Three likely winners in the new oil price environment

6th October 2017 09:22

by Emil Ahmad from interactive investor

Share on

Everybody loves a comeback. At the very least, the oil sector will be echoing these sentiments as the price of Brent crude gradually moves towards $60 resistance levels. After reaching a two-year high of $59 a barrel last week, the $28 nadir endured in early 2016 are a distant memory.

While the sector may be reasonably bullish about its recovery, the celebrations are likely to be somewhat muted; a case of thinking in terms of plain old Brent rather than black gold. With the heady heights of $110 over three years ago, the more prudent investor will not be reassessing this anytime soon.

The travails of shale

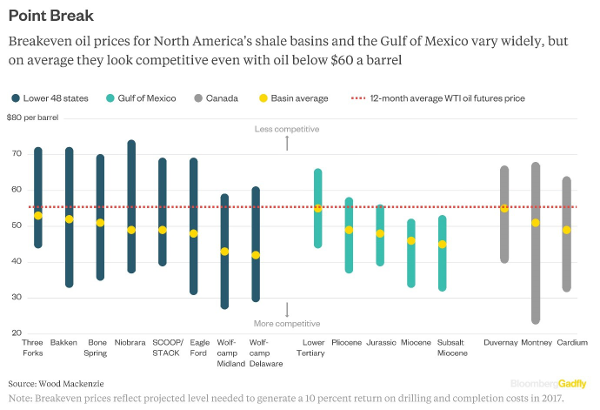

Throw shale into the equation and any future return to trading in the three-figure price is a flight of fancy. Only a few years ago the break-even price of shale basins were $80-$100. Now it's $50.

Analysis of second-quarter financial statements for US shale producers was consistent with this figure, with production at just below $50 a barrel resulting in small losses. Corporate activity confirms this level as a viable marker. When WTI dropped to the low $40s several months ago, drilling activity and the rig count were both brought to a standstill.

Despite OPEC's best efforts to rebalance the market, shale production remains one of the biggest obstacles to ensuring a more stable and buoyant oil price. As John Driscoll, director of JTD Energy Services, wryly observed in the press in August: "It's still sheikhs versus shale."

This huge increase in US shale oil production was one of the primary factors attributable to the commodity market crash in 2014. The weak oil price environment in conjunction with higher marginal production costs put a number of companies under great financial pressure.

The shale producers that avoided bankruptcy had to quickly adapt, reducing output to levels that allowed operations to continue. Remaining steadfast in these more challenging times, the US 'survivors' recognised the need to invest in technology which would improve capital and operational efficiency.

These enhancements ultimately brought down break-even prices as the shale industry enjoyed greater economies of scale; more oil production with fewer rigs. Consequently, the 2017 shale producer is a very different beast from its 2014 counterpart, and is far better positioned to adapt to changing market conditions.

As the price of industry benchmark Brent crude edges towards $60 and WTI follows a similar trajectory, US shale producers are ready to pounce. This could prove to be one of the biggest headwinds for OPEC in ensuring oil prices continue to rise.

It is also one reason why a number of analysts feel that, in terms of Brent, $70 may be the new $100. Janet Kong, Eastern Hemisphere CEO of integrated supply and trading at , is under no illusions that the two production rivals are intrinsically linked in shaping oil's future trading trajectory.

Speaking at the annual Asia Pacific Petroleum Conference (APPEC) in September, Kong suggested that $60 Brent was feasible in 2018 with further OPEC cuts but added that "…it's hard for me to see that prices will be sustainably higher".

This process of rebalancing is complicated by US shale producers, perfectly positioned to rapidly increase output if prices rise above $60. As Kong noted: "That's the interesting thing about shale presence in the world. They are so short-term focused and very responsive."

The rebalancing act

Industry experts more bullish about a tighter oil market simply point to increased demand from China, India and Europe. This is arguably accelerating the draw down process of global inventories and strengthening market rebalancing.

Adi Imsirovic, head of oil trading at Gazprom Marketing and Trading, does not consider $60 to be a major resistance level. Speaking at the APPEC conference, Imsirovic stated: "We see the market over the next six months going well above $60 for a simple reason... surprisingly good demand."

Diesel demand has undoubtedly received impetus from Hurricane Harvey. At one point, this storm was responsible for a reduction of US refinery capacity exceeding 20%. Bulls would suggest that this surge in demand simply augmented an already well-established trend.

Mike Muller, vice president of crude trading & supply at Shell Trading, was another industry expert in attendance at the APPEC conference. Muller identified a growing need to fill strategic reserves and heightened demand for diesel fuel as the primary factors behind 2017's increased oil demand growth.

Official oil demand projections arguably support Muller's assertions. The International Energy Agency (IEA) recently amended its 2017 forecast for oil demand growth to 1.6 million barrels per day (mbpd) from a prior 1.5 mbpd growth estimate.

Indeed, crude demand would appear to be seasonably surpassing supply. Traders now have more incentive to sell their stored inventories, as the physical market for certain crude varieties has tightened to levels not observed in two years.

This market strengthening has resulted in 'backwardation' re-emerging in September. Backwardation occurs when spot prices rise above future prices, thus indicating a tighter supply.

This contrasts with the market since the 2014 commodities crash which has predominantly been in 'contango', essentially the opposite of backwardation. The comparatively higher futures prices encourages hoarding. Under these market conditions, traders will buy and store crude whilst hedging forward to guarantee profit from a future sale.

Citigroup feels that the bears preparing for an excess OPEC supply in 2018 will be unprepared for a tighter market driven by an oil squeeze. Ed Morse, Citigroup's head of commodities research, feels that five OPEC members (Libya, Venezuela, Nigeria, Iran and Iraq) may already be operating at their maximum capacity.

As reported last week by Bloomberg, Morse thinks these members' failure to invest in exploration and development could result in "…a supply gap emerging, which could point to a tighter market".

An industry in recovery

A healthier industry is typically a more active one. According to research from Mergermarket, mergers and acquisitions in the oil and gas sector in the first three quarters of 2017 are up by 40% year-on-year.

This could represent the first annual growth in activity since 2014. Industry giants and recent acquisitions clearly reflect a sector characterised in 2017 by expansion rather than consolidation.

Closer to home, stands to benefit from higher oil prices as production increases at its TEN oil fields. The resolution of a maritime dispute between Ghana and Ivory Coast is also good news for Tullow Oil. It means this huge resource off the Ghanaian coast will not be adversely affected by any national boundary changes.

After reaching a settlement in 2016 regarding its Gulf of Mexico liabilities, BPnow has certainty about its future obligations. With liquids representing of 60% of total production, BP is in prime position to benefit from any ongoing oil price recovery. From an investment perspective, BP's dividend yield of over 6% remains one of the most attractive in the .

At the other end of the scale, continues to make progress towards 'first oil' production at the Lancaster oil field. Having gained regulatory approval for the field development plan in September, Hurricane has targeted initial production for the first half of 2019.

There are clearly cases to be made for an increasingly tighter market or for shale production acting as a natural cap. Irrespective of which side of the divide provides a more compelling argument, one fact cannot be denied; the market is in a far stronger position in 2017 than last year.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.