10 small-cap titans for brave value hunters

6th September 2017 14:02

by Ben Hobson from Stockopedia

Share on

Value investing strategies often underperform in bullish markets. You don’t hear much about stocks that are cheap when sentiment is running wild and go-go growth shares are the talk of the town. For those value investors prepared to wait for the next correction, these are not easy times - and the past eight years have been a particularly barren spell.

But it’s not all bad news for strategies that care about valuation. Ben Graham, the man who crafted the discipline of value investing, once said that “in the short run the market is a voting machine, but in the long run it's a weighing machine”.

In other words, short-term price movements are often driven by emotion. But over the longer-term, emotions are put to one side as the market ruthlessly prices stocks for what they’re really worth.

To get ahead of the curve, and figure out what share prices should be, investors have learned to employ a wide range of measures. For the most part, they assess what each company earns and what it owns. As a result, what we have now is a toolbox of ratios spanning the likes of price-to-earnings, price-to-sales, price-to-book, price-to-cashflow, dividend yield and the enterprise value-to-ebitda. But which should you use?

James O’Shaughnessy, a US fund manager, has spent years answering this question. His detailed analysis of stock market data has endeavored to figure out just what it is that predicts future outperformance.

One of his earliest strategy suggestions what an approach called Tiny Titans. Through his research, O’Shaughnessy found that the strongest returns came from the smallest companies in the market. He used the price-to-sales ratio as a measure of value and relative price strength over 12 months as a measure of positive momentum. In essence, it looks for cheap stocks that are beginning to re-rate.

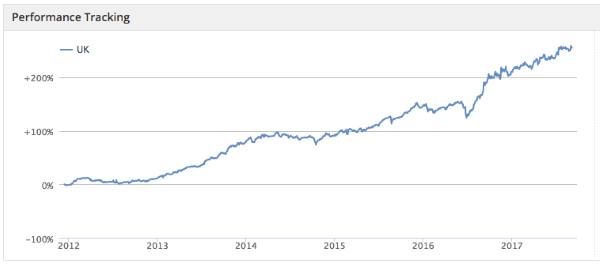

It seems that simple approaches are hard to keep down. While O’Shaughnessy later evolved his thinking and suggested using a ‘composite’ of value measures, the Tiny Titans strategy just keeps ploughing on. Stockopedia’s modelling of his approach in the UK has seen a 31% gain over the past year, and nearly 60% over two years.

It’s important to say that while the performance is impressive, this was never designed as a portfolio-building strategy because the nature of the stocks is so volatile. But even so, the consistency over the longer-term is remarkable.

This week, we’ve re-created O’Shaughnessy’s original Tiny Titans rules for Interactive Investor. We’ve also added Stockopedia’s Value Rank to the list, which shows how each stock ranks in the market based on its valuation against a range of measures - from zero (expensive) to 100 (cheap).

| Name | Mkt Cap £m | Price-to-Sales Ratio | 1 Year Relative Strength | Value Rank | Sector |

|---|---|---|---|---|---|

| Creightons | 21.1 | 0.69 | 208.2 | 45 | Consumer Defensives |

| North Midland Construction | 43.1 | 0.17 | 179.4 | 68 | Industrials |

| Molins | 31.3 | 0.39 | 174.3 | 47 | Industrials |

| Fairfx | 118.1 | 0.15 | 133.9 | 35 | Industrials |

| Base Resources | 125.6 | 0.95 | 104.2 | 94 | Basic Materials |

| Lighthouse | 24.3 | 0.51 | 89 | 54 | Financials |

| Elektron Technology | 25.4 | 0.78 | 82.4 | 38 | Industrials |

| Northern Bear | 15.6 | 0.34 | 79.8 | 95 | Industrials |

| Hargreaves Services | 111.6 | 0.33 | 70.3 | 58 | Energy |

| Anglo Asian Mining | 31.9 | 0.52 | 69 | 97 | Basic Materials |

These are unmistakably very small companies, so they would warrant very careful research by investors. Smaller stocks are unpredictable and potentially difficult to trade. And, given that the main measure of value is the price-so-sales ratio, these sorts of firms may not have any earnings.

However, the top three in the list - , and - show just how explosive the share price performance can be in fast moving micro-caps. Indeed, all of the companies here have produced blistering price gains, which is the trade-off for the risks of investing in companies of this size.

The great appeal of this strategy is that it focuses on cheapness rather than chasing popular and highly speculative micro-caps, which can become very expensive. So, while investing at the smallest end of the market is risky, O’Shaughnessy’s diligent research showed that it can produce stunning gains for investors who are prepared to do their homework.

About Stockopedia

Interactive Investor's Stock Screening series is written by Ben Hobson ofStockopedia.com, the rules-based stockmarket investing website. You canclick here to read Richard Beddard's review of Stockopedia.com and learn more about the site.

Interactive Investor readers can enjoy a completely FREE 5-day trial of Stockopedia by clicking here.

It's worth remembering that these and other investment articles on Interactive Investor are simply for generating ideas and if you are thinking of investing they should only ever be a starting point for your own in-depth research before making a decision.

*No fee for publication is involved between Interactive Investor and Stockopedia for this column.

Ben Hobson is Investment Strategies Editor at Stockopedia.com. His background is in business analysis and journalism. Ben researches and writes regularly on investment strategy performance and screening ideas for Stockopedia.com. He is the author of several ebooks including "How to Make Money in Value Stocks" and "The Smart Money Playbook"

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.