Air Partner: A successful company, striving to be more successful

4th August 2017 08:57

by Richard Beddard from interactive investor

Share on

So what's wrong with Air Partner?

What do you mean, what's wrong with it?

You reduced the Share Sleuth portfolio's holding to a small rump of shares, and then said perhaps you should have got rid of them all*. Something must be wrong with it…

Ah. Actually no. That's not the way it works. could be a good investment, that's why I was so reluctant to get rid of all the shares. But I'm not very sure about that. Maybe I just lack the vision or knowledge to have confidence it will succeed. You might just as well ask "what's wrong with you?"

OK then, what's wrong with you?

How impertinent. Well… Now you've put me on the spot I admit, when it comes to Air Partner the future is cloudy. I like to invest in companies that don't have to change much to prosper. They've already hit on a business formula that allows them to earn high returns from customers who favour their products and services, and are prepared to pay handsomely in comparison to the cost of providing them. Evolution, not revolution is my mantra.

I thought I'd found such a company in (although its founding CEO promptly resigned!). And despite its profitable history, I'd begun to doubt Air Partner. I reduced the portfolio's holding to fund the purchase of Howdens.

So there is something wrong with Air Partner?

You don't give up, do you? I hesitate to say wrong. Air Partner's changing. It probably needs to change. Air Partner in 10 years' time may be a very different company from Air Partner now. Not just a bigger company, but a company that earns profit in a different way. That makes it a difficult company to assess.

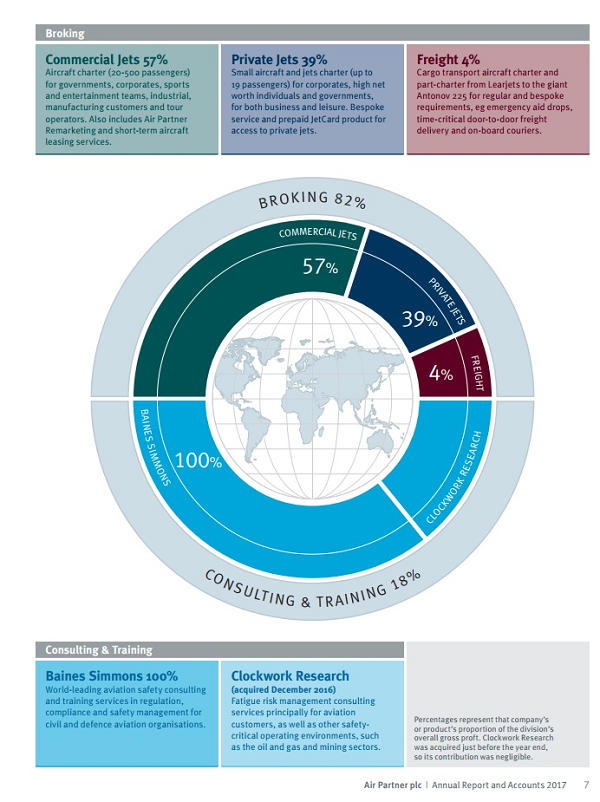

Look at this pie-ish chart published in Air Partner's annual report for the year to January 2017. Notice anything funny about it?

Hmm, now you mention it, there is something odd about the chart. It's a pie chart that adds up to 200%. Or is it 100%? I'm confused.

I was too. It looks like Air Partner has two equally large divisions, Broking, and Consulting & Training. That is until you read the grey text on a grey background, which shows that Broking is 82% of the business and Consulting & Training is 18%. It gives a false impression.

Sneaky…

I'm not saying Air Partner's deliberately misleading us, I think it's more likely a statement of intent. The greyed out figures show the split now. The colourful who ate all the pies chart that adds up to 200% shows where the company wants to be at some unspecified point not too far in the future.

Chief executive Mark Briffa told me that he could foresee Training & Consulting growing to be half the business at last year's AGM, and the firm's strategy is to achieve balance between the two divisions.

Briffa and I were speaking just after it had made its second acquisition: Baines Simmons, which does safety audits and training. A few months earlier it had acquired Cabot Aviation for the broking division. Cabot doesn't do charters, so it's a diversification as well, it arranges sales and leases. Last December, Air Partner made its third acquisition: Clockwork Research, which specialises in pilot fatigue.

Why isn't it sticking to its knitting, it's been profitable enough?

Actually, I'm not sure. I think Air Partner has done well to achieve an average return on capital of 17% over the last nine years, but it hasn't grown. There are push factors and pull factors.

Let's deal with the good news first. Air Partner believes it can profit from busier skies, the pressure on aircraft operators to keep their planes in the air for longer, and increasing regulation, by providing safety audits and training. Since it already charters, leases, and sells planes there are opportunities to provide customers of the broking division with consulting services, for example auditing aircraft operators for them.

Air Partner hopes to become an aviation services business, perhaps following a similar strategy to shipbrokers, which have grown tremendously as they have diversified into shipping services companies.

And the push factors?

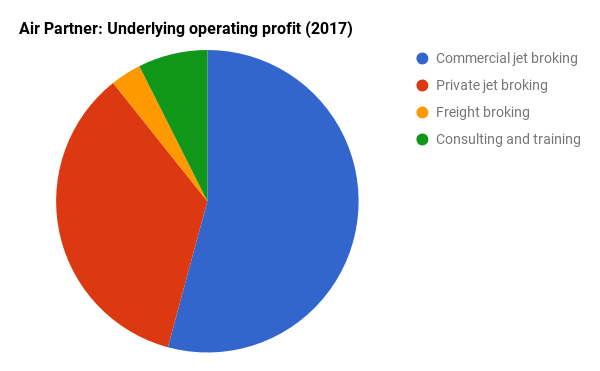

Broking charters is a competitive business. Air Partner may be a market leader but it only serves a tiny fraction of the market. The company grew rapidly before the financial crisis of 2008 flying soldiers, aid workers, equipment and supplies, but once the Government reined in its overseas commitments, Air Partner's commercial jet broking division was left competing for business from holiday companies, football teams, and corporations on roadshows. Air Partner flew Hillary Clinton's campaign team during the US election last year. While it's still earning good returns, they're ad-hoc and vary considerably from year to year.

Air Partner's private jet broking business faces a technological threat in the form of online broking platforms that allow wealthy individuals to charter a plane using an app or website. Air Partner sees itself as a concierge, declaring in its annual report:

"In our experience, technology cannot replace people. We invest in technology to improve the customer experience and drive efficiencies, but the key to our success is a genuine 24/7/365 service by our aviation experts for customers who want a bespoke, personal service."

It wouldn't be the first business to be wrong-footed by technology though, and it seems to accept the march of the robots may make it redundant one day for all but the most exotic** cargoes:

"We fundamentally believe - and our customers seem to agree - that until technological capabilities have further developed, complex travel scheduling is better handled by people rather than machines."

To give you a better impression of how important commercial and private jet broking is to Air Partner now, here's a simpler pie chart:

OK, I get it. Past performance, as they say, may not be indicative of future results.

You got it. That's always the case, but especially so when there's so much change afoot. Nevertheless, I feel bad about it. This is a successful company, striving to be more successful.

I couldn't let go completely.

~

1 See 'This share wins place in Sleuth's portfolio':

2 In this year's annual Air Partner reported it arranged to transport 445 Romanian artefacts and 200,000 one-day old chicks. Last year's included a case study of how it flew a cowl for an Airbus from Heathrow to Miami. The only plane big enough was an Antonov.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.