13 investment trusts offering dividend yields of 4% plus

27th September 2017 09:01

by Marina Gerner from interactive investor

Share on

At times, such as now, when stockmarkets are riding high, it becomes tougher for income seekers to source income at a sensible price.

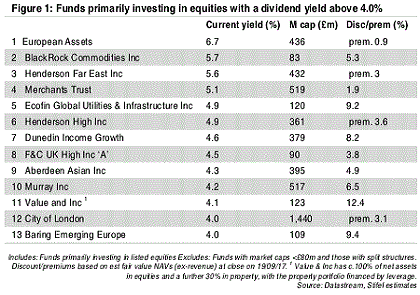

But, thankfully, in the case of investment trusts, there are plenty of opportunities to find a market-beating dividend yield on the cheap. According to Stifel, the broker, there are currently 13 investment trusts investing in equities that have a dividend yield of 4% or higher, an increase from 11 six months ago.

As the table below shows - nine of the 12 are trading on a discount - so therefore the share price is lower than the underlying value of the assets that are held by the trust.

As the table below shows the highest yield on offer is 6.7%, followed by , which has a dividend yield of 5.7%.

UK equity income trusts are well represented. has the highest yield in this sector at 5.1%, with the shares on a 2% discount.

The rise in the number of trusts reflects the inclusion of , and , which have all seen their yields rise over the past six months.

Note: The table excludes trusts with market caps of less than £80 million.

Discounts and premiums explained

The two layers mean trusts have two values: how much the trust itself is worth (the net asset value or NAV) and its share price.

If the trust is popular (perhaps because the wider industry or geographical sector in which it invests is attracting a lot of interest), the share price will be boosted by extra demand, but this doesn't necessarily mean the underlying NAV has changed.

When the share price is lower than the NAV per share, this is known as a 'discount'. When the share price rises above NAV, it's trading at a 'premium', as you're paying more than the assets are worth.

If you buy at a discount and that discount reduces or narrows (due to increased shareholder demand, say), your holding could gain in value, even if there's no movement in the underlying NAV.

Conversely, the discount could widen, so your holding loses more value than the underlying assets do. Many trusts therefore control discounts artificially through share buybacks.

It's generally not a good idea to buy a trust on a high premium, of say 5% or more, because it tends not to be sustainable over the long term and can turn into a discount when conditions change.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.