12 'out of form' cheap shares that could bounce back

19th September 2017 09:28

by Tom Bailey from interactive investor

Share on

In our seemingly never-ending world of low yields and overvalued stockmarkets, trying to find profitable investments is no easy task. Investors, then, could do well by taking a look at a form of value investing, which goes by the name of "bottom fishing", or "bottom feeding".

As unappealing as its name sounds, bottom fishing suggests investing in "cheap" shares, endorsing the value investing approach.

The idea behind value investing is that a catalyst will occur to revive an underpriced company's financial fortunes, in the form of a restructuring, refinancing or management change that increases its earnings and dividends.

The trouble and danger with bottom fishing is that a company's share price could decline much further before staging a recovery, so investors risk catching a falling knife.

In the early years of the financial crisis, there was renewed interest in bottom fishing. And it was a good idea at the time, given that stockmarkets around the world had taken a battering. Smart investors swooped in and bought up the companies well below their real value, making a tidy profit in the process.

However, right now we're in a bull market and by most measures stocks look pricey, particularly in the US. To go bottom fishing today takes a bit more effort.

According to Simon McGarry, a senior equity analyst at Canaccord Genuity Wealth Management, bottom fishing is an investment practice that can reap significant results in the current climate where "overvaluations are common" and "yields are stretched".

Therefore, McGarry has compiled a number of companies he thinks are undervalued."We've done some research looking at some equities we feel have been sold off indiscriminately, but where analysts who cover the stocks are being more positive," he noted.

McGarry said that there are three key tests that must be applied to a stock before it should be considered in a bottom fishing strategy, in order to filter out cheap stocks that cheap for all the wrong reasons. "It is based on the premise that the low valuation is temporary and will bounce back at some point in the future, making the investor a profit," he adds.

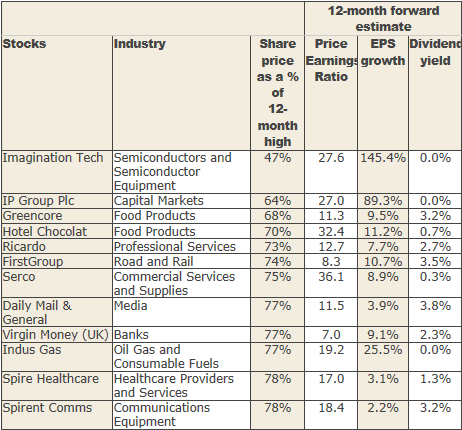

First of all, the stocks must be trading at least 20% below their 12-month high. So in the case of , its share price is currently 47% below where it was during its 12-month high. This suggest that the stock may be trading below its value - having been sold off in panics over a one-off profit report, or sold indiscriminately during larger events such as reaction to the UK's vote to leave the European Union.

Bottom fishing is risky: how do you know if the company you're betting on will bounce back? Therefore, two other filters are applied. The earnings per share (EPS) must be forecast to grow over the next 12-months and analysts must have been revising upwards their estimates for current-year projected earnings.

So, for example, is estimated to see its earnings rise by a respectable 10% over the next year.

But don't be seduced by sky-high earning growth estimates. Take Imagination Tech (see table above). Its EPS is projected to boom by a 145.4%. While that sounds impressive, investors need to look under the bonnet, as it doesn't necessarily mean the business will have fantastically high profits in the future. The growth rate, expressed in percentage terms, is high, but it could be because of profits having previously been so low, or non-existent, to begin with. A small jump in profits can lead to what appears to be a huge EPS growth rate.

McGarry points out that anyone looking into these bottom fishing stocks should take a closer look at each company first. When he carried out the research, he says, he took a "very mechanical approach." While they qualified for his bottom fishing criteria, they may not be good bets.

Bottom fishing, McGarry emphasised, comes with risk: "the price is depressed for a reason and might well stay languishing at the bottom and not make a recovery at all."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.