A top-ranked, contrarian long-term investment

28th July 2017 16:17

by Richard Beddard from interactive investor

Share on

Ever since I have been ranking stocks, has been near the top of the list.

The company should be easy to rank because almost everything I know about it is good. Actually, though, every summer, when Castings publishes its annual report and I re-evaluate the company, I wonder if I have got it all wrong. It's what I don't know that worries me.

The best way to share my dilemma is to take you through my checklist. I score every company I follow out of 10, awarding up to two points to each criterion.

Castings manufactures parts for vehicles, mostly heavy trucks. It makes differential housings and steering knuckles, for example.

A Straightforward business

Score: 2

Accounting

Over the last 10 years Castings has only once reported exceptional costs, a sometimes dubious practice that allows firms to declare higher profits than is truly justified.

That was in 2009 when the Icelandic bank into which Castings had deposited its cash went bust and Castings thought it had lost £4 million.

Treating this cost as an exceptional item better reflected the underlying performance of the business, i.e how profitably it manufactured truck parts. In fact, it didn't lose that much money. Every subsequent year it's reported an exceptional profit as much of it has been returned.

The accounts are not scarred by accounting judgements relating to acquisitions, hidden debt in the form of operating leases, or, in fact, any kind of debt. Castings' pension scheme is in surplus and, in 2017, it actually repaid money to the company.

With Castings, what you see is what you get. Sometimes, you get a bit more than you expect!

Business model

What you get is two foundries, a machine shop and a lot of experience. That may sound early twentieth century, but it isn't. One of its foundries was commissioned in 2009.

It prototypes components using 3D printers, it checks their quality using 3D scanners, and it's investing in robotic handling.

Castings buys machines to reduce costs and earn high returns despite competition from lower wage economies. Since it's closer to its large European customers, it can also compete with Asian suppliers on service, turning around prototypes and orders faster, and sending engineers to work with customers.

Castings has supplied Scania, its oldest customer, for over 40 years, and its other major customers, Volvo Trucks and DAF, for almost as long. A truck chassis remains in production for about 10 years and once a manufacturer has tested and approved components, it tends to stick with them.

The reason Castings' long-term supply agreements have lasted is not because the truck manufacturers are bound contractually; the terms are very flexible. They're successful because supplier and customer have a vested interest in maintaining goodwill and continuing the relationship.

Castings fulfils its side of the bargain by matching capacity to the needs of customers. Truck makers experience high demand when new European emissions regulations are imminent and customers queue up to buy older, cheaper models while they are still available.

During recessions demand can fall, particularly from car manufacturers, from which Castings derives less revenue. Because of its heavy investment in plant, Castings operates less efficiently when demand spikes up or down, which means profitability can vary quite a lot from year to year.

There are two impressive things about Castings. The first is that variability is not as extreme as you might expect. The second is its ability to ramp up investment when customers need it, even if profitability is at a low-ebb.

Generating excess returns

Score 2

Return on capital

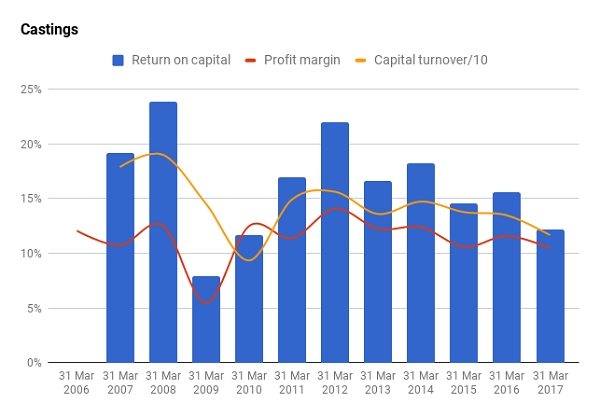

There's not a single year in the last decade when Castings failed to earn an acceptable return on capital (my measure is after tax).

In 2008 it came close to 8%, a level I consider marginal, but that was the year to March 2009, a year in which economic confidence evaporated and many people predicted a prolonged depression.

An average return on capital of 15% is remarkable. Fusty old British industrials aren't supposed to be this profitable.

The year to March 2017 was a sub-par year. Revenue at Castings' machining business, CNC Speedwell, fell by over 60% compared to the previous year after Land Rover ceased production of the venerable Defender.

Castings has secured enough new business to make good most of the loss, some of it from Jaguar Land Rover, but the work will only come on stream as new models are introduced over the next two years.

Meanwhile, Castings has borne the £5 million cost of tooling up for new components, resulting in below average return on capital, a 10% reduction in group revenue and a 19% reduction in profit.

Cash flow

Despite the disappointing result, Castings has demonstrated its superpower by doubling capital expenditure in the year to 2017 as it prepares to satisfy new contracts and roboticises its foundries.

It last used the superpower during the credit crunch, when it also doubled capital expenditure to complete its new foundry.

This year's increase in capital expenditure amounted to a little more than £14 million and Castings' considerable cash balance fell at the year end by a little less, £13 million, which is reassuring but the company also funded a £13 million special dividend.

Had it chosen not to return cash to shareholders the impact of its heavy investment would have been negligible.

Less well financed competitors have to cut investment when times are hard, turning temporary setbacks in profit into a prolonged drag on growth.

Measuring growth at a business like Castings is messy because of the variability of profit and turnover, but the direction is positive. My data from 2006 to 2017 shows an increase in revenue from £76 million to £118 million (£132 million in 2016) and an increase in profit from £9 million to £12 million (£15 million in 2016).

That it's resilient and adaptable…

Score 1

Castings' superpower has served it well. I'm sure customers have stuck with it because it's so reliable and it's been reliable because profitability pays for investment, which has enabled it to adapt to the demands of customers.

For example, as customers increasingly sourced components from the Far East 15-20 years ago, Castings invested in technology to reduce costs and improve service.

Today, Castings faces a different set of challenges, though, and the six million dollar question is whether it will be able to adapt to them. The challenges are:

Brexit

And the potential for tariffs and increased bureaucracy if different trade rules are introduced. In 2017, 71% of revenue was from exports, mostly to Europe.

Scania

Castings' customers are seeking to reduce the number of suppliers they use. Scania is a particular risk because it's one of the big three and it's now part of .

Unsurprisingly, perhaps, German truck and car manufacturers have large, efficient, local suppliers and Castings has been unable to break into the German market because Germans prefer to deal with fellow Germans.

That attitude might harden after Brexit. Together, the big three accounted for just over half of revenue in the year to March 2017, although that figure is higher than normal. Castings' biggest customer, which may well be Scania, paid it £33.5 million in 2017, 28% of total revenue.

Diesel

Diesel seems to be becoming a pariah fuel. While hybrid engines might be a benign development, some truck manufacturers like are prototyping electric models.

Technological hurdles remain, but there's a risk the writing's on the wall for the diesel engine. Since electric vehicles tend to have fewer, lighter components (because of the great weight of their batteries), Castings might have to manufacture in completely different materials to supply the market.

While Castings machines some aluminium components, its core business is casting and machining durable but heavy iron alloys.

These are fearful challenges, but they may not turn out to be as fearful as we think. Nobody knows how rapidly or how completely they will develop.

Castings is also a resilient business, we can be pretty confident about that.

Managed equitably for the long term

Score 2

Chairman and former chief executive Brian Cooke joined as an apprentice in 1960 and joined the board in 1966. He owns 4.5% of the shares. While his direct influence on the business may wane, the culture he and recently retired chief executive David Gawthorpe nurtured should persist.

Chief executive Adam Vicary and finance director Steve Mant have been with the company since 2010. Although Vicary is only recently promoted, both have had plenty of time to appreciate what makes Castings special.

One of those things is their remuneration policy, which is still generous by any normal standard. It is at least straightforward and transparent.

It gives me some confidence their focus is on growing the business and not gouging it.

And reasonably priced

Score 2

A share price of 455p values the enterprise at £180 million, or about 12 times normalised profit. The earnings yield is 9%, which implies decent returns for investors.

9/10

Castings scores 9/10, which makes it a highly attractive investment.

On the basis of the factors I can know now that will influence the future, Castings should prosper.

But my system takes little account of what might change in the future, which is uncomfortable because the future is at the same time unknowable and all that matters.

That makes Castings at the same time one of my highest ranked, and one of my most contrarian, investments.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.