Evy Hambro: Lost money on commodities? Keep the faith

12th October 2017 09:05

One of the biggest risks investors face is poor timing - buying into a stockmarket or a sector that has reached a peak. But those who hold their nerve, as opposed to panicking and cashing in their chips, should in theory ride out the losses and eventually see the colour of their investment returns change from red to black, as evidenced by the stockmarket recovery that has taken place in developed markets since the financial crisis.

Peak to trough, the slumped 45% between May 2008 and March 2009, but it only took a couple of years for those losses to be recouped; the fund, for example, had managed to get its head back above water by September 2010 in terms of total returns, largely thanks to the power of compounding dividends.

However, for investors who bought into a specialist resources fund seven years ago, at the height of the boom now referred to as the 'commodities super-cycle', paper losses remain.

Commodities boom and bust

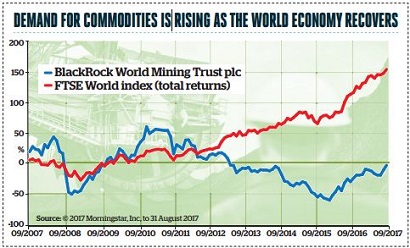

For veteran commodity investor Evy Hambro, the bear market that began in 2011 and ended last year has been severe. "There's been a loss both of capital and trust in the sector; investors are very sceptical now," he says.

Commodity prices tend to move in boom and bust cycles - something that Hambro, who has worked on the natural resources desk at BlackRock since 1994, knows all too well.

The latest downturn, sparked by China's reduced appetite for commodities, has been unprecedented, he argues.

But, while declining commodity prices have been an obvious headwind, mining businesses themselves have not helped the cause: Hambro points out that unwise capital spending has also been a key factor in the damage done to the creditability of the sector, as well as to the stunning returns that were generated during the previous decade.

"The bear market went on for much longer than we thought it would. We had never before had five years of consecutive underperformance versus world markets. In fact, we had never had four years of underperformance, so it was uncharted territory," he comments.

Over the past 18 months or so the tables have started to turn, with , on which he is lead manager, up 141% in total return terms since the beginning of 2016. But despite such a spectacular rise, on a seven-year horizon BRWM is still showing a loss of 7.4% to the end of August.

"It all depends on your entry point - those who bought shares in the 1990s will be happy, given that the share price is now 10 times higher than it was back then, while those who bought last January will also be pleased," he says.

As one would perhaps expect, Hambro's message to those unlucky shareholders who bought seven years ago is to not throw the towel in.

Further, he suggests investors should perhaps adopt a more hands-on investment approach to such a cyclical and high-risk sector: "Investors should manage their money through the cycle, taking profits during good times and averaging down during downturns: this also reduces risk."

Declining commodity prices hit their trough last year in the case of precious metals (gold, silver, platinum) and various other types, including iron ore and zinc.

Hambro says 'rock-bottom valuations' became too cheap for investors to ignore, particularly against a backdrop of improving fundamentals - in layman's terms, of businesses becoming more profitable.

As a result, a flood of money returned, with the institutional investors that were betting against the sector closing their short positions. "Mining businesses were priced as if they were going to go bust the following day. By the end of the summer (in 2016), the five-year vicious circle was well and truly broken," he adds.

Corporate discipline improves

But lessons have been learnt, argues Hambro; he points out that "corporate discipline has increased" and "cash generation has improved".

"Over the long term, if companies do not over-expand and instead try to produce what is needed, that discipline will be rewarded by higher valuations. What has evidentially changed in the sector today is that it is no longer a matter of growth for the sake of growth.

What investors are struggling with is the fact that many companies are now offering very attractive yields, and as a result investors are sceptical. But from where I am sitting, these companies are not capital destroyers - they are capital generators."

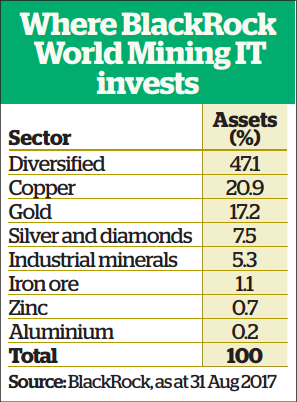

BRWM has around 60 holdings across a broad spectrum of commodities: copper, gold, silver, diamonds, iron ore, zinc and industrial metals.

Hambro takes a bottom-up view of a firm's credentials first, and then considers the outlook for the commodity the business is attempting to mine. "We also look for trends in terms of whether a company is using a commodity less or more, and how this will impact future demand," he adds.

At present Hambro is focusing his attention on companies that are in the process of debt-reduction or deleveraging. His thinking is that firms that are making use of free cashflow to pay down debt and return cash to shareholders will ultimately be rewarded with higher valuations, and as a result their share prices will move higher.

In addition, Hambro says he has been increasingly moving away from backing "pure commodity themes" and is instead "focusing on identifying value that should be released through the successful delivery of a business plan".

This could be through building new mines or discovering new sources of supply, as well as the aforementioned debt reduction. Three UK-listed miners - , and - are among BRWM's top four holdings.

Overall exposure to gold stands at just shy of 20% in BRWM; but in the case of the open-ended fund, exposure is unsurprisingly much more substantial at 99%. It has been a rollercoaster ride for fans of the yellow metal - the spot price hit a peak of almost $1,900 in July 2011, before entering a savage bear market. At the end of August gold was hovering at the top end of its one-year trading range of $1,100 to $1,300.

Glorious Gold?

But Hambro does not expect gold to return to its former glories anytime soon. "Gold is pretty range-bound and I expect it will continue to be. I don't expect interest rates to change throughout the world, and inflation is not coming through."

However, while he is relatively subdued about the outlook for gold, there are nonetheless various threats on the horizon, including rising tensions between America and North Korea, that have boosted demand.

The yellow metal is the equivalent of marmite in the context of the investment world, but whether you love it or hate it, it tends to shine at times when political risk is high.

Another key attraction is that gold cannot be manipulated, not even by governments or central bankers.

However, cryptocurrencies - most famously bitcoin and ethereum - are also perceived to be immune from manipulation, and this has been one of the drivers behind the current mania for digital currencies.

Bitcoin has surged in price over the past couple of years, so much so that in March this year a unit of bitcoin exceeded the value of an ounce of gold for the first time.

While some say this has all the hallmarks of a speculative bubble that will inevitably pop, others argue that bitcoin could one day replace gold as the ultimate safe-haven asset.

Hambro rejects the notion that bitcoin may one day knock gold off its perch, though. "While I am not an expert on digital currencies, what I can say is that the thing they are all trying to emulate is gold's characteristics, which have been around for thousands of years. Gold is [and will continue to be] what people turn to in periods of uncertainty. It does not tarnish or erode - it holds its wealth through time, and will continue to do so."

Hambro in six

1. My best investment was... a painting I bought when working in Australia. It was painted by a local artist whose work subsequently rocketed in value after she went on to win a major prize.

2. My worst investment and lesson learnt... Eurotunnel warrants. The project overran and cost more than expected, and they expired worthless. Investing in them taught me a lot about 'option value' and how rapidly it can erode with time.

3. Alternative career would have been... media, and more specifically the creative side of advertising. I did a marketing degree at university.

4. In my spare time I like to... spend time with my family.

5. The one thing I would like to see change in financial services is... the introduction of a single tool that you can use to amalgamate your outgoings and finances to see how you might better manage them.

6. Do you invest in the trust… I have invested across the funds I manage throughout my career, via both Isas and self-invested personal pensions. I also invest on behalf of my children.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks