Big levels to watch for sterling and Barclays

26th September 2017 10:51

by Alistair Strang from Trends and Targets

Share on

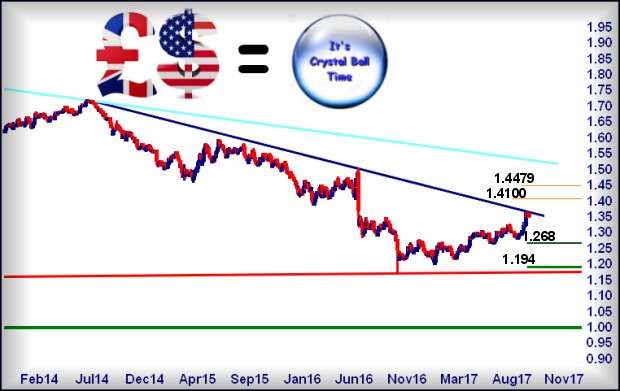

Sterling (FX:GBPUSD)

It's that time of the month when we discuss the disgusting and take a look at the Great British pound versus the US dollar.

A headline caught our eye mentioning that Mitsubishi Bank expected GBP:USD to hit $1.40, causing our hackles to rise. This sort of thing strays into our territory, provoking a rush to immediately dismiss their nonsense and explain why.

Except they almost have a point for a change. Aside from a big fat massive "however!", which they failed to mention.

If we adhere to our law of "Higher Highs", a short position on GBP:USD is liable to go catastrophically wrong if the pairing is either trading above $1.3658, or (important bit) closes a session above roughly $1.36122.

In either case, the pairing will better the long-term downtrend since July 2014 and also enter a phase where we'd anticipate coming growth toward $1.4105, slightly bettering Mitsubishi's proposal. Our longer-term secondary target calculates at a less likely $1.4479.

For now, though, the relationship is simply threatening the trend and most emphatically has not triggered a movement to $1.4100.

In fact, when we map GBP:EUR with a similar method, this pairing is in a similar predicament. It almost hints the currency markets have not decided whether UK politicians are stupid or not, a really difficult question...

On the calamity side of life, the pair needs to drip below $1.3148 to signal coming trouble, as reversal to an initial $1.268 makes sense with secondary, if broken, a very likely $1.194.

And if the secondary breaks, the relationship founders quite dangerously as while effective parity is the next calculation, we rather suspect a lower number is possible.

Barclays (LSE:BARC)

share price rather oddly exhibits vaguely similar symptoms to the above currency pair, as in it's stuffed, but perhaps showing efforts to escape the plunge into the gutter.

We've attempted to make the chart below as confusing as possible, painting lots of lines in an effort to highlight something important.

To be blunt, the ruling logic against this share dictates the price is currently heading to 165p, perhaps even a longer term 148p if such a level breaks. To trash this argument, the share price needs better 204p currently, which, pausing for thought, does not represent a horrible stop level.

We're a bit twitchy about this due to recent price behaviour.

It appears the market is not entirely happy at the thought of Barclays once again immolating itself and we're looking for signs bottom is actually "in".

The share price keeps threatening the immediate downtrend and, now, the situation exists where it need only trade above 192.45p to tick the first box for a coming miracle.

If opting to take the blind faith approach and go long, the tightest stop looks like 185p currently. And, should the upward movement trigger, our first ambition calculates at 198.4p which, if bettered, ticks the second box to confirm bottom is probably in. Additionally, the share price enters a region where 208p becomes believable!

The fly in the ointment is the solid blue downtrend since February this year. Currently, it's around 201.3p and liable to provide an excuse to throttle a rise.

And above 208p we'll need to take another look at future potentials as, visually, there's something going on at this price level which again risks stifling the future. Plus, in a month or so, the 208p ambition also collides with the downtrend since 2007 - just before it all hit the fan.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang, Shareprice, or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.