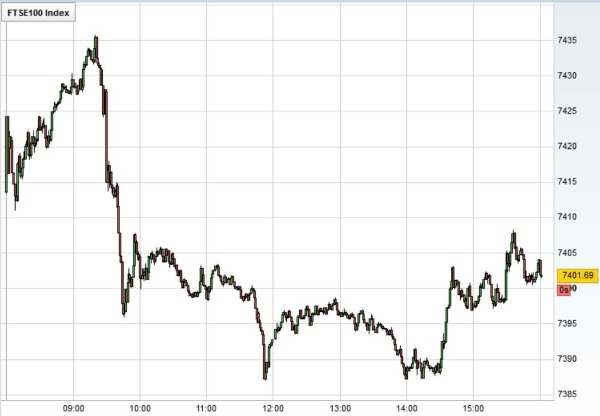

Inflation shock deflates FTSE 100

12th September 2017 16:18

by Lee Wild from interactive investor

Share on

Things were looking great first thing Tuesday. The S&P 500's new record overnight shoved the FTSE 100 to a one-week high, and we'd likely still be there had it not been for an aggressive inflation number that lit a fuse under the British pound.

According to the Office for National Statistics, the Consumer Prices Index (CPI) reached 2.9% in August, up from 2.6% the month before. That matches the May number, a level not exceeded since April 2012.

Any further increase and Mark Carney will have to sharpen his pencil. The Bank of England governor must write to the Chancellor if inflation strays 1% from the central bank's 2% target, spelling out what he plans to do about it.

The August number is also way above the 2.7% pencilled in by most economists, which explains why the FTSE 100 gave up 40 points in quick time on the news.

A crash in the value of the pound last year increased the cost to producers of imports from overseas, and businesses began passing these higher costs on to consumers in the spring, we're told. Clothes prices and petrol were the big contributors this time.

Under normal circumstances, that would strengthen the case for an interest rate hike, giving a boost to the local currency. And on Tuesday we've seen sterling hit a high of $1.32883, a level not seen since September 2016.

As three-quarters of revenue from FTSE 100-listed firms is generated in foreign currency, this surge in the value of the pound reduces the benefit to companies who report in sterling.

And, with the UK economy in reasonable shape and unemployment low, a first increase in UK interest rates for a decade is getting closer. That's not necessarily bad news for the blue-chip index, but it does mean opportunities will likely be found among more UK-focused companies.

You've only got to glance at the list of Tuesday's top performers. It's packed with domestic earners like , , , , and . Higher interest rates tend to boost bank sector margins, while a strong pound will reduce import costs for retailers.

Equipment rentals firm , which does much of its work in the US, will benefit from rebuilding work there following the recent hurricane season, we're told.

There are no pounds and pence figures but, in a first-quarter update, it admitted: "as a minimum, we expect that the impact will help to underpin the current market assumptions in our 2021 plan and therefore the board continues to look to the medium term with confidence."

A strong first-half at has put the tracksuits-to-trainers chain back on track after a tricky few months.

And further down the food chain there was great news for , the supplier of financial services to expats which crashed after damaging changes to government policy were announced in the March Budget.

STM, a specialist in Qualifying Recognised Overseas Pension Schemes (QROPS), was hit by a 25% tax imposed on UK pension funds transferred overseas by expats. It's share price plunged by up to 40%, but leapt as much as 18% Tuesday.

Management has been quick to replace lost business with an International SIPP catering for the UK expat market. It's easier to understand and the fact that it's administered by a UK regulated firm has made it a popular alternative.

Chief executive Alan Kentish told Interactive Investor that QROPS rivals were vulnerable and that industry consolidation was inevitable over the next six months. Merging its own life assurance businesses in Gibraltar could free up to over £3 million of regulatory capital to be used as a warchest for acquisitions.

Respected analyst Jeremy Grimes argues that a forward price/earnings (PE) ratio of 10 times implies the company is priced as an ex-growth business. UK SIPP providers like and are valued on 18 and 24 times earnings, respectively.

"Rewards are high for those that spot the growth company dressed up as an ex-growth company," says Grime, raising his price target to 70p. "Valuation growth leverages earnings growth and such is the joy of investing in small companies."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.