Bargain hunter: Widest discount in years on popular income trust

17th October 2017 09:03

by Kyle Caldwell from interactive investor

Share on

In the current climate, with stockmarkets continuing to hold their form, income seekers are facing a greater challenge to source income at a sensible price.

Eight years into the bull market, investment trust bargains have become harder to find, with the average discount across the sector hitting an all-time low on 16 August, slipping to 3.2%.

According to broker Stifel, there are other factors at play that have led discounts to dry up, including the fact that more and more funds are turning to discount control mechanisms to keep them within a certain range.

As ever, though, opportunities remain - such as , which Stifel has just upgraded from 'neutral' to a 'buy'.

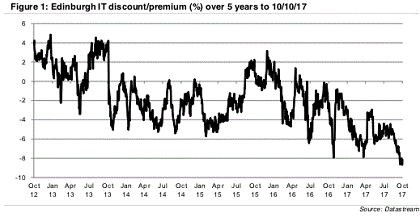

As the chart below shows, the trust is offering a discount of 8.1%, the widest entry point in years.

Over the past five years it has traded mainly within the range between a 3% premium and a 7% discount. The last time the discount topped 8% was way back in November 2008, during the financial crisis.

EDIN boasts a strong performance track record, beating the in six of the past seven years.

Neil Woodford was at the helm for the majority of this period, prior to handing the baton to Mark Barnett at the end of January 2014.

Over the past 18 months, performance has taken a turn for the worse, evidenced by the net asset value (NAV) return of just 6.8%, heavily underperforming the trust's benchmark (FTSE All-Share) return of 16.8%.

This year EDIN continues to trail its benchmark, with its NAV up 5.7% at the end of September, again below the FTSE All-Share return of 7.8%.

On the back of performance coming off the boil, the trust has seen its discount widen; that has had an adverse impact on EDIN's share price, which on a one-year view is almost flat, having gained 1.9%.

But, rather than being put off by the performance woes, Iain Scouller, an analyst at Stifel, is backing Barnett to turn performance around.

According to Scouller, EDIN is a high-conviction portfolio that is very different in composition from the FTSE All-Share index, meaning that the trust will have periods where it will underperform.

Moreover, he adds that some of Barnett's sector bets - most notably his overweight position to tobacco - have proved to be a drag on performance more recently.

In addition, his zero weighting to the mining sector, which has come back into favour since the start of 2016, has held performance back. There have also been a handful of stock-specific problems.

"This (discount) de-rating is understandable given the relative performance of the shares over the past 18 months, with a significant lag behind the FTSE All-Share index," says Scouller.

"However, we do think this is explainable by the high-conviction stock-picking approach, the sector weightings and the focus on higher-yielding equities which deliver the attractive 3.7% dividend yield.

"Given the manager's strong long-term track record, we think the poor performance is a short-term sector/style-related issue, rather than a long-term structural problem. We upgrade our recommendation to positive from neutral."

Barnett, who has managed funds and investment trust for Invesco Perpetual since the 1990s, focuses on companies with sustainable earnings and stable dividends.

He is cautious in regards to the outlook for the UK economy, but when addressing shareholders in May said he was confident the portfolio was positioned accordingly for the tougher times that likely lie ahead.

"The portfolio is well positioned, invested in a diversified range of companies which have the scope to increase in value, driven either by sustainable dividend growth or from companies that can improve or transform their financial prospects regardless of the wider economic environment. In addition, a number of holdings, having fallen temporarily out of favour, have significant recovery potential," he said.

The trust has low costs (ongoing charges of 0.6%) and a good dollop of gearing, at around 13%. If performance does improve, investors will in theory benefit on two counts - from higher returns and a narrowing of the discount.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.