Are we set for a large stockmarket fall in August?

31st July 2017 10:03

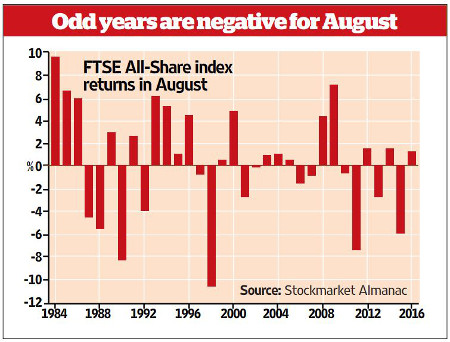

Since 2011, the UK equity market has displayed rather odd behaviour in August: alternating mildly positive returns for the month in even years, with large negative returns in odd years. In the event that this pattern continues then we are due a large fall in the market in August this year.

Besides that odd pattern, as can be seen in the chart, apart from the anomalous years of 2008 and 2009, since 2000 even when the market does rise in August, the returns are small.

From 1970 the average return for August of the has been 0.7%, with 62% of years seeing a positive return in the month. But since 2000 the performance has declined and the average return has fallen to zero. As a result, August now ranks ninth of all months of the year.

Over the past 10 years the FTSE 350 stocks that have tended to perform well in August have been: , , and .

By contrast, poorly performing FTSE 350 stocks in the month are: , , and . Rio Tinto has fallen in every August since 2007.

Towards the end of the month (on 21 August) the US will experience a total eclipse of the sun.

This is a big event, as the last total eclipse observable in the continental US was in 1979 (when, in fact, the weather was not the best). And the last solar eclipse whose path of totality moved from coast to coast (as it will in 2017) was back in 1918.

What's the relevance of such an event for investors?

Well, spooky things happen around eclipses. On average, in the 15 total solar eclipses that have been visible from the US since 1900, the Dow Jones Index tends to be weak on the day before the eclipse, and on the day itself, but then prices bounce back on the day after.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks