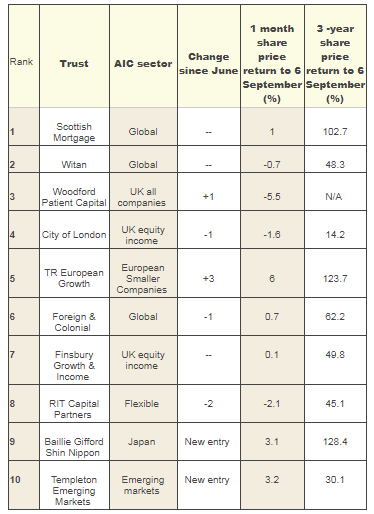

10 most popular investment trusts - August 2017

13th September 2017 10:08

by Kyle Caldwell from interactive investor

Share on

Emerging markets have enjoyed a spectacular recovery over the past 18 months or so, but remain cheap compared to developed markets.

This is something users of our Interactive Investor's website have perhaps been taking note of, as an emerging market-focused investment trust gained popularity in the month of August - . It was the tenth most-bought trust, a new entrant to our league table, alongside .

Templeton Emerging Markets is managed by Carlos Hardenberg, who has been lead manager since October 2015. He took over the hot seat from veteran emerging market investor Mark Mobius, who remains on the portfolio management team of the trust. Hardenberg looks for capital growth from companies with strong corporate governance and robust balance sheets that are generating plenty of cash.

The Money Observer Rated Baillie Gifford Shin Nippon, which was the ninth most-popular trust in August, has been managed by Praveen Kumar since December 2015. The types of business he favours are those that he believes have above-average growth prospects and strong, entrepreneurial management teams.

Exiting the top 10 are and , which were the ninth and tenth most-purchased investment trusts for the month of July. The most popular trust in August will come as no surprise to regular readers - . It has been the most-bought trust on Interactive Investor every month since February 2014, except one: April 2015, when it was overtaken briefly by during the latter's record-breaking £800 million launch.

Since then Woodford Patient Capital has tended to be the second or third most-bought trust on Interactive Investor each month, until July when the trust slipped out of top three for the first time. In August, however, it regained its place in the top three, behind in second spot.

Exiting the top three and into fourth spot is income favourite , which is one of three investment trusts that has achieved the feat of 50 years of consecutive dividend increases.

Climbing up the table into fifth position is , managed by Ollie Beckett, which invests in small-sized shares listed on the continent. The trust has been on a hot streak over the past year, notching up a share price return of 70.8%. This has not gone unnoticed - due to higher demand for the trust's shares the discount has narrowed significantly, from around 15% last summer to 2% on 5 September. This has led Stifel, the stockbroker, to switch its recommendation from 'buy' to 'hold'.

Maarten Freeriks, an analyst at Stifel, said in a note to clients last week: "We believe the fund should trade on a wider discount for multiple reasons. Whilst performance has been impressive, TR European Growth has the most significant exposure to European smaller companies, with the rest of the peer group having more of a bias towards mid and small cap. The inherent risks that lie with investing further down the market cap spectrum demand a wider discount, in our opinion."

In sixth place is , the UK's oldest investment trust. It has been managed since 2014 by Paul Niven, who decides where to allocate its assets and its level of gearing. Since then the trust's performance has showed a marked improvement.

Next is , managed by veteran stock picker Nick Train who explained to us recently why he believes the bull market is here to stay.

Finally, in eighth position, dropping two places in the table, is the defensively positioned , the investment trust chaired by Lord Jacob Rothschild.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.