How to invest wisely for your retirement

29th September 2017 15:48

by Dzmitry Lipski from interactive investor

Share on

What's the right portfolio mix for your pension?

Investing for retirement generally has two stages: accumulation and drawdown. Typically, both can be accomplished using a balanced portfolio of mainly equities and bonds with a focus on income. At accumulation, or growth, stage investors usually reinvest dividends and income and begin taking money out in the drawdown, or retirement stage.

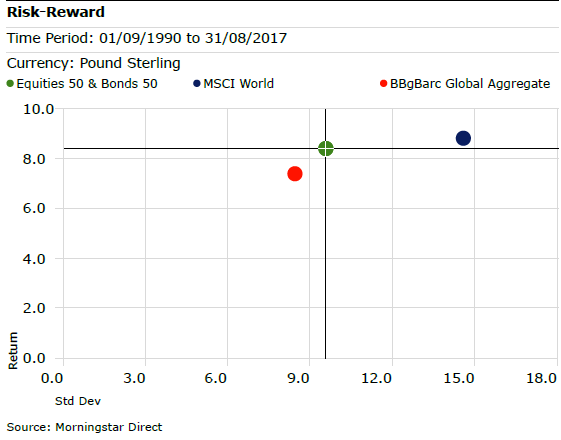

The chart below shows that over the last 30 years, an equally balanced portfolio of global equities and bonds (green circle on the chart below) generate similar returns (y axis) to equities of 8.4%, but with much lower volatility of 9.6% as measured by standard deviation (x axis).

Compare this with the MSCI World index return (blue) - as a proxy for equities - of 8.8% with volatility 14.6%, and the Barclays Global Aggregate index (red) - as a proxy for bonds - return of 7.4% with volatility of 8.5%.

Equities are considered more-risky and can be volatile at times, but can offer greater rewards. Cash and bonds tend to be safer investments, but typically provide more modest returns. While it's generally recommended that pension investors should take on a more conservative investing approach as they near retirement, it will depend on an individual's unique circumstances and tolerance for risk.

According to the classic life styling investment strategy, you meant to subtract your age from 100 to gauge how much you should have invested in equities. So, if you're 30, have 70% of your portfolio in equities as more risk is allowed due to your longer term horizon - time to retirement. If you're 60, have only 40% in equities and 60% in safer assets as bonds and cash since there is less room for loss as you approach retirement.

However, this approach is being increasingly challenged following changes to the pension rules, which came into effect in 2015. New pension freedoms almost encourage investors to manage their portfolios through their retirement. This has caused demand for annuities to collapse.

So, today's investors have a serious dilemma. Life expectancy has increased significantly over the last decade, with a person retiring at 65 expecting to live another 20 years or more. Investors, especially those with limited assets, may find it difficult to build a portfolio that provides a comfortable retirement without fear of running out of money, and being dependent on family or the state.

Challenging economic environment or new normal?

And it's a challenging time to be an income focused investor. Current low interest rates and uncertainty over the prospects for monetary policy in the developed world have made it difficult for many investors to find a good yield. The yield on the UK 10-year Gilt is only 1.4%. The dividend yield on equities is higher, but it's been under pressure as equities have had a strong run in the last few years, bringing average yields down.

The yield on the FTSE All-Share index is now under 4%. This is a direct result of central banks ultra-easy monetary policy of low interest rates and quantitative easing designed to boost economic growth post the global financial crisis. Investors have been forced to look for higher yields in more risky areas of the markets such as high-yield and emerging market bonds.

But with an improving economy, central bank policies are starting to reverse. For example, the US Federal Reserve has already started to raise rates in response to rising inflation expectations, with the European Central Bank and Bank of England likely to follow.

Therefore, investors are concerned that this could cause bond prices and possibly high-yielding equities to fall in value when rates to return to more normal levels. In addition, with the strong performance from equities and bonds recently, the upside for both asset classes also seems limited.

Less yield, more safety

More risk averse investors are probably better off targeting less yield and more safety.

In bonds, this means allocating more to short duration and higher quality bonds, while reducing risky long-term and high-yielding low-quality bonds.

For example, a 1% rise in yields will have a much larger impact on the price of longer-maturity government bonds compared to shorter-maturity bonds. This means short duration exposure to bonds could help investors reduce the impact of rising interest rates and market volatility.

Furthermore, investment grade bonds are considered to be less sensitive to interest rates than government bonds, so their price return is better in a rising rate environment.

Global and Strategic bond funds may be best positioned to navigate the current environment. These funds have the flexibility to seek the best returns from across global markets, and to move their asset allocation significantly, shifting exposure to government bonds, investment grade corporate bonds and high-yield bonds depending on the prevailing environment.

These Money Observer Rated bond funds could be a good option for a balanced portfolio: , and

Within equities, preference should be given to stocks with moderate but rising dividends and strong balance sheets, instead of high dividend payers, especially in more defensive areas so-called 'bond proxies', which are more sensitive to rising rates and where valuations look stretched.

These Money Observer Rated equity income funds be a good option for a balanced portfolio: , and

Despite the challenges and limitations of investing for retirement, there's still a role for both equities and bonds in a balanced, well diversified portfolio. While allocation of investment grade bonds that are not overly sensitive to interest rates helps produce reliable income and keeps portfolio stable.

In equities, adding steady dividend growth stocks should boost income and provide greater potential for capital growth.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.