Can this winning Dogs of the Footsie portfolio do it again?

5th October 2017 11:02

by David Brenchley from interactive investor

Share on

This time last year, we put together our very own Dogs of the Footsie portfolio, taking a different approach to others.

Ordinarily the popular strategy picks the 10 highest-yielding blue chips at the beginning of the year in the belief that their shares are undervalued. Our sister website Money Observer runs one of the more popular incarnations.

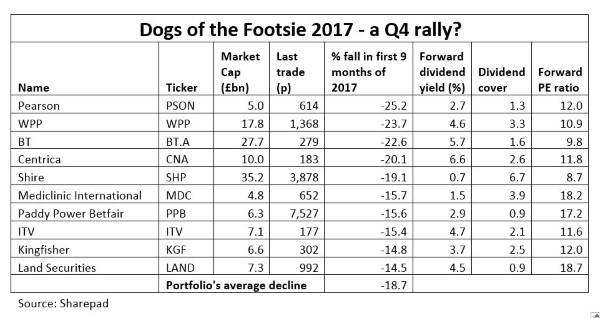

We decided to pick the 10 worst-performing shares through the first three quarters of 2016, hoping to pick up some gains as bargain-hunters moved in during the seasonally strong fourth quarter.

All were cheap on the standard price/earnings (PE) valuation multiple, while seven out of the 10 offered an above-average dividend yield. That's because the shares had tanked and the market had doubts about the companies' ability to maintain shareholder returns.

The best performers included a duo of high-street lenders, (up 28%) and (15%); and a pair of airlines, (16%) and (13%).

By the end of 2017, only one of the 10 Dogs - - had fallen in value, dropping 12% in the fourth quarter to take its annual loss to over 50%.

Having had such success, we thought we'd try it again this year. 2017's Dogs are almost completely new. Spare a thought for , though. The broadcaster is in our portfolio once again after declining 15% in the year to 29 September.

is top dog this time around. Losing a quarter of its value so far this year, the education services giant has been a basket case for a while now, issuing profits warnings and slashing the dividend.

Shares advanced late September after broker Exane BNP Paribas upgraded to 'outperform', suggesting a forthcoming third-quarter update would be positive.

Yet fellow sell-side analyst Liberum countered that the rally will be a "false dawn", similar to that seen mid-May when a 12% rise proved short-lived. Still, it only needs to hold out for three months to benefit this Dogs portfolio.

Advertising behemoth a company to be wary of. It's already downgraded earnings forecasts twice in 2017. The old maxim that profits warnings come in threes means investors should be on alert.

Having traded above £19 as recently as March, shares are at 20-month lows around £13. UBS reckons the stock's still worth 1,900p, though. Boss Sir Martin Sorrell soothed the broker's worries and it is confident on prospects for 2018 and beyond.

Still, that does nothing for our portfolio's timescale of three months. Issues of WPP's largest clients cutting their advertising budgets aren't something that'll disappear overnight. Let's hope it doesn't complete the hat-trick at its third-quarter update later this month.

also fallen on hard times. Fighting to bust through stiff resistance at £5 early 2016, it's almost halved since. A well-documented accounting scandal in its Italian division led to a profits warning in January and it's down 23% year-to-date.

While sentiment doesn't look like picking up any time soon, technical analysis reveals reasons for hope. Our expert John Burford reckons it could be time to buy, with potential for big gains longer term. For now, though, he's cautious, calling shares up to 320p initially.

Broker Barclays certainly isn't afraid of being bullish, sticking a target price of 450p on shares.

The energy sector has long been the subject of political posturing, with speeches from party leaders capable of hitting share prices. And with Labour in favour of re-nationalising energy providers, sentiment towards the likes of has waned in 2017.

Down 20% in the first three quarters, it slumped further Wednesday after prime minister Theresa May pledged to cap energy prices at the Conservative Party Conference. The British Gas owner fell as much as 7% on the day, taking YTD losses to 24%.

Conversely, improved this month, jumping back above £38. Down a fifth through September, Liberum flags it as one to watch on its "red flag" criteria.

Still, the share price chart suggests the drug manufacturer goes through ups and downs regularly, so recent moves to reverse losses are encouraging.

That said, Liberum reckons any further news, good or bad, is priced in currently. "The 35% [price/earnings] discount to the sector [is] more a trap than an opportunity," argues analyst Roger Franklin.

Aside from ITV, the rest of the list includes (-15.7%), bookie (-15.6%), B&Q and Screwfix owner (-14.8%) and real estate investment trust (-14.5%).

Like last year, we'll monitor performance and provide regualr reoprts until the end of the year.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.