Three 'debt' investment trusts for income seekers

24th August 2017 10:31

by Fiona Hamilton from interactive investor

Share on

Investors' thirst for yield has driven colossal growth in the range of closed-ended funds investing in alternative asset classes. Social infrastructure and specialist property funds have proved so popular that most have risen to premium ratings, which has reduced their yields to less than 5%.

Some specialists in asset leasing and collateralised loan obligations (CLOs) continue to offer meaty yields, but are too complex for comfort; while the direct lending sector has had an unnervingly bumpy ride. However, investors may be tempted by the attractive dividends on offer in diversified debt.

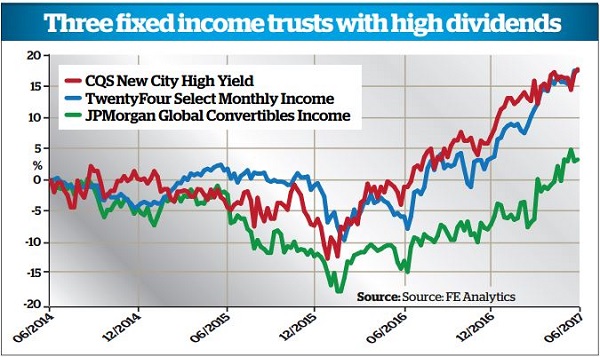

We have selected three to illustrate the options. and offer the highest yields in the sector, but with limited scope for both capital and income growth. offers the lowest yield, but has greater potential for capital growth.

All three invest in assets that are too illiquid for most open-ended funds or large institutions to consider and therefore offer an above-average yield in comparison to the credit quality of their portfolios.

However, that does not make them immune to the factors that can undermine nearly all fixed income assets: namely, rising interest rates (which are closely linked to inflation expectations) and widening credit spreads.

The credit spread is the difference in yield between two different securities: in the context of this article it is between government securities and non-investment grade bonds. The latter yield more because they are deemed to be at higher risk of default, and they are the main focus of all three featured funds.

Thanks to rebounding global growth, fears of default have been suppressed and credit spreads are hovering near 10-year lows in the US and Europe. However, they have not fallen as far in the UK due to worries about Brexit, which are far from over.

Interest rate forecasts are unreliable, with expectations of increases in the West repeatedly postponed. The Federal Reserve has finally started the ball rolling in the US, but could pause again if growth and inflation weaken.

The Bank of England's monetary policy committee has been more hawkish recently, but governor Mark Carney seems likely to be wary of choking off growth at such a parlous time. Meanwhile, the European authorities are generally considered to be some way from raising rates.

Despite this uncertainty, the 35-year bull market in bonds must surely be approaching, or have passed, its peak.

Mark Holman, chief executive of fixed income specialist TwentyFour Asset Management, says the trend is towards slightly higher rates, while Robin Dunmail of JPMorgan's convertibles team says that, as long as global growth remains positive, inflation will tick-up and monetary policy will tighten. "We are at the low of interest rates across the world," he warns.

Peter Spiller, who manages , believes that trend will accelerate as deeply indebted Western governments try to inflate their way out of their difficulties rather than inflame the populace with yet more austerity measures.

He suggests the consequent difficulties for many borrowers will result in a nasty reminder of why non-investment-grade bonds are widely referred to as junk.

Sebastian Lyon of shares Spiller's belief that most bonds, like most equities, are dangerously overpriced, and suggests investors are ignoring the long-term risks to their capital in their determination to boost their short-term income.

"The disappearance of income from traditional safe haven assets such as cash and government bonds has led income-conscious investors to chase yield in the manner of a relay race, when, after each lap, savers and investors have to change to the outside lane and reach out further across the risk asset class spectrum," he states.

High-yielder disappoints on capital front

CQS New City High Yield offers the highest yield in its sector and has raised its total dividend every year since the fund's relaunch in 2007. As a result, its shares trade on a substantial premium.

However, dividend growth over the past five years has averaged just 1.8%, dividend cover has shrunk from 1.33 times in 2014 to 1.03 times last year, and the net asset value (NAV) per share has achieved almost no net gain over the past seven years.

This is disappointing: not only because falling interest rates should have been good news for fixed income investors, but also because a useful chunk of NCYF's portfolio has been invested in equities, including stakes in infrastructure and property trusts that were sold after a strong run.

Ian 'Franco' Francis has been lead manager of the trust since November 2007. Supported by the CQS credit research team, he invests worldwide mainly in non-investment grade bonds in hopes of above-average income returns and modest capital appreciation.

Corporate bonds currently account for 84% of NCYF's portfolio, up from 76% three years ago. 30% of those bonds are floating rate, on which returns should rise with inflation.

The balance includes convertibles and preference shares, as well as equities - including some direct lending funds. Around 70% is invested in sterling-denominated securities, with most of the rest dollar-denominated, but overseas currency exposure is not hedged.

Francis expects interest rates to rise modestly in the US this year, but to lag in the UK due to macroeconomic and political uncertainty. He also expects the authorities in Europe, Japan, China and other Asian states to maintain accommodative monetary policies.

He expects high-yield bonds to be less affected by rising interest rates than investment-grade bonds, and his focus therefore remains on finding niche opportunities offering above-average yields.

Revenue reserves equal to last year's total payout should ensure the dividend, which is paid quarterly, is at least maintained if bond markets come under pressure.

Moving further out on the risk spectrum

Launched in September 2008, TwentyFour Asset Management specialises solely in fixed income securities, and has grown assets under management to over £9 billion, including three closed-ended funds.

specialises in UK and European asset-backed securities, while offers geared exposure to portfolios of UK residential mortgages.

TwentyFour Select Monthly Income is the smallest of the three, but offers the highest yield, and is the only one to offer a monthly income.

In addition, its unconstrained mandate permits its managers to search for "the best sources of fixed income risk from around the world", so it seems surprising that its shares typically trade at the lowest premium.

SMIF generates its high income by investing in fixed income categories that are further out on the risk spectrum than those favoured by the CQS fund.

They have recently found the most attractive pockets of value in contingent convertible securities (CoCo bonds) issued by banks and European CLOs (portfolios of floating rate senior secured loans), both of which currently account for close to a quarter of the fund's portfolio, with much of the rest in US or European high-yield debt.

Explaining their CoCo bond exposure, Holman says that banks have improved their creditworthiness and regulatory changes over the past year "have made these bonds safer".

The portfolio's interest rate risk is minimised by SMIF's substantial exposure to floating rate debt, by focusing mainly on shorter-dated bonds which it expects to hold until maturity, and by taking out interest rate swaps.

Credit spread duration is higher. However, the managers expect to retain most holdings to redemption, generating returns "through timely interest payments and the natural pull to par".

This means widening credit spreads should prove a temporary problem, so long as the managers' due diligence keeps actual defaults low.

In its first three years SMIF has fulfilled its commitment to pay gross dividends of 0.5p per month, with any excess income topping up its October distributions, but it has been much less successful at achieving its secondary target of 2p to 4p capital growth per annum.

The currency exposure of its overseas holdings is all hedged to sterling, and there is no added gearing risk.

Straddling bond and equity asset classes

JPMorgan Global Convertibles Income is the only UK-listed closed-ended fund focusing on convertible bonds. These are fixed income securities with an option to convert into the issuing company's shares at a fixed price within pre-specified dates.

They typically offer a lower income than non-convertible bonds of a similar investment grade, but yield more than equities in the same company and can secure attractive capital gains if that company's share price rises.

The fund is managed by JPM's convertibles team, which deploys both equity and credit.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.