Is Mears' profit warning slump a buying opportunity?

15th August 2017 12:02

by Graeme Evans from interactive investor

Share on

A profits warning from support services group put its shares under pressure Tuesday amid significant short-term disruption in social housing.

The group, which generates 85% of its revenues from housing services, expects orders to be delayed by the impact of the Grenfell Tower tragedy as clients review commissioning and safety practices at their properties.

Mears now anticipates housing revenues of about £800 million in 2017 against an original expectation for £830 million, with a resulting loss of profit and lower overhead recovery.

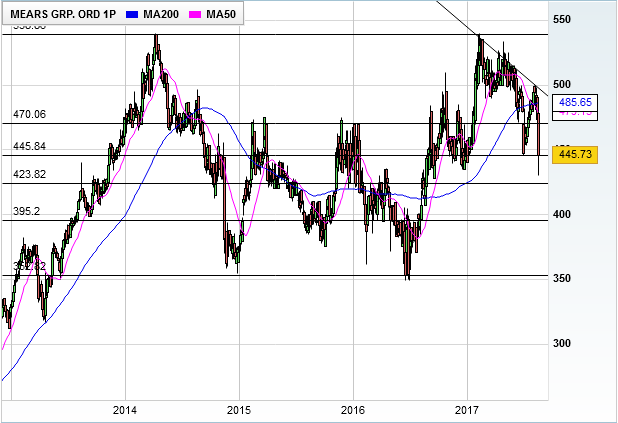

The stock fell by as much as 11% to an 11-month low 430p following the warning, although confidence was shored up by joint house broker Liberum retaining its 'buy' rating with a target price of 540p. By midday it had settled 8% lower at 445p.

Liberum points to good long-term drivers for the company's care division, particularly as pressure mounts on the government to improve funding.

It also noted that those aged 65 and over as a percentage of the total population are expected to increase from about 18% today to about 25% by 2045.

While Mears has admitted that it continues to find the care market challenging, it has drawn some encouragement from an improved order book, with a portfolio of "good quality contracts at clear, sustainable margins".

Revenues from its services providing care for older and disabled people were 10% lower in today's half-year results, with the reduction to £68.7 million reflecting the rebalancing of the contract portfolio.

Liberum noted: "Throughout 2017 and into 2018, there should be a better mix of contracts as the newer ones have been taken on at better terms, and the loss makers have been cut."

Mears said it was "extremely satisfied" with the progress made by its housing division after half-year revenues grew by 3% to £402.1 million.

The group, which maintains, repairs and upgrades properties for local authorities and social landlords across the country, noted that high-quality affordable housing was now at the top of the political and social agenda.

The operating margin in housing in the half year increased to 5.2% from 4.8% a year earlier, reflecting fewer new contract mobilisations in the period, which are typically dilutive to operating margin.

Chief executive David Miles said: "Whilst the likely revenue shortfall for the full year is frustrating, it is entirely understandable in the circumstances and the group will be working closely with its partners and clients at this time to address their immediate priorities.

"Our order book remains strong and the board remains confident in the group's future prospects."

As a result of today's downgrade, Liberum has reduced its full-year EPS estimate from 33.8p to 30.8p. However, it continues to assume double digit growth in FY 2018 and 2019.

It has also nudged down its estimated dividend per share growth from 6.4% (in line with 2016) to 5%, to be consistent with the half year.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.