City's back in love with ITV as "relief bounce" predicted

26th July 2017 13:22

by David Brenchley from interactive investor

Share on

Love Island may be over for another year, but the recovery for shares could be just getting started.

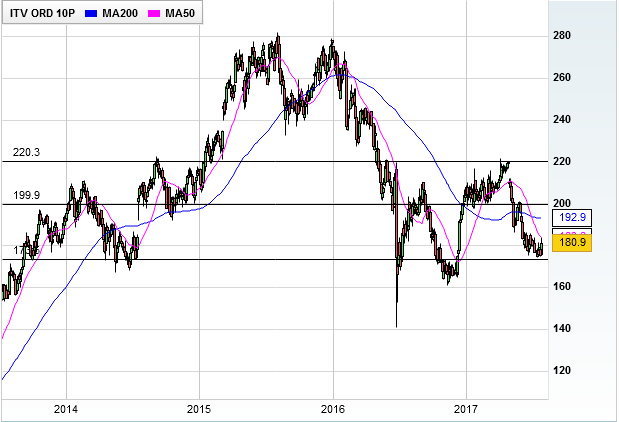

It's been a long road for the media company. It got hammered after the Brexit vote, slumping 36% to a three-year low of 141p. A recovery ensued and by late March the stock had shot up to 221.7p – 57% higher than its 24 June nadir.

That optimism lasted just a month, though, and the share price has weakened ever since. But, after first-half results beat analyst expectations, shares ticked up 4.5% to 184p Wednesday.

Its programming has been buoyed by Love Island, which has gone from a guilty pleasure to must-watch TV in the space of a year. Viewing figures for Monday's finale almost doubled 2016's number, with 2.43 million tuning in – a record for ITV2.

The surprise success of the reality show should help "provide reassurance on structural concerns", according to Panmure Gordon analyst Jonathan Helliwell. It's certainly been a boon for ITV, and chairman Peter Bazalgette said it "demonstrates that young viewers engage in great TV content". The challenge now is to follow it up with something just as engaging.

ITV's numbers for the six months to June were down as expected, but they weren't as bad as had been feared. Pre-tax profits were 10% lower year-on-year at £381 million and earnings per share (EPS) declined 9% to 7.7p. Meanwhile, margins also fell back to 15.8%, from 18.6% in the first half of 2016.

Good news came in the form of the interim dividend, which was increased 5% to 2.52p. Bazalgette says this reflects "confidence in the underlying strength of the business". Having acquired stakes in three production companies in the first half, a strong balance sheet allows for further investment in the business.

Brokers are mostly positive, with UBS the outlier. Liberum is the most bullish at a target price of 320p.

While ITV confirms there is no change in its full-year guidance, Investec has put its forecasts and target price (previously 228p) under review after pre-tax profits and EPS smashed its predictions. With a 'buy' recommendation on the stock, it acknowledges prospects for UK macros and advertising are tough in the near term but reckons shares currently discount this.

While Panmure's Helliwell only has a 'hold' rating, his 225p target suggests upside of 24% and comments are positive. There's scope for full-year numbers to nudge up, he explains, believing ITV "is now moving past the worst point for cyclical headwinds".

Carolyn McCall is set to take over as chief executive in January after former boss Adam Crozier switched to Vue Cinemas. The appointment of the former Guardian Media Group has been taken positively, considering the cracking job she's done with .

A forward dividend yield for FY 2017 of 4.4% remains supportive, covered twice by EPS and with scope for specials going forward. With EPS expectations of 15.8p, Helliwell says the forward price/earnings (PE) ratio of 11.5 times "remains very undemanding".

Bearish UBS set out five key challenges facing McCall when she takes the hotseat recently and, clearly, she's going to have her work cut out in the longer term. It's going to be a tough ask to break the 220p level that's provided both support and resistance since mid-2014, but Helliwell sees "scope for a relief bounce" from today's depressed levels.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.