Time to buy and hold Dart Group shares?

1st September 2017 15:45

I saw you reading Dart's annual report Richard. Business as usual?

Yup, Jet2, airline, is cruising nicely at altitude, and its haulage business Fowler-Welch is slugging it out on the roads as usual. Both companies are investing. Neither did as well as last year though…

Oooh. That sounds bad. Wassup?

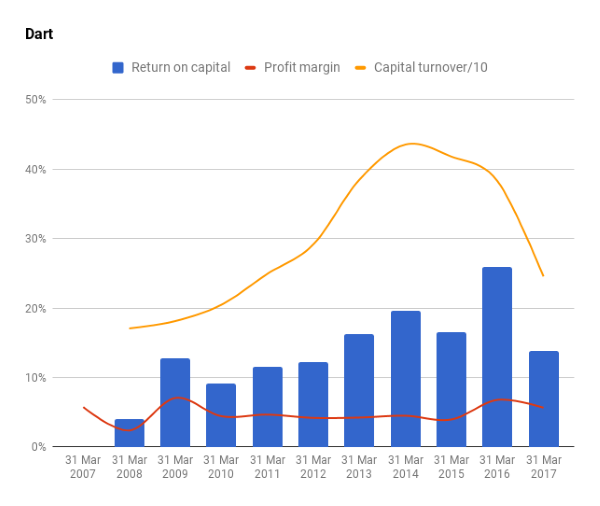

It may not be bad news at all. The airline has grown much bigger than the haulage business, so its figures dominate the group totals. Revenue increased considerably in the year to March 2017 and, although adjusted profit didn't change much and return on capital declined substantially, there are mitigating circumstances. Take a look at this chart:

Woah… Looks like profitability collapsed?

I wouldn't go that far. Return on capital almost halved from 26% to 14%, but which year looks more unusual to you, 2017, or the year before?

The year before, 2016, is the outlier I suppose. But even so, profitability is back where it was four or five years ago. That's not a good sign, is it? I mean Dart's supposed to be getting better…

Well, that's where the mitigating circumstances come in.

Return on capital has two components, return (aka profit) and capital (money required to operate the business, paying for planes, hangars, warehouses, offices, and working capital). You divide return by capital to get the return on capital.

It's like an internal interest rate for the company, so the first thing to say is a return of 14% isn't bad at all. It happens to be Dart's average over the last 14 years.

Now it's true, Jet2 has improved the business in that period, principally by developing lucrative package holidays, so profitability should generally be higher than the historical average.

That won't happen every year because Dart is predominantly an airline and package holiday company and profitability in the short-term is influenced by factors outside its control like fuel prices and the state of the economy.

While Dart's airline Jet2.com and holiday company Jet2holidays occupy a particular niche in the travel industry, people can choose to fly with others or holiday here in the UK. If there's overcapacity, airlines will discount flights to fill their planes.

So you're saying average profitability is temporary and not really Dart's fault?

Probably. Twenty-sixteen was a hard year to follow, demand for flights was high, Dart increased prices, and simultaneously the cost of jet fuel fell dramatically.

But the situation is complicated by factors within Dart's control. Jet2 is expanding dramatically. It's mid-way through taking delivery of 34 new planes, it's operating from two new bases at Stansted and Birmingham, and it's built its second maintenance hangar at Manchester. Last summer, Jet2 flew 63 planes. This summer it flew 75. Next summer and in summer 2019 it should be flying even more.

The expansion impacts both the numerator and the denominator of the return on capital calculation.

The amount of capital required to operate the business has increased, it owns and leases more property and planes. Other things being equal if the number you divide by gets bigger, the result, in this case return on capital, gets smaller.

Coincidentally, other things were equal. This year's profit wasn't much of an improvement on last year's. There are two factors influencing profit: revenue and costs. Revenue rose, but costs rose even more. That had a lot to do with the expansion too.

Rising costs is a bad sign, surely. Are they out of control?

I doubt it. New ventures are more expensive to run until they are operating at full-swing.

Not being an expert airline analyst I can't list all the exceptional costs associated with operating from a new base, but the annual report gives a few examples. Right from the first flight on a new route you need passengers, which requires advertising in advance. And you need staff: pilots, crew and ground staff which must be recruited and trained. The airline bears these costs while it's earning no revenue from them.

Jet2 also reduced prices to fill its planes, reducing the amount it earned on each ticket by 5%. Even so, there were more empty seats, another reason they were less profitable.

Hopefully, this is not a permanent reduction in profitability, but the temporary consequence of expansion.

OK, so you're not too ruffled by events. Should I buy the shares?

Only you can answer that question, but for what it's worth I think there are good reasons to buy and hold Dart shares.

Let's start with return on capital. Even though it's a rough calculation, an average return on capital of 14% is pretty good in a competitive industry, especially as the average spans the financial crisis and the grounding of European Planes while an Icelandic volcano vented.

It suggests Jet2 is doing something special. It takes families on holiday. By specialising in a particular kind of customer it can offer a more specific service. Flight times are convenient, baggage allowances generous, often customers can check in at their resorts.

Happy customers are more likely to return, so I expect Jet2 is creating a virtuous circle as it continues to refine how best to serve them. Meanwhile, having proved the concept and established a strong presence in the north of England, it's now establishing bases further south.

Jet2holidays is barely more than a decade old, but now almost 50% of the passengers on Jet2 flights have booked a package. Not only are package holidays more profitable, the company also believes they are particularly attractive when money's tight as they give people certainty about the cost of a holiday. This is why Jet2 may well be more profitable in the future than in the past.

We can also talk about management, but I won't go on too much because I have many times before. Dart was founded by Philip Meeson, a flamboyant former acrobatics pilot. He's a majority shareholder. The other board members, Dart's finance director and Jet2's chief executive, exude competence on the few occasions I've met them. These are the men that have built Dart.

They're also, perhaps belatedly, sharing the spoils with staff. From 2018 all staff will share in 5% of the company's profit, which I expect may spread some of the founding entrepreneur's zeal.

I like it. I like it. Should I push the button?

What button? You have a button? Is it red?

There are a couple of things I'd consider before unleasing the nukes.

The first is debt. Jet2's financing its expansion with a combination of debt and operating leases. Working out the value of the operating leases requires estimates, so my figures are even rougher than usual, but this is the first year Dart's operated with a significant amount of debt and that's likely to play on my mind, especially if it continues to discount flights or fly with more empty seats. It would be unnerving were Dart to fly into recession as it expands, and that's making me wonder about Brexit…

Jeepers. The 'B' word and the 'R' word in one sentence. Now you've put the wind up me. What's up with Brexit?

Well, first off, it might be bad for trade, and therefore the economy. So it could bring about recession. In addition, we don't know if British airlines will be able to fly freely in the EU, as the rules allow while we're in it.

Finally, there's a rule that airlines operating in Europe must be 50%-owned by European citizens. That's fine, while we're in the EU, but if we leave without addressing these issues it could be particularly problematic for Dart, which is 38% owned by Meeson.

Dart expects the UK government and the EU to sort something out. After all, Europe wants our tourist euros, and airlines are an important part of the British economy.

It's probably right, but the possibility of disruption combined with Dart's growing debt is making me pause for thought.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks