Record-breaking Redrow chased to fresh 10-year high

5th September 2017 13:53

by David Brenchley from interactive investor

Share on

Demand for new housing in the UK remains "robust" despite an uncertain political and economic backdrop. That's the view of execs at as the company - and the wider sector - continues to make a mockery of warnings that the housing market would collapse following the Brexit vote last June.

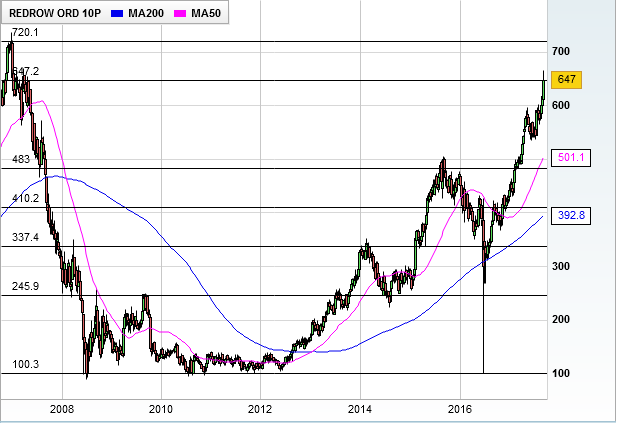

After an initial sell off in the immediate aftermath of the vote, almost all housebuilders have bounced back to form and are trading way above pre-referendum levels, with Redrow leading the way.

Gains since the close of play on 23 June 2016 now exceed 50% thanks to full-year results published Tuesday, which extended a run of consecutive record quarters to four. It also upgraded medium-term guidance for the second time this year.

Legal completions, including joint ventures, breached 5,000 for the first time ever, we're told, and were up 15% year-on-year to 5,416. Pre-tax profit of £315 million, up 26%, was a record, on revenues of £1.66 billion, up 20%. Net debt fell to £73 million from £139 million in June 2016.

Earnings per share (EPS) rose by 27% to 70.2p and gross margin is close to "normal levels" at 24.4%, while the dividend was hiked by almost three-quarters to 17p. That's the result of a dividend policy introduced in March that will see the payout ratio grow by 33% over the medium term.

This should see the dividend reach 32p by 2020, giving a forward yield of 5%. As a consequence, Barclays analyst Jon Bell reckons the shares are starting to look attractive to income seekers for the first time in the current cycle. Clearly, star fund manager Neil Woodford agrees and the stock has a place in his new .

Having begun the current year with a record order book of £1.1 billion, Redrow chairman Steve Morgan tells us sales in the first nine weeks of the current financial year are "very encouraging". Should market conditions remain unchanged, he adds, turnover should reach £2.2 billion by 2020, with pre-tax profit of £430 million.

This triggered a surge in the share price of over 7% to 666p and puts it within reach of the January 2007 record high at 737p. , which reports half-year numbers Thursday, took its cue from Redrow and is up over 2%.

Bell says investors should not see the results as a high watermark and expects further records in the coming years. He forecasts Redrow will have net cash on the balance sheet by 2019, leaving it "well placed to plan the next leg of its strategy by re-assessing the housing cycle from a position of strength".

Chief executive John Tutte hailed the "exceptional results", calling its strategic decision taken two years ago to focus its London operation on the outer boroughs "timely". Since that decision was made, Redrow's average selling price has increased 14.8% to £309,800.

And the company remains bullish, "showing confidence against the still uncertain UK housing market over the next two years", according to UBS analyst Miguel Borrega, who reiterated his ‘buy' rating. Still, there were undertones of caution.

While Tutte insists the longer-term prospects for the housing market remain encouraging - unemployment and mortgage rates remain low and underlying demand for new homes is robust - there are still "key issues that need to be addressed". These include the status of EU workers after Brexit, the future of the Help to Buy scheme and the need to revitalise stalled planning reforms.

Analysts agree. "Housebuilders should be given every reasonable assistance to ensure Britain keeps building," says Anthony Rushworth, founder of a property crowdfunding platform Homegrown.

On a company specific level, Tutte says Redrow's "exceptional" compound rate of growth in recent years is likely to "moderate over time as divisions reach optimal scale and our scope for divisional expansion reduces".

Still, Bell raises his price target by 9% to 688p. Based on revised forecasts for 2018 and 2019, the shares trade on a price/tangible net asset value of 1.5 times and a price/earnings ratio of 8 times, both at the lower end of the peer group valuation range of 1.7 times and 9 times respectively.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.