Be patient with Neil Woodford

14th September 2017 11:37

by Dzmitry Lipski from interactive investor

Share on

Neil Woodford is one of the world's leading fund managers, with a long and successful track record. He has been investing in out-of-favour companies with sustainable earnings and strong cash flows for over 25 years. After leaving Invesco Perpetual in April 2014 he set up his own Woodford Investment Management business and launched his flagship fund two months later.

The manager has consistently outperformed the UK market and his peers over the longer term, beating the every time. For example, over 10 years to the end of August 2017, the manager has delivered annualised 7.7% return against the FTSE All Share index 6% and the UK Equity Income sector average 6.1%. If you invested £10,000 with Woodford 10 years ago it woud be worth almost £21,100 today.

With a focus on the long-term opportunities, he makes significant fund investments in his favourite individual sectors and stocks, while completely avoiding some other areas of the market.

The fund has been heavily biased towards large-cap healthcare and tobacco firms, which combined accounted for more than 50% of the portfolio. However, the manager has been selling down exposure to tobacco lately and adding to domestically-oriented stocks such as , , and , reflecting a more positive view on the UK economy.

At the same time, Woodford has tried to avoid mining, oil and gas, banking and industrials due to his negative outlook on dividends from these sectors.

Most of the fund is invested in larger companies, but it also has exposure to smaller firms, some of which are not yet quoted on the stockmarket. The manager is known for taking large high conviction bets on stocks which mostly proved successful over the longer term, but this has led to short periods of underperformance when these holdings fall out of favour.

Recently, several of the largest holdings such as (8.2% of the portfolio) and (4.1%) have suffered sharp share price declines, but Woodford reaffirmed his commitment to them by buying more of the stock.

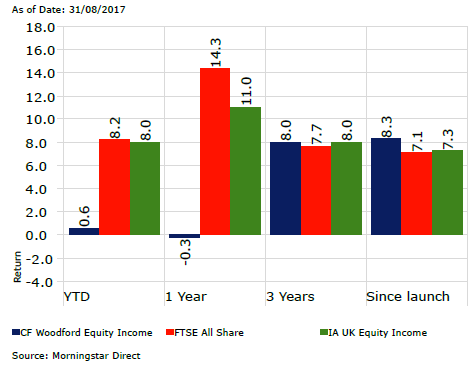

The fund has underperformed the FTSE All-Share and the sector year-to-date and over one year. However, since the fund's launch in June 2014 it has returned 8.3% annualised, compared with 7.1% for the All-Share and 7.3% for the sector.

Woodford's holdings are scrutinised more than others due to his high profile and popularity among retail investors. While investors have been left disappointed about recent performance, they should remember that every fund manager has stocks in his portfolio that can go through difficult times from time to time.

Along with being patient, investors should also fully understand risks that come with the Woodford approach and how his portfolio is built and managed.

Currently, top 10 holdings account for 40% of the portfolio, and the top 20 for 57%. However, there's a long tail of small stocks - 106 out of 136 positions have a weighting below 1% and 80 below 0.5%. There are 44 unquoted companies included in the portfolio that carry significant liquidity risk, given the size of ownership stakes.

The fund has grown significantly over the years and is now £9.8 billion. Together with the other funds run by Woodford - and, since March of this year, the - the firm's assets are close to £18 billion. That kind of size could potentially limit the opportunity set of the manager, providing a headwind to performance.

Since the launch of the newest fund, there is also a risk that Woodford will not have the time to manage his main fund as well as he has done in the past.

Investors should be aware that 'this is not your typical fund' as Woodford has a very distinctive investment approach - taking big long-term bets on stocks and sectors - compared to his peers, so be prepared to tolerate associated risks.

Woodford's recent underperformance highlights the importance of diversification in any portfolio. Investors can blend Woodford's fund with other high quality funds in the sector to gain broader, more balanced exposure to UK equity income, including Money Observer Rated Funds - , and .

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.