump's election was supposedly positive for banking stocks due to an anticipated easing of regulations.

Fund managers have also generally become more positive towards European and UK financials, with the likes of – in Barclays' European Recommended Portfolio (ERP) since May – backed by many high-profile managers like Neil Woodford.

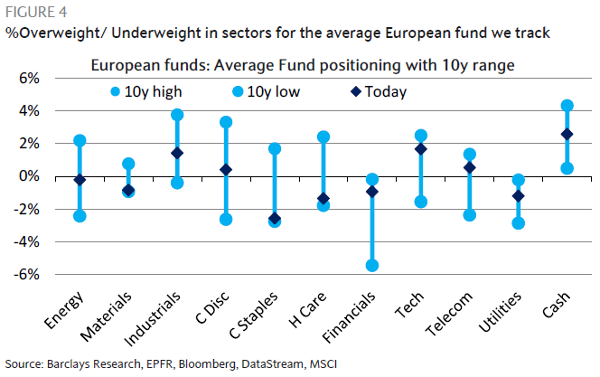

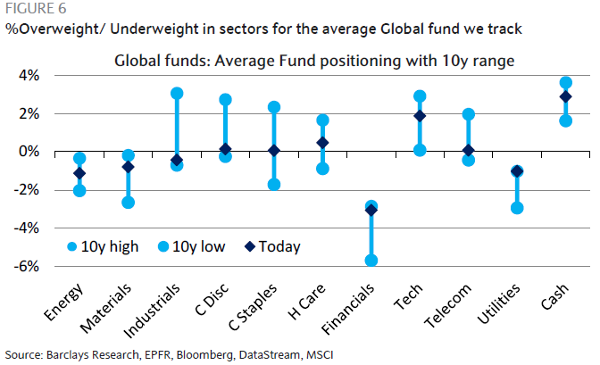

However, a study of European and Global funds carried out by broker Barclays reveals, in truth, this is not happening. In fact, funds focused on both regions are still underweight financials, though the position within European funds is not as extreme as it was a year ago.

That's at odds with Barclays' view; financials is the largest sector bet in its 42-strong ERP, with the likes of and joining Lloyds alongside Madrid-listed Banco Sabadell and Banco Santander amongst others.

Other findings show an overweight to technology stocks, after a strong run led by the US behemoths including , and Google owner . Global funds are 2% overweight techies. Just two tech stocks are in the ERP: Amsterdam-listed semiconductor firm and German financial services outfit .

Regionally, Europe continues to be popular, with 72% of MSCI World-benchmarked funds overweight the continent. The average fund is overweight by about 7%, which is approaching the highest levels seen in the 10 years Barclays has run the data. Conversely Japan is consensus 'underweight'.

Meanwhile, cash balances within both European and global funds have risen, especially in recent months, and are currently high relative to historic levels - 2.6% and 2.9% respectively.

Barclays' data analyses the equity holdings of 264 global and 169 European actively managed funds benchmarked to indices including MSCI Europe, MSCI World and the equivalent FTSE indices.

With European funds' positions in tech, telecoms and utilities all running at 10-year high levels, sentiment towards consumer staples, materials and healthcare are at a 10-year low, as you can see in the table above.

Within global funds, despite their 3% underweight position to financials being less than Europe funds' 1%, it's still near the best sentiment for 10 years, with the 10-year low at nearly 6%. This, along with sentiment toward utilities running at 10-year highs and industrials, consumer discretionary and telecoms at 10-year lows, is illustrated in the chart below.

On a region-by-region basis, the data shows global funds are underweight the US, possibly because markets across the Atlantic currently look expensive.

However, Barclays does point out that global funds have historically had a heavily underweight stance on the US. On further analysis, this is primarily driven by global income funds, with US equities typically offering low dividend yields.

Barclays' research also shows that conviction is currently low amongst active fund managers, supported by those historically high cash levels. "It appears to us that investors are taking less extreme sector positions than they have historically," the broker says.

This could be because managers anticipate stock-picking opportunities on the horizon and want to keep some powder dry, though it's equally likely to be the result of greater caution due to political and economic uncertainty.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.