Should you hold Renishaw shares forever?

15th September 2017 16:06

by Richard Beddard from interactive investor

Share on

Come on Richard. Renishaw's an out-and-out growth stock. You're a value investor. Why are you holding?

I often ask myself the same question. Last time I thought about it, I broke out in a cold sweat and offloaded some of the shares. Now published its annual report, I'm asking myself the same question.

Renishaw's earnings yield is just 2%. Profit belongs to shareholders, right. Let's pretend Renishaw pays all its profit out in dividends, unlikely, I know. You'd get a 2% return on your investment. Not much is it?

If you prefer thinking in terms of profit multiples, at the current share price the enterprise is valued at 42 times adjusted profit (after tax).

You know what that means, obviously, since you asked the question. Investors expect Renishaw to grow a lot.

Fair enough if you look backwards, it's gone from zero to revenues of over half a billion pounds in little more than 30 years.

So what makes Renishaw so special?

I'm so worried about that I read most of Renishaw's 65-page strategic report this year. It's unusually long, by the way. In fact it's far longer than the company's remuneration report. You don't often see that, these days.

OK, what does the strategic report say?

I'll tell you, but let me start with the company. It's located at New Mills on the edge of the Cotswolds. I think I'm right in saying the mill was new in 1810, but enter the company's Innovation Centre, where Renishaw holds the Annual General Meeting, and you're in a scene from 2110 as the cleanest, quietest machines whirr, probe, gauge, sense, calibrate, and print around you.

Whizz-but-not-bang technology then. Sounds good. What do the machines do?

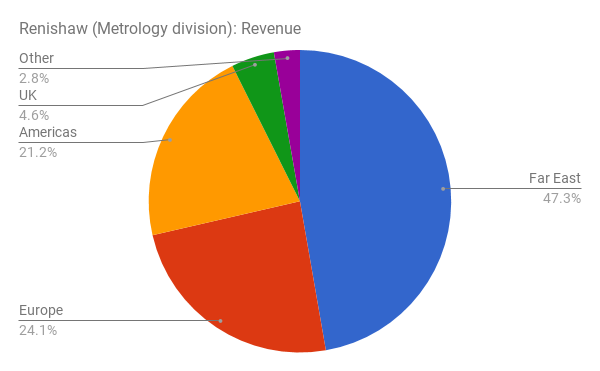

Renishaw's machines are used in factories to set-up and automate other machines and check the components they produce. It's expertise lies in metrology, the science of measurement, a market that is growing as manufacturers automate. Renishaw is not limited by its rural UK location, when so much of manufacturing is in the Far East. Would you like to see a chart?

OK. I predict a pie…

Correct…

Wow. It's global…

Exactly. Advantage number one. Renishaw's been in industrial metrology for a long time, and it's followed customers West and East as they, and it, have grown. Renishaw has offices in 35 countries and they don't just sell machines, they support customers.

That leads me to advantage number two. The business is increasingly solutions oriented…

Solutions oriented? Sounds like corporate mumbo-jumbo...

Traditionally, Renishaw produced components for machines manufactured by other companies, but over the last decade it's also focused on selling machines and components directly to end-users, manufacturers that make bits of planes, trains, automobiles and smartphones for example. It's simultaneously broadening its customer base and deepening its relationship with customers, because they need support to integrate, upgrade and maintain increasingly complex technology into into their production lines.

I think supplying end-users partly explains the acceleration of growth since the Financial Crisis. In the 25 or so years before then revenue grew to £200 million in 2008. Ten years on it's grown £330 million more.

Increasingly complex technology leads me to advantage number 3: More than 1,600 patents.

Now you're talking. Thousands of patents means Renishaw's products can't be copied, right?

Sort of… All those patents are evidence Renishaw has valuable products and that the vast amounts it spends on R&D and capital expenditure may be worth it (20% of revenue in the year to June 2017).

Renishaw probes are used in coordinate measuring machines (CMMs) for example. These tools measure manufactured components very precisely to ensure they're up to specification. One of the most common types of probe, the touch-trigger probe, was invented by Renishaw's founder Sir David McMurtry. Renishaw supplies them and other components to many leading CMM manufacturers like Zeiss and Wenzel. They can also be retrofitted into almost any CMM.

Innovation and patents are one of the reasons Renishaw is the dominant supplier. However, the early patents on the touch-trigger probe have expired. McMurtry invented it in the early 1970's, so the company is relying on patented improvements and new products like its flagship REVO probe head that makes CMMs more nimble. REVO also contains patented technology.

Other companies, like Hexagon, perhaps the world's biggest metrology company, make touch-trigger probes these days, so Renishaw must keep on innovating if it is to retain its advantage. Innovation is advantage number 4, by the way.

It's still innovating then.

Oh yes.

Last year it talked up its 3D Printers. This year's annual report makes a big deal about ATOM a position sensor the size of your fingertip that contains patented optics that improve accuracy and resolution. One of the first applications for ATOM is in the next generation REVO, REVO-2.

ATOM's also an example of advantage number five, vertical integration.

Eek… Vertical integration. More jargon…

Renishaw makes machines with its own machines. The ATOM sensors, for example, are too small to be manufactured by hand and the fully automated production process uses a touch-trigger probe to calibrate them.

Renishaw must learn a lot by using its own products. Even though rivals probably benefit from insights gained by using their products, if Renishaw is using and improving better machines, it will be a more efficient manufacturer and new generations of its products will probably still lead the market.

This self-sustaining cycle should persist so long as the culture of innovation and self-reliance survives Renishaw's co-founder, David McMurtry. Culture's probably Renishaw's real secret weapon - the source of all the other advantages.

If McMurtry's responsible for Renishaw's culture, there's a problem isn't there? He's getting on a bit isn't he?

Yes. He's 77. He's still chairman and chief executive, and he owns 36% of the shares. To say he's an important figure is an understatement. But I'm not sure how important his continued presence is to the future of the company.

The culture's probably pretty ingrained. With the exception of health and safety, all of Renishaw's non-financial key performance indicators relate to the recruitment, training and retention of the staff that innovate. In 2016, employee turnover was 5.7%, little more than half the rate for the UK manufacturing and production sector, and its committed to increasing the number of apprenticeships and student and graduate placements every year.

While McMurtry runs the board and the business, at the AGM last year he pretty much took a back seat. Will Lee, the sales and marketing director, and finance director Allen Roberts did most of the talking. Lee's been with the company since 1997 and still looks pretty young to me. Roberts joined in 1979, and is less fresh faced.

Renishaw is the kind of company that promotes from within, but if it did recruit senior executives, the culture would probably live on.

Terrific. Why wouldn't you want to hold the shares on a PE of 42?

That's what stops me selling all my shares If you believe a culture of innovation can keep a company competitive, Renishaw is the archetype. But…

But… There's always a bleedin' but. But what?

I wonder what would happen in a major recession. We only have to look back to the financial crisis to see Renishaw was vulnerable then. Manufacturers stopped investing in their factories and Renishaw's revenue dried up. It's employees remained loyal. The majority that weren't made redundant took pay cuts, and by the most lenient measure it just about managed to scrape a profit.

Today Renishaw is a bigger, more diversified firm, and it's less reliant on a few big machine manufacturers. It probably isn't as as susceptible to recession any more, especially since it retains the virtues of financial sobriety and employee loyalty.

That said, I don't think a company so highly rated that serves cyclical markets will ever be comfortable to hold through thick and thin.

Wait! What about the surgical robots. You've not talked about the whizziest of all Renishaw products.

There's a reason for that. The robots are part of Renishaw's loss-making healthcare division that also manufactures dental implants and spectroscopes. It's trying to create a new market, like it did with probes. If surgical robots are the future, and Renishaw's have unique and patented features that lead the market, we'll be in the money again.

I can't imagine an application that requires more careful measurement than neurosurgery and I'm rather pleased a company as clever as Renishaw is trying to do it. But prudence keeps me from ascribing any value to the business.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.