The sectors that fund managers are buying

15th August 2017 15:54

by Graeme Evans from interactive investor

Share on

In the latest sign of market caution, defensive sectors have a higher weighting in global fund management portfolios than cyclicals for the first time since 2009.

The pessimism is revealed in Who Owns What, a review by Barclays Capital of the equity holdings of more than 260 global and 160 European active funds.

Given that active funds own 23% of the market cap in the United States and 30% in Europe, the research provides a decent insight into investor consensus.

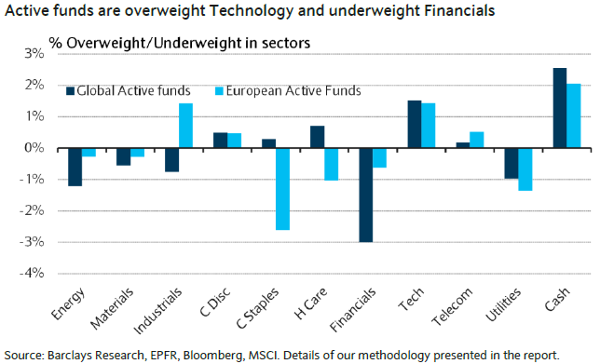

The trend of global funds turning more defensive is mainly driven by investors paring technology stock holdings, with about 8% of funds turning underweight in the second quarter of this year.

This is likely to reflect the increasing view that US and global technology stocks are now expensive after a long bull run that has been the driving force in markets.

Global funds are also underweight industrials, with the scale of this positioning the largest seen in 10 years. Financials also remain a key underweight.

The picture is slightly different in Europe as Barclays reports that funds continue to be overweight in cyclical sectors relative to defensives.

European funds are cutting exposure in tech but remain overweight, accompanied by reduced positioning in staples and in energy.

Even though global markets have performed well in 2017, optimism appears to have been dampened in recent months, particularly in the US. This was also highlighted in Bank of America Merrill Lynch's recent monthly funds survey, with managers more underweight US stocks than at any time since 2008.

Fund manager expectations that profits will improve fell to a net 41% in July, the lowest level since Donald Trump won the US election in November. A net 22% didn't expect any substantial improvement in profits over the next 12 months.

This tallies with today's Barclays research as global active funds remain heavily overweight Europe, broadly neutral emerging markets and underweight Japan and the United States.

Fund flow data also suggests that investor buying of European funds has remained robust over recent months, while investors are now selling US funds.

Active funds tracking global and European indices saw inflows of $9 billion (£7 billion) and $4 billion respectively in July, whereas US active funds saw outflows of $13 billion.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.