Are these UK index-linked bonds the best way to protect against inflation?

5th October 2017 12:19

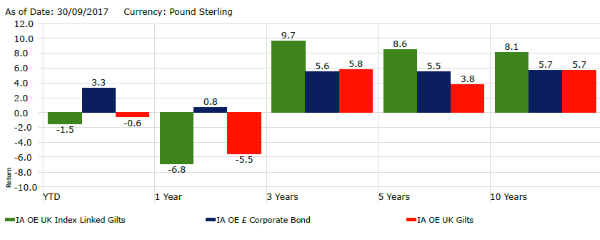

UK index-linked gilts have been under pressure following the Brexit vote, which triggered even further falls in gilt yields. In recent years, the majority of managers have held an underweight position in duration based on their view that UK are yields are too low, but longer-dated gilts continued to outperform short-dated gilts, hurting their funds' performance.

However, despite the persistent lack of inflationary pressures and further delays to interest rate rises in the UK, the sector is among the top performing niches of the fixed income universe over the longer term, largely because of 'liability-driven' allocations from large pension funds.

Source: Morningstar

The current outlook for the sector remains fairly positive on the back of heightened inflation expectations, driven by weaker sterling and the Bank of England's extremely loose monetary policy.

High levels of debt and prolonged Brexit negotiations might also make it difficult for the Bank to increase interest rates by much to control it.

Historically, UK government index-linked bonds have proved to be a good inflation hedge over the longer term, protecting the real value of a portfolio, due to the link of the bonds' capital and income returns to the UK RPI index.

How can investors gain exposure?

Due to institutional demand, UK inflation-linked bonds are long-dated with high duration (the sensitivity of a bond, or bond fund, to changes in interest rates). The higher the duration the more sensitive the bond is to changes in interest rates. This also means that benchmarks for this market such as FTSE Actuaries UK Index-Linked All Stocks, and thus the passive funds tracking them, come with very high duration, typically above 20 years.

After such a strong performance in UK index-linked gilts, and with interest rates still low, the Bank of England could react to a further increase in inflation by raising rates quickly. This would cause long-dated bond prices to fall sharply and offset any inflation protection.

On top of that they are now a lot more expensive - all trade above par value with negative real yields. This means if investors hold this gilt to maturity, they are guaranteed to lose some of their capital in real terms.

Taking above factors into consideration, investors should be better served by an experienced active fund manager who has the flexibility to adjust fund duration according to prevailing market conditions.

Two managers who rank highly are Paul Rayner and Craig Inches who run the . They've maintained and actively managed an underweight duration bias for the past few years, positioning the portfolio for a steepening in the UK yield curve by an overweighting in 0-5 year maturities and underweighting in bonds with maturities of more than 15 years.

Their stance stemmed from the managers' expectation of a gradual rise in UK bond yields. They believe long-term real interest rates in the UK are still too low, and do not reflect long-term fundamentals.

With global inflation expected to rise and implied inflation across most global markets attractively priced, managers believe shorter dated global index-linked bonds should continue to outperform nominal bonds and longer dated UK index-linked bonds.

Another option for investors is global index-linked fund such as . The fund provided global exposure to the index-linked market and the fund manager can take advantage of discrepancies in bond valuations worldwide, an opportunity not available to dedicated UK index-linked gilt funds.

An investment across the entire spectrum of this asset class should further lower the correlation to equities, thus increasing diversification. Furthermore, global exposure allows access to a larger and more liquid market.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Editor's Picks