Why this portfolio is selling China and banking 36% profits

25th July 2017 09:22

The UK market has ebbed somewhat in the last month, and the hope must be that this is the extent of any correction.

There are some grounds for optimism, as brokers expect a resurgence in earnings growth, with the consensus forecasting a 17% rise over the next 12 months.

Another big driver of profits this year has been the weakening of sterling following Brexit, as some 70% of companies' earnings are generated overseas.

Investors will have to watch out for any shifts in exchange rates as the Tory minority government negotiates with the EU in the weeks ahead. Theresa May is faced with the prospect of passing eight EU exit bills within two years, and each will inevitably be caught up in squabbles and posturing.

Investors will also be listening out for any hint regarding interest rate hikes. The Bank of England governor's Mansion House speech in June implied that weak consumer demand and sluggish wage growth rule out further rate rises, especially because the impact of the Brexit negotiations has yet to be fully understood.

Additionally, the oil price has dipped below $45 a barrel, which will also help dampen inflation in the coming months. That's a factor that has been concerning at least one member of the monetary policy committee. Andy Haldane, the Bank's chief economist, suggested a rate hike would be necessary to stave off inflation.

Markets have also been buoyed by merger and acquisition activity, driven by these low rates of interest plus the weak pound, and this should continue to help support the markets.

One of the nicest surprises is that financials have also not been dragged down by the economic backdrop and regulatory burden as much as expected. So far, at least, investors have also been quick to buy any dips.

China risk still looms large

That is not to say that markets are cheap, and that risks aren't growing steadily. Take China, where there is considerable uncertainty around president Xi Jinping's appetite for reform and ability to liberalise the financial markets and sort out problems such as the shadow banking system. The most visible sign of progress has been the admission of 222 mainland-listed Chinese stocks to the MSCI World index.

If President Xi Jinping can engineer a clean sweep at the 19th Party Congress, then there will be a chance of progressing beyond the current paralysis towards a reform agenda that will attract foreign inflows. If he fails, the old guard will be able to hinder reform with comparative ease and accelerate capital flight.

China's sub-prime market is also in a mess, with credit card and car purchase delinquencies. State-owned banks have focused on lending to the state-owned institutions, but a shift to the private sector is required. These difficulties are just part of the argument that the Chinese economy could collapse within 12 months.

On a brighter note, the likelihood of a global trade war with the US has receded for the near term, so there is little prospect of stifling China's large bilateral trade surplus.

It also helps that the US would be vulnerable to protectionist policies by president Trump as the Chinese authorities would be quick to devalue the yuan and sell US Treasuries. Where Trump really stands on 'America First' is not quite clear, but much of the rhetoric around trade wars seems to have been pre-election vote courting.

There is certainly more focus on Trump's reform of the corporate tax code, investment in infrastructure and the deregulation of the energy, finance, healthcare and jobs markets, which are all supportive of the stockmarkets. Moreover, very significantly, productivity is improving and employment data is already encouraging.

Reasons to be cautious

Just one question lingers, and that is how the Federal Reserve plans to wind down its $4.5 trillion (£345.5 trillion) balance sheet to more moderate levels.

The Fed is not alone in keeping its cards close. The European Central Bank (ECB) is also being opaque about how it intends to deal with stubbornly low inflation. President Draghi's recent speech in Sintra indicated that the ECB might now decide on a faster withdrawal of stimulus to adapt to the improving growth outlook.

It has a difficult job trying to time its rate rises and could fall behind in raising rates if wage growth rises sharply. Even so, the first interest rate rise is likely to be just 15 basis points.

Retail investors appear unperturbed, however. They have poured into European funds in recent weeks, with inflows of £343 million in May, the second highest after global equity funds. Even the government bailout of two Italian banks has not deterred them.

So, while there are some reasons to be cheerful, downside risks are also growing, and monetary policy exhaustion and excessive debt could derail the sustainability of the global recovery and market stability.

There is much to be said for taking profits where you can - particularly in China - and building reserves of cash for buying opportunities should the markets drop. This is our thinking this month, although the portfolio is still lighter in cash than is prudent at this stage of the cycle.

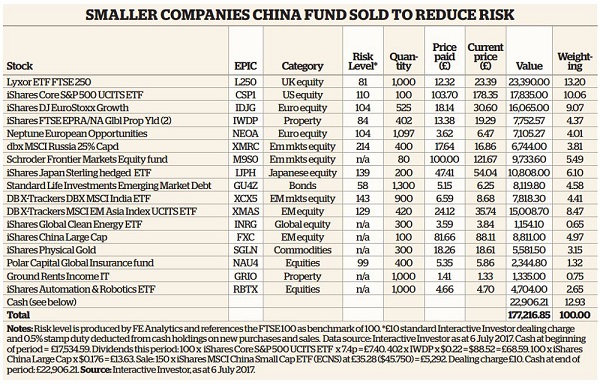

We hold both large and small cap China ETFs and are selling the smaller cap fund, . Our disposal nets the portfolio a tidy 36% profit since its purchase in September 2015.

But on the basis that these are the companies that could be most hit by the nation's debt overhang, we feel now is the time to sell. Larger-cap stocks will be exporters, which are more likely to be hit by any protectionist policies. This is something also worth keeping an eye on.

Our holding in has had a predictably dismal run since we bought it to take advantage of Trump's negativity towards climate change issues.

It should be viewed as a long-term hold, as ultimately wind and solar power and other renewable energy is the way the world must go. Several US states such as California have ignored Trump's stance and adopted the Paris Accord - one of the joys of the US Federal system.

Buying a Clean Energy ETF rather lacks credentials, however. A Clean Energy ETF will invest in companies that do all of the right things, which in this arena tend to be small companies.

In contrast, environmental, social and governance (ESG) funds increasingly embrace dirty companies and bring shareholder pressure to bear, which in turn helps improve the long-term prospects of the company.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks