India: Funds to play the biggest turnaround story

25th August 2017 17:21

by Dzmitry Lipski from interactive investor

Share on

India celebrated 70 years of independence from Britain this month. The country has made impressive progress since 1947 and is now a hot destination for international investors.

After the Second World War, the US economy completely overshadowed India which accounted for only 15% of US GDP. India is now almost half the size of the US. It is growing fast, with a 6.6% increase in 2016 just behind China's GDP growth of 6.7%.

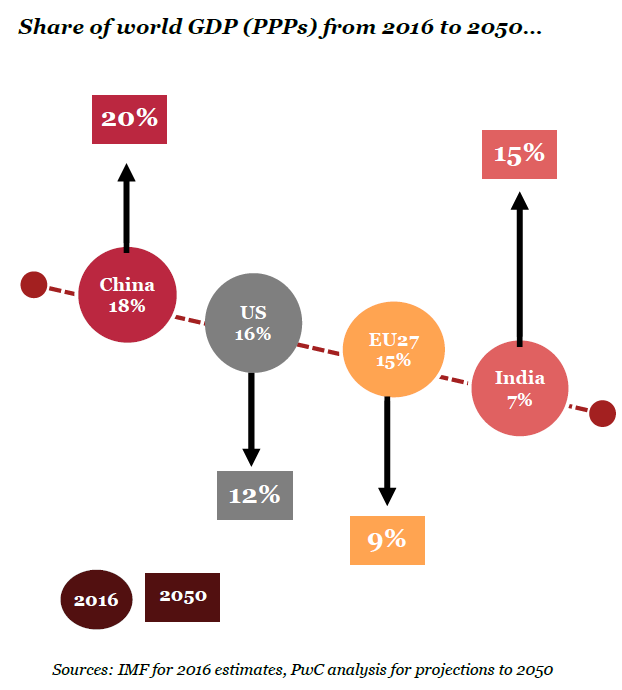

According to PwC's report, The World in 2050, India is expected to grow by nearly 5% a year between now and 2050. Its economy currently stands in third place and is projected to overtake the US by 2040 in purchasing power parity (PPP) terms.

India's population is three and a half times larger than at the time of independence. At 1.3 billion, it accounts for nearly a fifth of the world population. In 1947, the country's life expectancy was only 32, but today is 68. It also has a very young population, with a median age of just 27. 7, and 65% of Indians today under the age of 35.

India has made impressive gains in literacy rates, which has increased from 16% to 72%. Its technical education sector is undergoing rapid development and India is also considered the largest exporter of engineers today.

India is now the second largest country in terms of internet users (ahead of the US, but behind China), with around 76% of the population having internet access.

The emergence of established democratic institutions has been another notable achievement since independence.

The "biggest turnaround story"

Unsurprisingly, India remains one of the most popular emerging markets today for investors. It has been called the "biggest turnaround story" in emerging markets. Investors recognise that the Indian economy is fundamentally driven by domestic consumption, unlike most other large emerging economies which are mainly an export-led. Private consumption currently accounts for around 60% of India's GDP.

The country's biggest asset is its young, vibrant and educated population. As their incomes rise, more young people move to the cities. Their lifestyles evolve as their aspirations grow. It has been estimated that India's middle class is expected to grow from around 50 million today to 475 million people by 2030.

Investor sentiment towards India has been boosted even further by rising confidence in the government's reform agenda which will strengthen economic growth and corporate earnings, thus driving equity prices higher.

President Narendra Modi's business-friendly government has passed a number of successful reforms such as the Goods and Sales Tax, demonetisation and issuing 1bn biometric Identities which will provide a backdrop for sustainable economic growth going forward and streamline the country's much maligned bureaucracy.

The Indian stock market is huge and diverse, comprising over 4,000 listed companies with a total value of $1.6trn, which should continue to benefit from the structural growth drivers in the long term. In particular, domestic cyclical companies in the Consumer Discretionary, Industrials, Financials and Technology sectors should benefit, such as ICICI Bank, Tata Motors, and ITC.

India is currently undergoing a period of change but these changes should guarantee India's future growth and development. This should benefit all companies who depend on the domestic economy and will provide a wide range of opportunities for investors.

Market valuations are looking stretched but India is still the best bet among emerging markets.

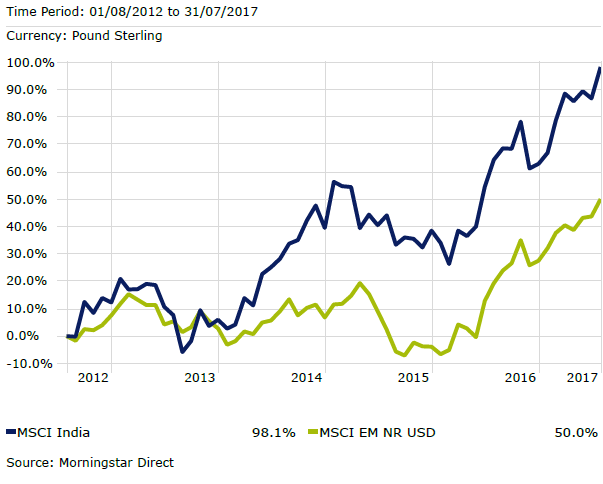

Indian equities have been one of emerging markets' strongest performers in recent years, and it could be argued their relative valuations no longer look attractive. However, a long-term investor should look beyond this, due to India's status as one of the largest and fastest growing economies in the world as well as well as the increased pace of business-friendly reforms enacted by Modi's government. The Indian market offers a diverse range of companies with good fundamentals that can take advantage of the untapped growth potential.

Money Observer Rated Funds

Investors looking for pure exposure to India should consider Money Observer Rated . The fund is managed by Avinash Vazirani who is one of the UK's most experienced Indian fund managers. Jupiter India is a compelling choice for higher-risk investors willing to take a long-term view.

There are other strong options listed below in the Asia and Emerging Markets category to consider for investors looking to gain broader exposure to the region. All funds are positioned to capitalise on the long-term growth potential of emerging markets like India.

| Money Observer Rated Fund | Allocation to India % |

|---|---|

| Stewart Investors Asia Pacific Leaders | 30.5 |

| Templeton Emerging Markets Smaller Companies | 21.1 |

| Schroder Small Cap Discovery | 14.7 |

| Fidelity Emerging Asia | 14.3 |

| Hermes Global Emerging Markets | 12.8 |

Source: Money Observer, 31 July 2017

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.