The impact of fees on your long-term returns

20th September 2017 10:00

by Rebecca O'Keeffe from interactive investor

Share on

Back when interest rates were 5% or more and equity markets were expected to provide similar annual returns, no one really cared about how much they were paying in fees as portfolio values were rising rapidly and investors were laughing all the way to their (massively overvalued) bank.

However, as we stare down the barrel of a protracted period of low interest rates and similarly low prospective returns, the impact of fees is proportionately much more important - and your financial future is increasingly dependent on paying attention to the smaller details, which can have a significant impact on your wealth over the long-term.

When we talk about long-term, the average investment horizon now stretches much further than before. It used to be the case that we were saving until we hit our magical retirement date, but most of us now ignore any annuity options available and are likely to be invested for 20 or 30 years post retirement, making an investment horizon of 40 or 50 years the norm.

So, how much does it matter?

If your annual real rate is higher, then the impact is even greater.

You may think because your portfolio is growing rapidly those extra few percentage points don't matter, but the effect is sizable. Higher fees early on leave you with less invested, which can't benefit from compound annual returns.

Looking at the numbers in the cold light of day perhaps explains why a growing number of investors are switching to passive funds to grow their portfolios over the longer term.

It may seem like hard work to calculate what you're currently paying and doing a quick comparison to see how much you could save, but actually it is not that difficult. And let's be honest - if you have a portfolio of £100,000, an hour or two of your time for the potential of over £64,000 more in the long-term is well worth it.

Size matters!

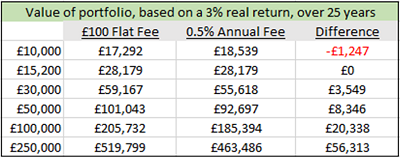

What about flat fees versus percentage based options? This is where the amount you have invested is critical; smaller portfolios are at a disadvantage if you pay flat fees, whereas larger portfolios benefit enormously from such a fixed cost.

However, size really does matter because as your portfolio grows, you would be much better off paying a flat fee rather than a percentage based model.

The pivot point between whether you should go for a flat versus percentage based provider is £15,200 based on the example above.

If you have less than this then opt for a % based provider, but if you have more, especially a six-figure sum, paying £100 in flat fees per annum would be a much better option. Who wouldn't want an extra £20,388 or £56.313!

Investing Regularly

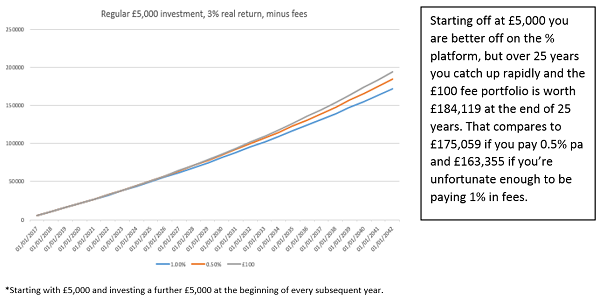

But of course, most investors are not sitting on a large amount and simply investing it, they are building their assets one step at a time.

This example is perhaps the most relevant for investors, and demonstrates that your first few investment years may be better off with a provider who charges a % fee, but, as soon as you have more than c£20,000 in assets, then switching would make a dramatic difference.

In the example above, if you started out paying 0.5% and then switched to a flat fee provider after three years, you get the best of both worlds and your portfolio would be worth £184,413 - £294 more.

Next steps

So, what should you take from the various tables and charts above? Well, for investors who are just starting out and investing small amounts in funds, then definitely choose the percentage based option for now.

However, if you're an established investor and have already managed to build a reasonable portfolio, then you should investigate your options. If you are lucky enough to have a large portfolio of funds and are paying percentage fees, then you really need to work out just how much you are receiving for the lofty fees you are paying.

Of course, price is not everything and you need to be happy with the service you receive - so you may also want to talk to friends, get recommendations or use review sites such as TrustPilot to see if you are truly receiving value for money versus the alternatives. You may be surprised at the results.

What sort of investor you are is also important, so investigate how you access and manage your account. Are you an online investor only, or do you want mobile apps or prefer to trade on the phone? Do you want access to news, research, tools and model portfolios? All these factors matter.

If, after all that, you conclude you're with the wrong provider and want to transfer, then this is a very simply process. Open an account with your new provider, fill in their transfer forms and the new platform will do all the heavy lifting for you.

Are you aware of how much you are paying to have your money managed?

Loyalty is a fantastic attribute, but over recent years we've gradually been waking up to the idea that some companies are taking advantage of our continuing custom and our loyalty is costing us more and more.

As a consequence, most of us have become much more adept at choosing mobile contracts and utility services based on how much we can save. We use cashback sites and are more savvy about looking for discounts and special offers when we go shopping or away on trips.

However, despite all this, many of us are failing to pay attention to how much we are paying to have our money managed. We need to start recognising that we should be more aware of fees when it comes to our ISA and pension providers too.

Most platforms provide the same functionality and the same investment choice. They pay dividends on the same day and invest your money regularly when you want it. They have experienced members of staff on the phone if you need to talk to someone - though to be honest, you should rarely have to pick up the phone if your provider is doing their job right.

Changing your insurance or gas provider might save you £200-£300 a year, saving around £6,250 over 25 years. Changing your pension provider could save you tens of thousands over the same time horizon.

So, if you are genuinely interested in maximising the return on your portfolio, then review your platform in the same way as you do other services to ensure it remains fit for purpose, and that it is your financial future that benefits the most.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.