Four investment strategies to generate £1,000 income a month

19th October 2017 11:11

by Kyle Caldwell from interactive investor

Share on

Pension freedoms have opened the door for more and more people to manage their own pension portfolios at retirement, in effect paying themselves an income from their investments.

Indeed, two and a half years on from the freedoms being introduced, the retirement landscape has changed markedly.

In July, the Financial Conduct Authority (FCA) noted that "twice as many pots" now move into drawdown, while in stark contrast annuities are largely being given the cold shoulder.

There are various motivations and factors at play behind the decision by increasing numbers of pension savers to place their retirement pots at the mercy of financial markets.

Those in the enviable position of having other sources of retirement income such as a defined benefit pension, or who have saved diligently over the years in stocks and shares ISAs or SIPPs, may be investing to leave a legacy for their children or grandchildren.

Others, though, will want to pocket an annual or monthly income from their investments alongside any other sources of income (including the state pension), in order to supplement their lifestyle at retirement.

With this in mind, in the October 2016 issue of Money Observer - with the help of various clued up experts - we outlined four different ways to go about constructing a portfolio designed to pay a monthly income of £1,000, or £12,000 a year.

A year on, we have reviewed their performances to assess how each approach has fared.

The all-out income approach

The most popular fund choice for those who decide to go down the stockmarket route rather than handing their life savings over to an annuity provider is multi-asset funds, according to research carried out by Aegon, the pension provider.

This is a sensible approach: multi-asset funds offer investors in-built diversification, and will therefore be better placed than single-strategy funds (focusing for example on UK equity income) to shield capital during tougher times.

But one current pitfall of putting all your eggs in the multi-asset fund basket is a relatively low yield.

In the present climate, while dividend yields come in at around the 3 to 4% mark, bond yields - an asset class to which most multi-asset funds also have a fair chunk of exposure - stand at historic lows.

In the past they were at much higher levels, so the starting multi-asset yield on offer for investors would have been higher.

As a consequence, those who, for example, want to use multi-asset funds to achieve a high amount of income in the early stages of retirement will need to have a significant amount of capital in their pension.

For example, for a portfolio that yields 3%, a pot size of £400,000 is required to generate an annual income of £12,000 a year.

This first approach - the all-out income strategy - is therefore structured for those who want to prioritise income today. The price paid by those who follow this approach is that neither their capital nor income are likely to grow much over the years.

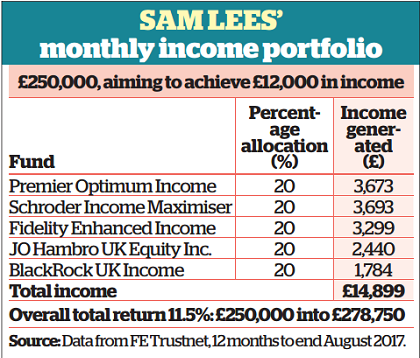

Over the year, the £250,000 portfolio - comprising five funds with equal weightings - has done exactly what it says on the tin.

The total amount of income generated over the year came to £14,889; moreover, thanks to the way the portfolio was constructed by Sam Lees of Fundexpert.co.uk, a monthly income of £1,000 was achieved.

Each fund chosen pays dividends quarterly, equating to in excess of £3,000, so a £1,000 a month payment can be achieved through a bit of manual intervention.

Three of the chosen funds - , Schroder Income Maximiser and - promise yields of around the 7% mark, which is achieved through boosting the natural income by writing covered call options on the underlying stocks.

These option contracts give the buyer - another professional investor - a right, but not an obligation, to buy shares at a fixed 'strike' price on a specified future date. In return, the fund receives a 'premium' (fee), which it then distributes to investors to boost income payments.

But, despite these funds achieving what they set out to deliver - a high level of income generation - they are seldom used by financial advisers, something that Lees regards as an oversight.

"Many in the adviser community still think that they ought to diversify as a matter of course - irrespective of investment need or income potential. And some think that if income investors need to withdraw around 4% a year, it can come from drawing down capital, which is very dangerous," he adds.

"You can't fulfil a long-term income requirement by drawing from capital - capital erosion is a horrible risk. And income from bonds doesn't grow, so they aren't an option for income over the long term. Plus, at this stage in the bond cycle we wouldn't want to be anywhere near them." The income booster funds help fill that income void.

Active balanced approaches

The reality, however, is that unless you are of a high-risk persuasion, devoting 60% of a portfolio to these specialist income funds is far too much. Instead, a figure of around 20% is deemed more appropriate, with the bulk of the rest of the assets invested in a mixture of income-producing assets: equity funds, bond funds and alternatives, such as property and infrastructure, in order to strike an appropriate balance.

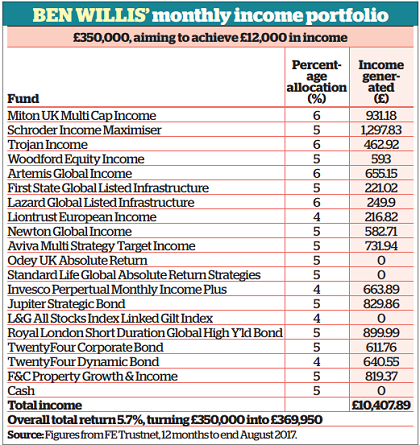

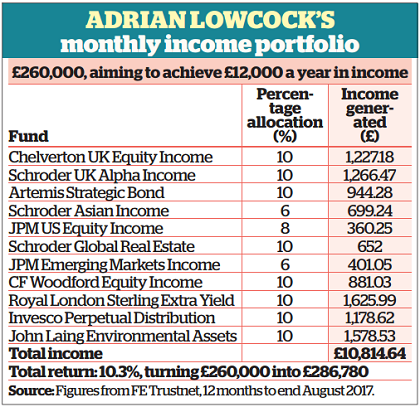

Three fund analysts - Darius McDermott of FundCalibre, Ben Willis of Whitechurch and Architas' Adrian Lowcock - all came up with a similar asset mix in attempt to achieve the £1,000 monthly income goal, with between 45% and 55% invested in equities.

All three portfolios fell short of the £12,000 annual income goal. McDermott's hypothetical portfolio was very close, however, with the income generated amounting to £11,961.96. Willis' portfolio generated £10,408.22 in income, while Lowcock's income added up to £10,814.64.

McDermott says if he were to tweak the portfolio going forward, he would reduce exposure to from 10% to 5%, as the sector has enjoyed a good run and so has become more expensive. The proceeds would be split equally between and , lifting exposure to 15% and 10% respectively. "Europe and Asia are offering much better value than other markets," he adds.

In addition, McDermott says he would swap in favour of Man GLG UK Income, as the latter has a value style and a higher yield of 4.2% compared to the Threadneedle fund's 3.8%.

Willis, on the other hand, says he would make several changes in order to boost the amount of income generated, adding (yielding 5%), (4.5%) and (3.5%), in place of the non-income paying Standard Life Global Absolute Return Strategies, the low-yielding and the , with the latter being deemed a sell on performance grounds.

"The last 12 months have been a good year for risk assets, and so while the income derived from the original portfolio will have fallen short of the target, the portfolio has also produced capital growth," says Willis.

"An investor in the portfolio would be 'having their cake and eating it', with half of the total returns being income and the other half growth."

Architas' Adrian Lowcock, however, says he would stick to his guns rather than make any changes.

"Overall, the portfolio delivered a good solid performance over the past 12 months, but an income portfolio is always going to behave differently from equity markets as the focus is on providing a diversified and stable income," he comments.

Moreover, although the income is slightly below target, increasing the overall yield of the hypothetical portfolio would "add more risk and volatility to the portfolio, which could potentially impact on performance going forward", he adds.

"It is important to think ahead with planning income portfolios," he says. "The yield of 4.2% would now deliver an income of around £12,000 based on the portfolio value of £286,000. Given that it is still well-placed to grow as well, I would stick with the portfolio, whilst monitoring any underperformers such as ."

Dividend calendar trick

Investors who prize consistency over high income promises that may not be kept should focus their sights on investment trusts with proven track records for increasing their dividends through both good times and bad.

There are plenty of trusts to choose from: according to the Association of Investment Companies (AIC), 18 investment companies have increased dividends each year for between 10 and 20 years, while a further 20 trusts have upped their payments for more than two decades. Leading the pack are , Bankers and Alliance Trust, which have all notched up 50 years of consecutive dividend increases.

As such it is possible to create a monthly income portfolio out of these 'dividend heroes', particularly given that most trusts pay dividends on a quarterly basis.

The easiest way to structure such a portfolio would be to not worry too much about the actual date of the dividend payment, and instead draw the income on a quarterly basis.

For those who desire a monthly income there's a fair bit more work involved, as you will have to jot down the dividend dates of the investment trusts you want to buy and then structure your portfolio accordingly so that you receive income payouts each month.

Last year, Money Observer suggested the following portfolio: (which currently pays dividends in January, April, July and October), (February, May, August and November) and (March, June, September, December).

We also proposed throwing two monthly income-paying trusts into the mix: and .

Splitting a £250,000 pot equally between the five trusts would have generated a 12-month income of £12,491.13, while on average the £1,000 a month goal was also achieved.

Bear in mind, however, that the date on which an investment trust pays dividends can be changed, and also that income growth is not guaranteed.

Dedicated monthly income portfolio

A less time-consuming and more straightforward approach is to buy a selection of funds that are dedicated monthly income payers. There's not a wide choice, as only a couple of dozen or so funds offer a monthly option.

Last year we listed , Artemis High Income, , , and t as six options available, tipped by experts. A £250,000 portfolio, with equal weightings of all six funds, would have generated an annual income of £10,394.19.

To achieve the monthly income goal, investors would need either a bigger pot size - £300,000 would be sufficient - or to ensure that funds yielded more than a certain level.

In the case of the six funds chosen, Fidelity Moneybuilder Income (yield of 3.5%) and Threadneedle Monthly Extra Income (4%) were the two income laggards. Replacing these two funds with higher starting yielders, such as (6.1%) and (4.6%), would have resulted in the hypothetical portfolio reaching its income goals.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.