German election: Will Merkel get green light for Brexit concession?

21st September 2017 10:19

by Emil Ahmad from interactive investor

Share on

When one reflects on the changing political landscape over the past 18 months, only a brave man would suggest that an election result is a foregone conclusion. However, Germany may prove to be a rare exception in a period characterised by the unexpected.

With polling stations open on Sunday, a fourth successive election victory for Chancellor Merkel seems an inevitability. The foundation for a successful election campaign would appear to be on as solid ground as the German economy.

The German comeback

The rebirth of the German economy over the last 15 years exhibits a level of revitalisation which many of its less affluent European neighbours can only envy.

Even some repercussions of the Great Recession were arguably negotiated with more skill than many of its counterparts; while many other major economies endured soaring unemployment rates, the effect was negligible in Germany. It is beyond dispute that the former "sick man of Europe" is in good health.

While the foundations may have been laid prior to Merkel's reign, there is no doubt that Germany has flourished under her leadership. The statistics for the world's fourth-largest economy make for impressive reading.

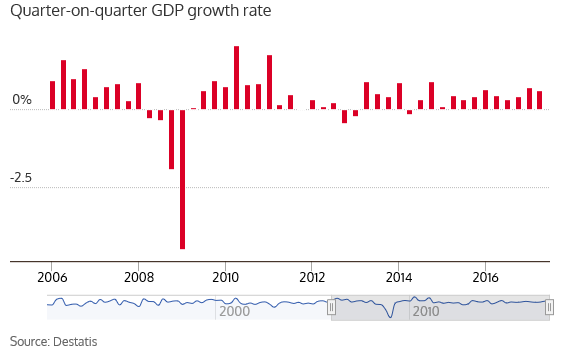

Recent figures produced by the Federal Statistical Office (Destatis) indicate that GDP grew by 0.6% in Q2 as the eurozone giant enjoys it's the best year-on-year growth since 2014. This is the 12th consecutive quarter in which the German economy has grown.

There is similarly good news from a workforce perspective, with unemployment at its lowest since reunification. This growth is expected to continue throughout 2017, albeit at a more muted level.

The economy ministry pointed towards lower household spending and industrial production as drivers, noting in its September report that "…the dynamics are likely to be somewhat weaker".

An exporting success story

As an export-led nation, Germany can look towards its budget surplus as a clear indicator of successful economic strategy. This has been achieved for three consecutive years with last year's €24 billion (£21 billion) figure representing the biggest annual surplus since the Berlin Wall came down.

While Germany may be basking in the glory of its status as an export powerhouse, these sentiments are not necessarily shared by other major economies.

In simplistic terms, Germany has been very conservative since beginning its post-war recovery, running a surplus on its current account in most years since 1950.

Critics of German economic policy emphasise the negative global ramifications of this propensity to save rather than spend and prioritise exports. With Germany's savings exceeding its investments, it still needs to earn a return on the surplus.

The outcome is that Germany lends these funds internationally. Therefore, other nations are forced to borrow and have a current-account deficit, thus ensuring sufficient aggregate demand to maintain employment. The fact that Germany's overall surplus was approaching $300 billion (£222 billion) in 2016 and exceeded China's figure really puts this problem into context.

As exports form a fundamental part of the German economic 'miracle', it should come as no surprise that there are a number of vocal critics. In addition to being accused of taking advantage of other countries' spending, Germany has been admonished for effectively running a policy of exporting unemployment.

Trump has thrown his hat into the ring, eloquently describing Germany's surplus as "…very bad". In reference to the huge number of German cars sold in the US and its alleged impact on domestic employment, Trump has decreed "…we will stop this".

In its role as the most powerful and influential member of the euro area, the rumblings of discontent have also been heard closer to home. Germany is the most creditworthy country within the eurozone and has arguably used this position to the detriment of other members.

It has demanded the implementation of austerity measures for the most indebted nations. Conversely, Germany apparently fails to recognise or acknowledge that its own limited expenditure simply compounds their problems.

The Anglo-German question

From a Brexit perspective, talks appear to be making little headway as the EU and the UK appear to have different agendas.

It is somewhat of a negotiatory stalemate; while the UK wants to provide certainty to business and begin to formalise its future EU relationship, Brussels wants to fully finalise the minutiae of the withdrawal process. It is clear that the EU is prepared to play the waiting game until the finer details are set in stone.

An 11th hour Brexit reprieve notwithstanding, there is little doubt that a free trade agreement would be in Merkel's best interests.

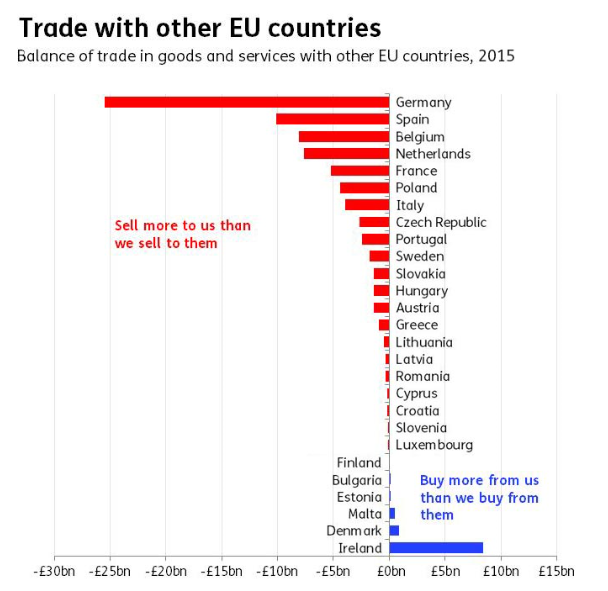

The UK imports more from the EU than it exports and Germany has the most to lose when compared to its European neighbours. According to figures from the Office for National Statistics, the UK ran a £25 billion trade deficit with Germany in 2015.

Source: Office for National Statistics, The Pink Book 2016, Table 9.3

The Association of German Chambers of Commerce and Industry (DIHK) represents over 3 million businesses and entrepreneurs in Germany. It recently suggested in the press that even if the UK negotiates a free trade deal with the EU the impact of trade barriers would simply be "reduced" rather than completely nullified.

The adverse effects of Brexit on the German economy are already apparent, something which DHIK spokesperson Thomas Renner fully acknowledges.

In his comments to the HuffPost UK in July, Renner stated: "Brexit will damage the German economy as a whole… Negative consequences are already there, even if Brexit negotiations have just begun. Brexit already has impacts on the UK trade with Germany: in 2016 exports to the UK decreased by 3%."

To fully consider the importance of the UK to Germany as a trading partner, one only needs to look as far as the car industry. The car industry represents the largest German export sector to the UK.

The German Association of the Automotive Industry (VDA) estimates that in 2016, approximately 800,000 new cars were exported to the UK. This amounts to almost 20% of the sector's overall exports.

While the UK may run a disproportionately large trade deficit with Germany, it is beyond question that it is a mutually beneficial relationship. Further figures from the DIHK estimate that 750,000 jobs in Germany are reliant on the UK as a trading partner.

Additionally, 2,200 German companies also provide employment to around 400,000 people in the UK via a network of branches. The equivalent figures in Germany amount to 1,400 British companies with their respective branches employing 250,000 workers.

The Merkel-Macron compromise?

Indeed, it could be argued the EU's relationship with the UK is so central to its stability that there are grounds for compromise and for Brexit to be reversed. However unlikely this scenario may be, former Labour cabinet minister Lord Adonis clearly believes in his own rhetoric.

He recently suggested in the Observer that this would be dependent on France and Germany agreeing to UK autonomy over immigration policy whilst remaining in the EU.

Furthermore, this would require an additional referendum before Brexit is finalised, with the UK voting to remain in the EU or accept the proposed divorce deal.

"The interplay between a referendum and such a Merkel-Macron 'offer' will be vital," observed Adonis. "If it is clear by next summer that Britain is going to hold a referendum, then the incentive for them to make a bold offer greatly increases."

As Merkel prepares herself for victory on Sunday, securing a fourth successive term as Chancellor may prove to be one of her less difficult challenges. Business is clearly buoyant in Germany and providing a tailwind for the rest of the eurozone.

However, the UK plays more than an incidental role in Germany's ongoing economic strength and Merkel will not want to jeopardise this. Assuming a Merkel victory, this will undoubtedly be at the forefront of her mind when she returns to her seat at the negotiating table.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.