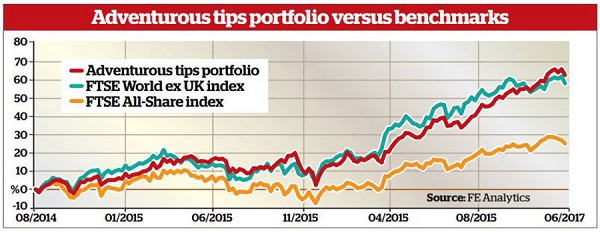

Nine adventurous investment trust tips for 2017/18

2nd August 2017 09:48

Fiona Hamilton runs through Money Observer's adventurous investment trust tips.

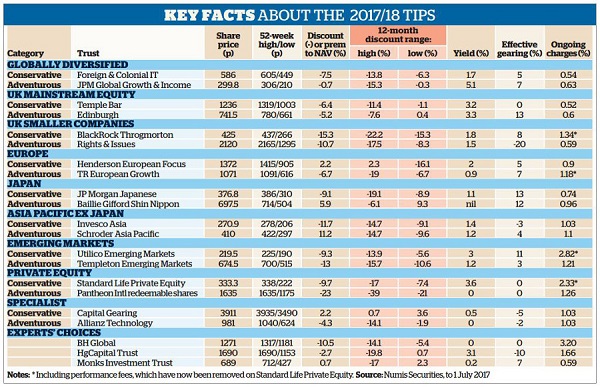

Global: JPMorgan Global Growth & Income

is our new adventurous choice*, replacing , which is now our conservative tip. We introduced the trust to the conservative portfolio in the May review but see it as more gung-ho than FRCL.

Manager Jeroen Huysinga and his worldwide research team scour global stockmarkets for high-conviction ideas with which to construct a sectorally diversified portfolio of 50 to 90 stocks.

They have achieved some of the best returns of any globally diversified trust over the last one, three and five years.

Gearing is currently modest for its sector and the commitment to a 5% yield (funded partly from capital) should help the board's efforts to limit the discount to 5%.

Its performance fee is capped at 0.8% of net assets per annum and is combined with a low base fee, which makes the potential extra performance charge more acceptable.

UK Equity: Edinburgh

The net asset value (NAV) total return of has usefully outperformed its benchmark year to date and over the three years since Mark Barnett became manager, pulling ahead of nearly all its peers in the process.

Barnett warns that geopolitical developments may disrupt business confidence and that political uncertainty in the UK would not usually be good for the UK stockmarket. If it leads to a "softer Brexit" and more fiscal loosening, however, it could be helpful for most domestically oriented companies.

The trust has low costs and a good dollop of gearing. Its exposure to UK medium-sized and small companies is above average for the UK equity income sector at 29%, and its 15% exposure to overseas companies - predominantly US-listed tobacco - is also relatively high.

It remains our adventurous UK pick.

Japan: Baillie Gifford Shin Nippon

The share price of has risen five-fold over the seven years it has been this column's adventurous Japanese selection, and holds its place despite its premium rating.

Baillie Gifford has an outstandingly successful Japanese team, and Shin Nippon's NAV returns have continued to outperform its peers since Praveen Kumar was promoted to manager in December 2015.

Charged with investing in new opportunities in Japan, Kumar has 29% in the information technology sector, 25% in consumer discretionary, and 23% in industrials. Gearing of 13% indicates his confidence in his holdings.

Europe: TR European Growth Trust

Our decision in January to introduce to the portfolios has been rewarded because it has continued to perform very strongly this year.

Manager Ollie Beckett focuses on genuinely small European companies, running a very long list to maintain flexibility.

He says smaller European companies are geared to global growth, and the trust has nearly a quarter of the portfolio in industrials, followed by around 15% each in business providers, technology and financials.

UK Smaller Companies: Rights & Issues

The impressive 10-year record for features a strong run over the past year, during which manager Simon Knott has been acutely alive to Brexit risks for all his holdings. Knott, a champion chess player, has been manager since 1990 and he and his family have big stakes in the trust.

Knott backs a limited number of companies whose characteristics fit his well-tested matrix of criteria and he retains them as long as they continue to do well. As a result, 20 holdings account for most of RIII's invested portfolio, headed by a chunky stake in , which accounts for around half its 25% exposure to AIM-listed shares.

Much of the rest of the trust is invested in industrials with highly specialised businesses serving a global clientele.

Emerging Markets: Templeton Emerging Markets

The performance of has improved so much since Carlos von Hardenberg took charge in October 2015 that we are making it our new adventurous choice, especially as its shares remain on a stubbornly high discount.

Hardenberg has maintained predecessor Mark Mobius's value-oriented approach and he is supported by the same global research network. However, he has almost doubled the number of holdings in TEM's portfolio, making it easier to include smaller and frontier market companies.

Exposure to the IT and consumer discretionary sectors has been ramped up at the expense of energy and financials. This has involved investing more in Taiwan, South Korea and Russia, at the expense of Thailand and Hong Kong/China.

New multi-currency borrowing facilities have been agreed but barely used as yet, and the annual fee has been reduced.

Asia Pacific ex Japan: Schroder Asia Pacific

replaces as our adventurous choice because its NAV returns have been much stronger than FAV's over the past year, as well as over the long term, and its shares trade on a much wider discount.

SDP is also more positively positioned, with a modicum of gearing, and longstanding manager Matthew Dobbs seems more confident about the outlook.

Dobbs says Japan and Europe appear to be on a recovery tack, there is no reason to expect a sharp downturn in the US and the Chinese authorities are committed to maintaining a "satisfactory level of growth" - all of which should sustain global trade.

He has been encouraged by "an earnings season (in Asia) which saw upward revisions, for the first time for a number of years", and is pleased his holdings have been strengthening their balance sheets rather than pursuing expansion for the sake of it.

Private Equity: Pantheon International

The redeemable shares of continue to make steady progress.

We like the geographic spread of its portfolio, with 58% in the US, 25% in Asia and emerging markets 12% Europe, and 5% global, as well as the mix of 59% in buyouts, 12% venture capital, and the rest in growth and special situations.

The consumer and technology sectors account for half of its assets, followed by healthcare and industrials. PINR's portfolio is attractively mature, with a weighted average age of around seven years.

The redeemable shares look particularly undervalued, and remain our adventurous choice.

Specialist: Allianz Technology

The NAV and share price of have both roughly doubled in the three years since it became this column's adventurous specialist choice.

However, San Francisco-based manager Walter Price believes selected technology shares have plenty more upside, with cloud computing and the transformation of the auto industry on the verge of delivering particularly exciting returns. It therefore keeps its place.

ATT is overweight the US at 82%, because Price says "it is hard to find good value combined with revenue growth of over 30% outside the US".

The forward price/earnings ratio on the portfolio is down from 26 times a year ago to around 21 times, because Price has raised exposure to value stocks to around 40%.

This has worked well recently and differentiates ATT from most of its peers, which focus more exclusively on growth. So too does its 25% exposure to medium-sized companies, which have been a big contributor to its outperformance of its benchmark over the last five years.

* Here's how Money Observer's 2017/18 investment trust tips are chosen

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks