Are small-cap investors right to favour size over style?

10th October 2017 12:00

by Richard Turnill from ii contributor

Share on

US small caps are on fire, but they're no longer cheap. Richard Turnill, global chief investment strategist at Blackrock, tells us how investors should play the sector.

Sizing up small-cap stocks

Reigniting reflationary hopes lit a fire under global small-cap stocks in the past month. Prospects of a corporate tax cut fanned the flames in the US given small caps' higher tax burden.

But we believe a sustained run will require more than lower taxes.

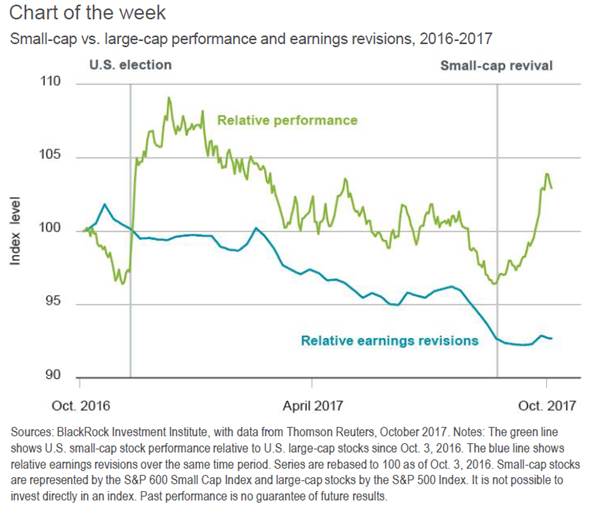

US small caps enjoyed a performance boost post-election on hopes of a corporate tax cut and pro-growth policies. But they failed to capture an edge on US large caps until August, when prospects for tax reform regained momentum. US small-cap returns have outpaced those of their large-cap counterparts by more than seven percentage points since Aug 21.

Analysts, meanwhile, have been downgrading small companies' earnings expectations for 2017, as shown in the chart, suggesting that enthusiasm for the group should be tempered.

Tough comparisons

Small caps are seen as big beneficiaries of a corporate tax cut. The median corporate tax rate for US small caps was about 33% in 2016, compared with 29% for large caps, our calculations show.

Hope that a deep corporate tax cut might come to fruition helped US small-cap stocks make up almost all of the year-to-date underperformance of their large-cap counterparts in just six weeks' time.

But US small caps have some hurdles to clear to win investors' affections longer term. Strong global economic growth and a weaker dollar are boons for large multinationals, which derive more of their profits overseas.

Small-cap earnings estimates also are lagging. Analysts have revised down their 2017 and 2018 estimates by 8% and 6%, respectively, year-to-date. This compares to downgrades of just 1% and 2% for large caps. The trend is not new.

Analyst downgrades of small-cap earnings estimates have outnumbered upgrades since 2011. Despite early-year optimism, actual earnings growth for small caps in 2017 is expected to be one-fifth that of larger companies. Disruption has played a role.

Small-cap energy companies are still adapting to the shale revolution, and small consumer players are searching for an edge in a world with less brand power. One result: a profit-margin gap between large and small US companies that has more than doubled since the mid-1990s. Closing this gap will require improved small-cap sales growth.

Valuations leave something to be desired as well. The S&P 600 Small Cap Index is trading at a lofty 21x forward earnings and the broader Russell 2000 Index of small-cap stocks at 27x, even after assuming a significant tax-cut-fueled earnings acceleration in the next 12 months.

Bottom line: US small caps have impressed recently, but have become relatively expensive and vulnerable to any tax reform disappointment.

Rather than size, we believe investors are better served focusing on equity style factors with potentially greater staying power in a sustained above-trend expansion, particularly momentum and value.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.