Saltydog Portfolio: Having a system and sticking to it

27th July 2017 10:31

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Momentum investing is definitely not an exact science, and being successful will involve rules that you establish yourself or crib from others. These must increase the return or security of your portfolio, or they are pointless.

Acquiring this knowledge may have involved expensive mistakes, so these rules should not be discarded lightly. The danger can come after a run of success when you start to feel omnipotent and able to buck the market - and it frequently leads to tears before bedtime!

You therefore need something in your memory to fall back upon that will act as a reminder to take a second look before you override your rules. It need not be a previous disaster, just unforgettable. I certainly have my own event.

It may not be a surprise to Saltydog followers that my own "think again" occasion is a maritime one. I used to own a sedate, safe, 70-tonne trawler yacht, upon which I crossed the Channel many times.

On this occasion, I was making an overnight journey from Le Havre to Southampton when a very heavy fog came down, shutting off all visibility. That is not dangerous in itself - it just requires more attention to the radar and your seamanship.

But three hours out, and the radar suddenly started to look like Blackpool Illuminations, as ships totally invisible in the fog bore down on our port side on a collision course.

Now the rule that concerns power-driven vessels that are crossing states: "When two power-driven vessels are crossing in such a manner as to involve a risk of collision, then the vessel that has the other on its own starboard side shall give way. The other vessel should maintain its course and speed."

This rule applies whatever the size of your boat, be it the Queen Mary or an 18-metre trawler yacht.

At two o'clock in the morning, however, in thick fog with what appears on the radar to be the Spanish Armada only three miles away on a collision course and closing fast, an element of panic can set in. Fortunately, I stuck to the rule and held my course and speed.

I had everybody up in the wheelhouse wearing their lifejackets when on the VHF radio listening channel 16 came an American voice: "Will the vessel at latitude and longitude such and such, please make yourself known to the American warship Charleston." Well, of course, we were that vessel.

I identified who we were and where bound. They acknowledged receipt and then instructed us to continue to hold course and speed. It turned out that was the American Fleet on its way to attend the 2005 Spithead International Review to commemorate the bi-centenary of the Battle of Trafalgar.

One of the seven ships was the massive aircraft carrier the George Washington, but they all manoeuvred around us, without us catching a single glimpse in the fog - although we could hear them!

Imagine what would have happened if the rule had not been followed. It would have been chaos with almost certainly a bad result for me and my guests. I believe that following the rules applies to momentum investing as much as to seamanship, if you want to enjoy long-term success.

At Saltydog, our primary rule for entering a sector comes from our four-week numbers. We look for the sector with an upward trend and the highest return, which is ideally backed up by the 12-week table.

We are looking to identify the best fund, in the best sector, in the best Saltydog group. The primary rule is sector choice first and fund choice second.

When we come to sell, the decision is made by looking at the decile performance of the fund and the performance of the sector. We will keep hold of a fund even if its decile rank is dropping for a few weeks.

But if we see that it has dropped out of the top half of the decile ranking for three weeks in a row - i.e. its decile ranking is six or worse - then we sell it. This can be a hard decision to make, especially if the fund has done well over a long period of time.

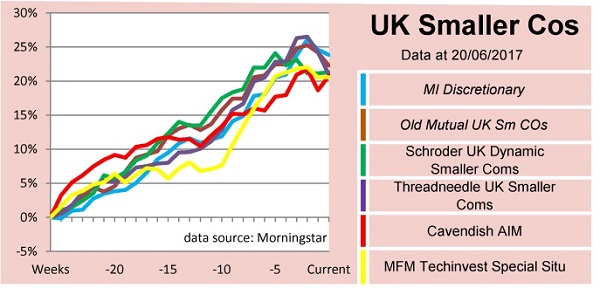

This was recently demonstrated by the performance of the UK small companies sector, which had run well for nearly 26 weeks until the recent election, when it fell off its perch. Here's a graph showing how the leading funds over 26 weeks looked a couple of weeks after the election.

We had made 23% by holding the for most of this period and it had become a favourite. Nevertheless, the decile rating had fallen off a cliff so it had to be sold.

At the time, the temptation was to assume it would recover when the election memories had faded: "Since nothing has changed with the economy, let's keep it."

But you just do not know what is going to happen. As it happens the sector has stopped falling and levelled off, but where to next? Perhaps it will turn down yet again and we will be pleased we sold, but if it goes back up then we have the choice to buy back in. We feel it is better to have avoided a loss than gambled on a continuing gain.

It is useful at times like this, when you are tempted to break your investment rules, to have that memorable event to fall back on - something that will act as a reminder to take a second look before you step out of line. If nothing else it will make you re-examine your situation before making a debateable decision that you might later come to regret.

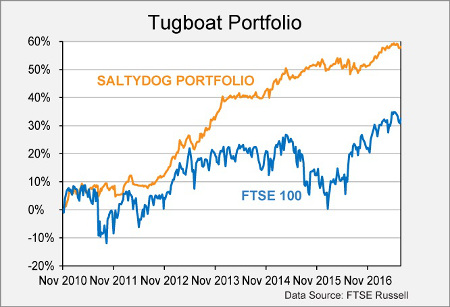

Our Tugboat portfolio has been making relatively steady progress since last September, but did suffer for a couple of weeks after the UK election.

Peformance of the Tugboat Porftolio since November 2010

In line with our momentum trading philosophy, we sold funds that weren't performing and allowed the cash levels in the portfolio to increase as we waited for new trends to appear.

Global equity markets dropped at the end of June, but have started to pick up again. If this trend continues we will be busy investing over the next few weeks.

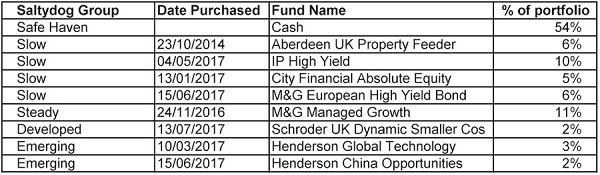

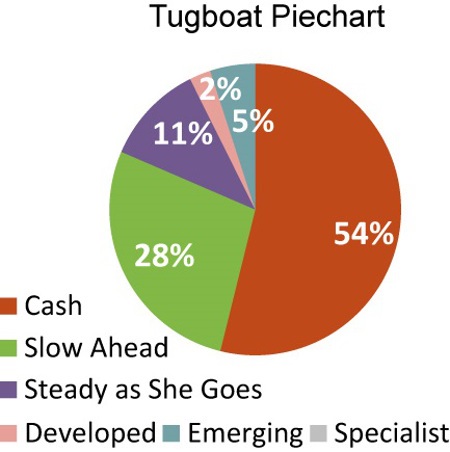

All the funds currently in the Tugboat Portfolio

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks