ETF income fund tips: Beware of dividend traps

28th September 2017 10:10

Morningstar's Dimitar Boyadzhiev explains the importance of looking under the bonnet of your chosen dividend ETF.

Over the past decade income-seeking investors have poured money into dividend-screened UK equity ETFs. Dividend appeal continues to be supported by ultra-loose monetary policy and historically low bond yields. Investors are spoilt for choice in terms of passive options, but this can make choosing the right fund a daunting task - not least when different investment strategies are marketed using a similar message.

We lay out the investment case for a dividend-oriented strategy, point out the benefits of the ETF wrapper and look under the bonnets of two popular yield-focused UK equity ETFs to highlight the importance of due diligence in selecting index trackers.

Why dividends?

Equity dividends have a tendency to rise over time, so potentially they offer income-seeking investors better long-term inflation protection than conventional bonds do. That said, not all dividend-paying companies behave equally.

Some are mature, slow-growth firms with strong cash flows and conservative, albeit stable, approaches to dividend payouts. Their stocks tend to react more in line with bonds to fluctuations in interest rates. Others are growth-oriented companies, usually with more aggressive expansion plans - firms that tend to mark their success by raising dividends but are more prone to volatility.

Dividend-weighted ETFs offer an efficient solution to investors. Not only do they cover the heavy lifting of screening and selecting the right stocks, but they also benefit from the usual advantages of using ETFs, including transparency both of strategy and of the fund holdings themselves.

Buying a well-diversified ETF can protect investors from over exposure to a single firm or sector. For example, an equally weighted portfolio of 10 stocks can deliver a significant loss, even if just one or two stocks suffer a severe price decline. Dividend oriented equity ETFs usually hold at least 30 stocks, so winners help offset losers.

The cost advantages of ETFs are a formidable hurdle for active managers hoping to generate value over the long term. In the case of yield-focused equity strategies, two of the most popular ETFs, and , charge 0.4 and 0.3% respectively. This compares with 0.95% charged on average by actively managed peers.

Yield conundrum

The basic merits of the ETF wrapper are universal, but investors should not be fooled into believing all ETFs offering exposure to a given market or strategy do so in the same manner. This is particularly so when moving away from plain vanilla market cap-weighted exposures.

Such is the case with dividend-screened equity strategies. Some of these ETFs focus on squeezing out the highest possible payout, while others concentrate on higher-quality companies that aim to maintain a balance between income and long-term capital growth.

Thus, the iShares UK Dividend ETF - which tracks the 50 highest-yielding UK stocks via the FTSE UK Dividend Plus index and currently sports a dividend yield of 5.03% - might initially appear an attractive choice.

However, the UK Dividend Plus index simply ranks stocks by promised yield. No measures are taken to evaluate companies’ debt levels or assess whether they are likely to stay profitable.

This exposes investors to 'dividend traps'. In this scenario, a company may be promising a dividend it cannot afford. For example, during the financial crisis in 2008, this ETF suffered significantly from holding stock in European banks that went on to suspend planned high dividend payouts.

Indeed, the absence of sustainability screening is the key reason why Morningstar awards a negative analyst rating to this ETF.

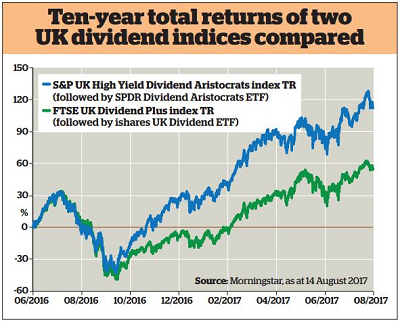

By contrast, the SPDR UK Dividend Aristocrats ETF tracks the S&P High Yield Dividend Aristocrats index, which holds 30 companies that have consistently raised or maintained dividend payouts over 10 or more consecutive years. In practical terms, these are companies for which a stable dividend distribution policy trumps the promise of a high payout.

Our analysis shows that the companies in this portfolio have better profitability characteristics and lower debt. But consistency usually comes at the expense of a lower yield, which for this SPDR ETF stands at 3.97%.

Nevertheless, in our view, this is a superior investment strategy. When it comes to passive funds, it pays not to overlook the fact that the strategy is defined by the index. Hence, thorough due diligence on benchmarks must be a key aspect of fund selection.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks