FTSE 100 rallies despite profit troubles

25th August 2017 12:53

by David Brenchley from interactive investor

Share on

Investors have been in an unforgiving mood this week, with a trio of London-listed companies severely punished for disappointing results. However, in general it's been a good few days for UK equities, blue chips in particular, as the has outpaced its mid-cap counterpart, the .

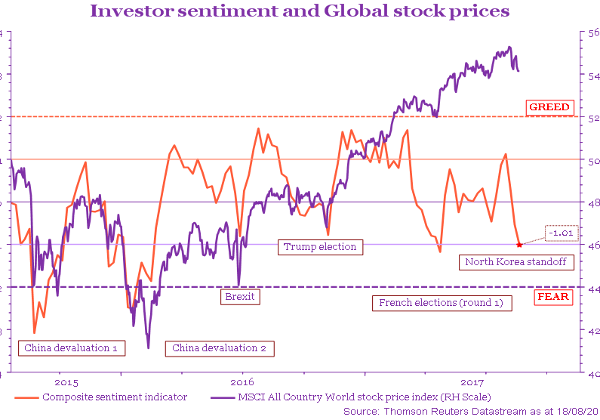

It's been a turbulent few weeks, with geo-political turmoil ramping up after recent ructions between the US and North Korea. Sentiment had waned since, which led one asset manager to claim now is a good entry point for equity investors.

On Wednesday, Royal London said its contrarian sentiment indicator has shown a first 'buy' signal since the French elections in March. "Stocks have performed strongly over the last 18 months and valuations are starting to get a bit stretched," says head of multi asset Trevor Greetham.

"But macro-economic fundamentals remain supportive, with global growth continuing at a reasonable pace, inflation pressures easing and interest rates low."

Interactive Investor's Edmond Jackson sees plenty of reasons to buy equities, re-iterating a "buy the dips" strategy.

This week has seen an upturn in fortunes for indices on this side of the Atlantic, with the FTSE 100 ticking up 1.5% during the trading week. Still, the losers have hogged the headlines despite accounting for just a quarter of the constituents.

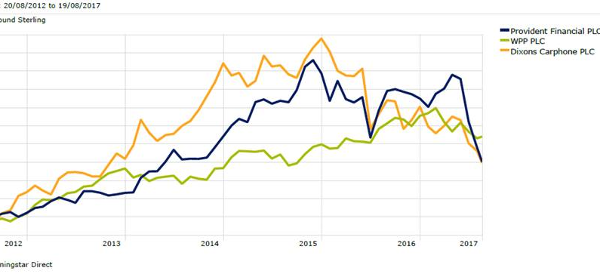

saw two-thirds of its value wiped out in just one day - one of the FTSE 100's largest ever one-day falls - after its second profits warning in just a couple of months Tuesday.

A day later, advertising giant took its turn to feel investors' wrath. Sir Martin Sorrell's behemoth slumped more than 10% Wednesday as it cut net sales growth forecasts to between 0% and 1%. Not since the depths of the financial crisis has the firm seen a fall on that magnitude.

Turning to the FTSE 250, up just 0.5% on the week, and Thursday saw a warning from , which said conditions in the UK mobile phone market remain "challenging".

The inevitable slump lowered the retailer's share price by almost a quarter (23%) and it fell further Friday. Despite this, brokers are keeping the faith, with Liberum and UBS both re-iterating their 'buy' recommendations albeit with vastly reduced target prices.

Even , a convenience foods producer, was slammed after the company issued a vanilla trading update in response to recent share price weakness. Nothing's changed since its third-quarter trading statement, it said, but shares are still down 15% this week.

Away from the bad news, though, and three-quarters of the blue-chip index are in the green for the week late-morning Friday. Miners led the way, with - on a strong first-half performance - and the best performers, up 8.9% and 7.7% respectively. (7.4%) also re-assured investors after making concessions to activist pressures.

"Progress has clearly been made at the miners and, while broadly expected, confirmation [of that progress] and more cash generation helped lift the sector to a marginally positive results season," say analysts at Liberum.

Market moves tend to be accentuated during the summer break, with trading and company reporting light on the ground, and holidaying investors reducing liquidity.

Add to that uncertainties across the globe and investors will be looking forward to September's interim results season. And it is this which will likely set near-term direction for markets in the weeks ahead.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.