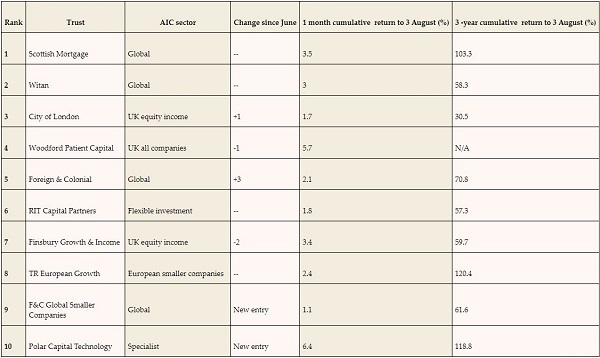

10 most popular investment trusts - July 2017

10th August 2017 09:41

For the first time in a while there's been a shake-up in our top 10 investment trust league table, which keeps tabs each month on the most popular trusts among Interactive Investor clients.

The new entries - and - were the ninth and tenth most-purchased investment trusts for the month of July.

Not since January has F&C Global Smaller Companies, a Money Observer Rated Fund since 2014, been in the top ten.

Managed by Peter Ewins, this trust has an eye-catching 46-year track record of consecutive dividend increases. As the name suggests, the fund can invest anywhere it sees fit, but at present a notable two-thirds of assets are invested in just two areas - US and UK equities.

It is Polar Capital Technology's first foray into the top 10. Another longstanding Rated Fund, since 2013, the trust invests in a diversified portfolio of technology companies from around the world.

The lead manager on the investment team is Ben Rogoff, who has specialised in technology for the past 20 years. Over the past year the trust's share price has risen 42% - a hot streak that does not seem to be deterring investors.

Making way for the two entries is , which was as high as sixth in our league table in May, and , which over the years has mostly hovered around the top 10.

Elsewhere, there's little change. As ever, has comfortably held onto top spot. The global trust, which earlier this year entered the , has been managed by James Anderson for the past 17 years. In an exclusive interview in March, Anderson told Money Observer why he is backing businesses built on cutting-edge technology, the likes of , , , , and .

, the multi-manager trust overseen by Andrew Bell, remains in second place, followed by , which has jumped up one position to third. The trust, managed by Job Curtis, has a stellar dividend track record, having upped payments every year for the past 50 years.

has slipped down the rankings to fourth place. This marks the first time the trust has fallen outside the top three since its record-breaking launch in April 2015.

The Neil Woodford-managed trust has been slow out of the blocks since listing on the main market almost two years ago, with its share price 3% lower than at launch. But, there are signs that a recovery is taking hold, with the trust's share price up 11% over the past three months. The discount, which just two months ago hit a peak of 9%, has narrowed to 0.6%, according to Winterflood.

Completing the top five is , which has gained three places. The trust, managed by Paul Niven, has just shy of half of its assets invested in US equities, but only 8% is held in UK shares. The other three names that remain in the top 10 are , and .

This article was originally published in our sister magazine Money Observer. Click here to subscribe.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks