"Distressed valuation" makes Barclays a 'buy'

28th July 2017 13:26

by Graeme Evans from interactive investor

Share on

There have been plenty of false starts for the share price in recent months. On the face of it, Friday's half-year results were another frustrating landmark for investors after a whopping bottom-line loss and a further hit to cover claims for the mis-selling of payment protection insurance.

But hang on. According to chief executive Jes Staley it won't be long before shareholders can finally plug into "the full earnings power" of Barclays.

He said: "Our business is now radically simplified, the restructuring is complete, our capital ratio is within our end-state target range and, while we are also working to put conduct issues behind us, we can now focus on what matters most to our shareholders - improving group returns."

The restructuring process has seen Barclays retrench back to core markets in the UK and United States, having carried out an accelerated run-down of non-core assets and reduced its majority shareholding in Africa.

With Barclays taking a £2.5 billion hit on the Africa sale, bottom-line losses for the first half of the year amounted to £1.2 billion today.

Underlying profits were 13% higher at £2.3 billion, even though Barclays was forced to set aside another £700 million to cover the PPI compensation bill, taking its total charge to more than £9 billion.

Much of this improved profit performance reflected reduced losses in non-core, with Barclays having successfully reduced the level of risk-weighted assets to below its £25 billion target six months ahead of schedule.

Staley said this marked an end to the restructuring of Barclays Group, "and brings forward the date when our shareholders can benefit from the full earnings power of this business".

He added that progress was demonstrated by the first-half performance of Barclays UK and Barclays International, with returns on tangible equity of 20.4% and 12.4% respectively.

Barclays will update investors on its capital management plans and dividend policy at full-year results in February. In the meantime, the half-year dividend was kept at 1p a share, with the group expecting a payout for the full-year of 3p per share as previously guided.

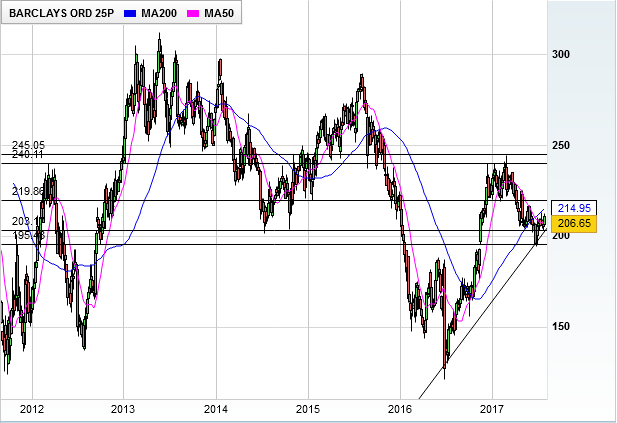

Investec Securities said today's results were messy, but analyst Ian Gordon has kept his buy rating alongside a target price of 245p.

He said: "Looking ahead, we keep a constructive view. 2017 should be the peak year for both non-core losses and restructuring charges.

"As such, caveated by conduct uncertainty, we continue to expect reported earnings and dividends to meaningfully recover in 2018 and beyond."

This conduct uncertainty includes an investigation by the US Department of Justice over allegations of mortgage mis-selling.

Gordon added: "Aside from , Barclays is the only large-cap UK bank on which we maintain a positive stance, given its 'distressed' valuation."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.