Conservative investment trust tips outperformed in 2016/17

1st August 2017 08:25

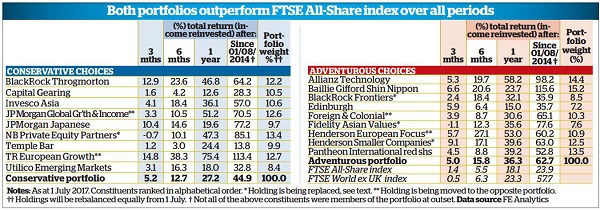

A trio of our conservative tips achieved double-figure share price total returns in the second quarter of 2017, helping the conservative portfolio to slightly outperform the adventurous portfolio for the first time in a while.

was again a star performer, with continued outperformance of its peers rewarded by a tightening discount. was also deservedly rerated, but still looks attractively priced given its ability to use contracts for difference to capitalise on falling as well as rising markets.

has been back in form at the net asset value (NAV) level year to date, so its discount also tightened usefully - but remains wide for its sector.

The most disappointing returns over the quarter came from , whose manager has been too bearish about the outlook, and , which has not only suffered from the 5.6 per fall in the dollar/sterling exchange rate in the first half of 2017 but may also have to wait a while for its reorganised portfolio to gain traction. Both have been replaced.

was also somewhat becalmed, but is more concerned with preserving value than capitalising on further gains in a market it considers overvalued.

has also been treading water, but we hope its value-based approach will come into its own in rougher conditions.

In the face of persistent suggestions that many actively managed funds are not worth their fees, it is encouraging that the NAV total returns of the majority of our tips have outperformed their benchmarks over both one and three years, and their share price total returns have in many cases been better still.

The exceptions include and JPMorgan Japanese which have both lagged over one year, but outperformed over three.

More surprisingly, has lagged the main Japanese smaller company indices over one year. However, it is still far ahead of relevant benchmarks over three, five and 10 years. Both portfolios usefully outperformed the and FTSE World ex UK indices over the past 12 months, with the adventurous portfolio ahead of both indices over three years.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks