A great way to add 'energy' to your portfolio

19th October 2017 12:11

by Dzmitry Lipski from interactive investor

Share on

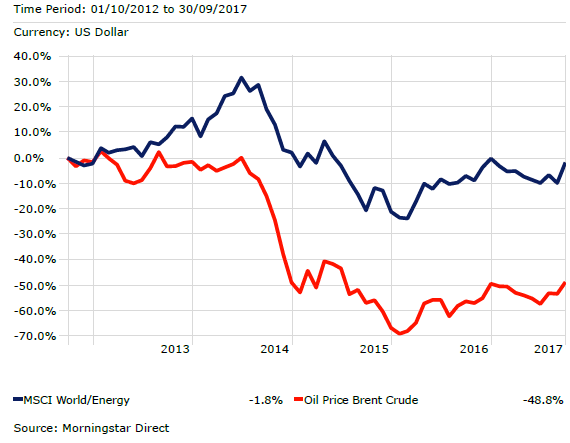

The energy sector has rallied over the past quarter along with strong oil prices, though it is still among the worst performers over the longer term. After falling under $30 at the beginning of 2016, the oil price has recovered to $58 a barrel today, confirming that recent efforts by both the OPEC oil cartel and non-OPEC countries to lower supply have been relatively successful.

More interesting is that this is the first time since August 2014 that the Brent oil forward curve has been in backwardation, where the spot, or front month price, exceeds the futures price and the forward price curve slopes downwards. A market in backwardation indicates a short-term shortage of supply in the market that will lead to higher prices as, over time, the futures price and spot price converge.

Managers of the fund believe that, while oversupply in the global oil market continues to keep a lid on oil prices, the current situation is unsustainable, with a large proportion of production occurring at a loss. Supply cuts by OPEC and slowly rising global demand could lead to more stable, higher prices over the longer term, creating a favourable environment for energy companies.

Their fund is a strong choice for investors looking to gain exposure to the growth potential of companies with energy resources, and in their service providers and distributors. In addition, it can offer a good portfolio hedge against inflation, as the oil price tends to rise along with any increase in the cost of living.

The fund benefits from an outstanding team of three managers: Will Riley, Jonathan Waghorn and Tim Guinness. They focus mainly on companies in the oil and natural gas sector and construct their portfolio with equally weighted positions of around 30-40 large-cap stocks.

The fund's global exposure means it is diversified across both developed and emerging markets. The largest sector exposure to integrated oil and gas companies (44%) such as , , and Total. The exploration and production (E&P) holdings account for around 35%. The emerging market allocation represent 12% and includes integrated companies such as Gazprom and PetroChina and E&P companies - CNOOC and . Alternative energy exposure is split between two companies: JA Solar and .

The manager's view is that not only oil supply and demand, but also companies' underlying fundamentals are improving, and there are signs of greater capital discipline and free cash generation. They have been encouraged by the recent share repurchase plans of , which provided a boost to share prices across the sector. That positive reaction indicates that other US domiciled E&Ps will shift from growth to a better focus on capital discipline and profitability.

Canadian oil sands-focused companies like and , are also highlighted by Guinness having worked 'energetically' to improve free cash flow at West Texas Intermediate (WTI) oil at $50 a barrel. Suncor has achieved oil sands operating cost reductions of 19% this year.

Similarly, European companies delivered a higher level of free cash flow generation in 2017, based on a $52 Brent oil price, than they delivered in 2014, based on $109 a barrel. The improved free cash generation means companies should be able to grow and cover their full dividends at $50-55 oil.

The Guinness fund has outperformed its benchmark, the MSCI World Energy index, over the quarter and, although over the longer term the performance has been hampered by low oil prices, it has managed to beat the average energy fund in the sector. Because of the fund's specialist nature, it is likely to be more volatile, making it a higher-risk option for investors and a satellite holding in a well-diversified portfolio.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.