Here's who should buy Solid State shares

13th October 2017 16:45

I'm wondering about Solid State. You're running a bit late with this one aren't you Richard?

Yep. reported its full-year results in July for the year ending in March. I'm not sure when it published its Annual Report, but I've let my annual review slip. Overconfidence, probably.

Overconfidence? That doesn't sound good…

Maybe it's just confidence. I like Solid State. It's run by Gary Marsh, the son of the founder. Family members and directors own large holdings. The firm has survived and prospered against terrible odds…

You make it sound like a historical epic. Go on…

I'm getting carried away. Solid State, then a distributor of electronic components, survived the hollowing out of British manufacturing around the turn of the millennium.

As manufacturing moved to China, the company found a way to survive in the few niches that remained.

It acquired manufacturers of rugged computers, radios, batteries and aerials, and clearance to handle sensitive Government information and dangerous materials like lithium.

Since there are technical and regulatory barriers to entry in these businesses, the pool of British companies able to compete for work is limited, which may explain why Solid State is so profitable.

How profitable is it, then?

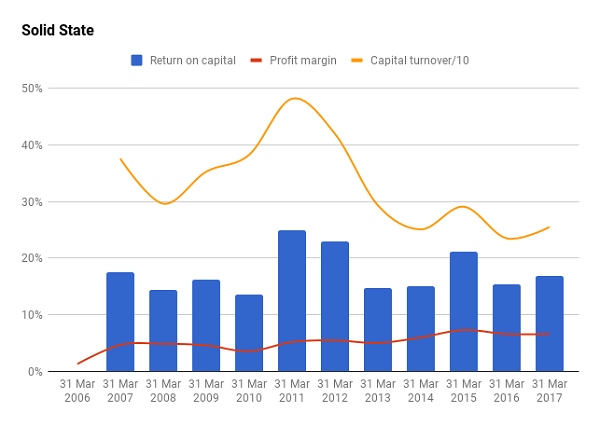

Good question. And I'm going to give you two answers. The first answer is very profitable. Take a look at my favourite chart:

Average return on capital (the blue bars) over the last eleven years, which is how far I've dug back into the annual reports, is 17%.

Coincidentally, that's the level Solid State achieved in the year to March 2017. Even better, when it reached its lowest ebb in the wake of the financial crisis, Solid State still achieved a return on capital of 13%.

This measure shows the profitability of Solid State's operations. The calculation excludes goodwill and the amortisation of acquired intangible assets.

Now, I appreciate that's a mouthful, so let me explain.

These are historical costs representing any premiums paid above the cost of the physical assets, factories, warehouses, machinery and so on needed to operate the business.

Solid State doesn't need to acquire companies to stay in business, so these costs won't necessarily recur. In one sense I don't want them polluting my profitability calculations. I want to see how profitable the businesses I'm investing in now are.

On the other hand, Solid State's strategy is to acquire one related business a year, because it thinks it can operate acquired businesses more efficiently than their previous owners.

Creasefield, is the latest example. Solid State acquired the then loss-making battery company two months into the last financial year. It moved its existing battery business onto Creasefield's site in Crewkerne.

The combined business has more customers, and a broader range of battery chemistries including lithium-sulphur, which promises lighter, cheaper and safer batteries. Although Creasefield only added fractionally to profit in its first 10 months as part of Solid State, it's already stemmed the losses.

I'm very happy that Solid State has gathered together a profitable portfolio of businesses, but it remains in the acquisition game, so I also need to reassure myself it hasn't frittered away shareholders' money by paying too much for the businesses it's bought in the past.

To do that I've calculated Solid State's Return on Total Invested Capital over the years.

This is a ratio I've nicked from Warren Buffett, and also , another acquisitive company.

Both Buffett and Judges suggest using ROTIC to judge whether a company is a good acquirer (laudably, Judges uses the ratio on itself) by working out whether it still earns good returns even after factoring in the acquisition related costs. The ratio includes the value of all goodwill and acquired intangible assets at cost, figures you can find in the notes to the accounts.

Solid State's average ROTIC is 12%, also bang on what it achieved in 2017. So, my second answer is the same as my first. I think Solid State is very profitable. And it's grown so fast, revenue and profit are four times what they were 11 years ago, because it's been a good acquirer too.

I get it. Solid State is highly profitable, however you look at it. But the acquisitions. They're risky aren't they?

Generally, yes. But Solid State has proven to be a disciplined acquirer. It acquired Blazepoint out of administration and walked away from Rugged Systems when the asking price was £2 million to come back a year later when the price was £200,000. Marsh is spending his own capital when he makes an acquisition and I get the impression he doesn't part with it particularly easily.

Wait! You said one acquisition a year. Isn't it overdue?

Very good. Yes Creasefield was nearly a year-and-a-half ago and Solid State is flush with cash. I'm expecting another one soon.

So, if Solid State hasn't been acquiring, what's it being doing?

I'm sure it's been evaluating acquisitions, but it's also been pretty busy improving its existing businesses.

Not only did it reorganise the battery division, it also invested £1 million in a new aerial facility and started a sourcing and obsolescence division in its distribution arm, Solid State Supplies.

That's another thing I like about Solid State. It's not just about acquisitions. Traditionally, the battery business has been less profitable than Solid State's other specialities but that is a "focus for improvement".

The aerial business is its most profitable, so it makes sense to invest in that. And Solid State is finding ways to add value in relatively low-margin distribution.

The sourcing and obsolescence division tracks down obsolete and hard to find components for customers, checks they're genuine, and tests they work to the manufacturer's specification. I

It's another niche, from which Solid State expects to extract better profit margins by providing a higher level of service.

You like this one, I can see it. But there's always a "but", so get it over with…

I like Solid State because its instinct is to add more value and that should ensure prosperity in all but the most apocalyptic economic scenarios.

There's a small 'but', though. I worry about how far the business can grow. As it gets bigger, the acquisitions must too, if they are to have a meaningful impact.

Currently Solid State is targeting £5 million companies, significantly larger than it has acquired before. Maybe it hasn't made an acquisition for a year-and-a-half because they're harder to find, and they would be harder to manage.

As the business gets bigger and supplies more niches, it gets more complex. Perhaps that also explains its relative introspection lately.

Don't do it Richard. Don't sit on the fence again…

…But I'm not going to sit on the fence. I think this is a good business trading at an attractive price for investors with a strong enough belief in the firm's capabilities to hold for the long-term. The current share price of 485p values the enterprise at just over £43 million, about 16 times adjusted profit. If I didn't already hold a significant slug in the Share Sleuth portfolio, I'd probably be adding some more.

You, though, will have to make up your own mind.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks