Could Alumasc shares be a bargain?

20th October 2017 14:19

by Richard Beddard from interactive investor

Share on

Companies analyst Richard Beddard gives us his view on this good business which is expected to do well over the very long-term.

Alumasc's just published its annual report. It's in your Share Sleuth Portfolio Richard. What's good about Alumasc then?

You may well ask. The annual report starts off iffy with this quote headlining the chairman's statement:

"We aim to grow revenues faster than the markets in which we operate and to grow profits at a faster rate than revenues, thereby generating superior financial returns to our shareholders."

What's wrong with that? It sounds like exactly what investors want to hear...

Exactly. But it's a bit trite. Most stable prosperous companies want to grow market share profitably.

Also, it's not really sustainable. You can't grow profit faster than revenue forever!

It's an outcome, not an aim. I'd prefer a mission statement that embraces what the company does and how it will achieve the outcome of, let's just say, profitable growth…

Apart from that, it's fine.

OK, what does Alumasc plan to do, and how will it do it?

Well, if I were writing the annual report, I'd go for something like:

"We aim to supply building products that are easier to fit, save more energy and manage rainwater more efficiently to save our customers money, help them meet building regulations, build prettier buildings and save the environment."

does tell us this stuff later in the report.

So it makes gutters then?

Among other things. It makes specialised building products, like gutters, downpipes, and drainage systems, waterproof roof membranes and living roofs (you know, the ones planted with vegetation), solar shading, balconies…

I get it, building products? So what ties these products together?

Well, they go on the outside of buildings mostly. They seal them up. Make them warmer, or cooler. Keep them dry. They may not be a major part of a building's cost but they are important. They help satisfy building regulations, for example to conserve energy or protect the environment. Usually, they're specified by the architect, engineer or project manager in charge of construction.

Being on the outside of a building, they can also improve the look of it, which may be an important factor for customers.

If the products are special in some way, Alumasc can charge more for them, enabling it to, you know… Grow revenue faster than the construction industry in general, and grow profit faster than it grows revenue (at least for a while). That seems to be what's happening.

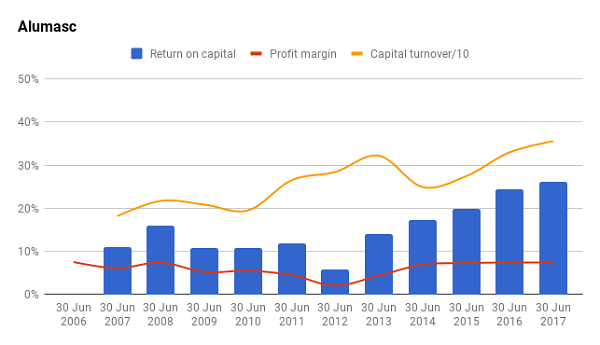

Here's my customary chart. An average return on capital of 15% is more than acceptable, and look how it's growing.

Alumasc claims Levolux is the UK's leading solar shading company, and it's making strides in the USA. Alumasc Rainwater is number one in aluminium rainwater systems and number two in cast iron. Gatica is number one in access covers (think manholes) and its Slotdrain system is second in line drainage. It's also number two in roofing and number three in walling.

The anomaly is perhaps Timloc, the smallest division, which supplies an eclectic range of building products for houses, from vents to loft hatches. It seems, well, less significant, and less specialised.

Mostly market-leading products then, tick. Focus on premium products, tick. It's doing well then?

Yes. Even though the cost of imported raw materials increased due to the weak pound, the construction sector grew, and Alumasc grew more, it grew revenue by 14% and although it didn't grow profit quite as much, averaged over recent years profit has been growing faster than revenue. It doubled export sales in the year to June 2017. Export sales account for 17% of the total.

Timloc is getting a new factory this year, and new facilities for Alumasc Water Management Solutions will follow. Meanwhile, it's pruning the company of businesses selling perhaps more run-of-the-mill products.

In the year to June 2017 Alumasc sold Scaffolding Products, which was just about breaking even.

But…

But?

Construction is a cyclical business. When the economy is doing well, construction companies tend to do very well. And when it's doing badly, they tend to do awfully.

In mitigation, Alumasc is quite well diversified. At least 35% of revenue comes from repair and maintenance, so it's not totally dependent on big new construction projects. Revenue is quite evenly split between residential and commercial building products too, and these markets may follow slightly different cycles.

Obviously, it takes time to build large buildings and so different elements are required at different times. Solar shading is put on last. Timloc's more prosaic products are firmly mid-cycle, consumed as the building is being built.

Here's a table showing the different businesses, their significance in terms of revenue and profit and during what part of the cycle they are busiest:

| Alumasc | Solar shading and architectural screening | Roofing and Walling | Water mgmt | House building and ancillary products |

|---|---|---|---|---|

| Revenue (£m) | 24.4 | 41.5 | 29.3 | 9.6 |

| Underlying operating profit (£m) | 2 | 3.3 | 3.6 | 1.6 |

| Operating margin (%) | 8% | 8% | 12% | 17% |

| Brands | Levolux | Alumasc Roofing Systems, Roof-Pro, Blackdown, Alumasc Facade Systems | Gatic, Skyline, Rainwater, Harmer, | Timloc |

| Stage in cycle | mid to late cycle | mid cycle | mid cycle | early-mid cycle |

You'll see the problem. Alumasc's mostly mid-to-late cycle. While the premium nature of the products may protect it somewhat from cutthroat competition at the bottom of the cycle, and diversification might also blunt the pain, it will surely suffer.

Hmmm, a capricious market. Don't like the sound of that. Anything else to worry about?

Yes. The defined benefit pension fund is in deficit. The assets, from which the company must pay pensions to retired staff are worth £20 million less than the obligation, the amount actuaries think the company needs to have invested if everyone is to get paid.

Alumasc had a pretty bad year in terms of cash flow. The company says it's using more cash as it grows and the timing of payments and receipts has created an unfavourable impression. But it's also paying £3.2 million a year into the pension fund to close the deficit.

Gosh, a big pension deficit and a cyclical business, how do you build that into your valuation?

I sidestep the nightmare of pension accounting by adding the cost of repaying the pension deficit in its entirety, as well as other financial obligations, to the company's market capitalisation - as though I were buying the whole business instead of a share in an indebted business. In other words, I pretend I've paid off the debt.

This is known as the enterprise value of the company and I compare it to profit before interest (but after tax). Since the enterprise value includes the cost of repaying financial obligations we don't have to include interest charges, or charges associated with the pension fund in the profit figure.

On that basis Alumasc looks like quite a bargain. A share price of 174p values the enterprise at about £90 million. That's 12 times adjusted profit. The earnings yield, is a handsome 9%.

There is one wrinkle I haven't accounted for. Unlike in my model, the company is only paying into the pension fund gradually. The deficit could widen as it does…

Wrinkle aside, it's a bargain!

Not necessarily. I haven't dealt with the cyclicality yet. It may be prudent to temper the valuation by assuming profitability will not be as high on average in future as it is today.

To put numbers on that. In 2017, Alumasc earned a 26% after tax return on £31 million of operating capital, hence my highly massaged adjusted profit figure is about £7.7 million, also after tax. That's very impressive. Average return on capital over the last 11 years is 15%, and applying that figure to Alumasc's operating capital in 2017 gives a smaller adjusted profit. The earnings yield derived this calculation is less attractive. It's 5%.

Alumasc is a more focused company than it was a decade ago, when it owned sporadically loss-making engineering businesses as well, and it's probably more profitable.

My guess is profitability will be higher than the average in future, but lower than the peak this year. The shares are probably not as cheap as figures based on one year, like the earnings yield or its close cousin the PE ratio, would have you believe.

So, tread carefully?

Yep. It's a good business, leaking large amounts of money to a hungry pension scheme. Its fortunes depend to an extent, which I cannot reliably judge, on a capricious sector. Over the very long-term I expect the good business to prevail, but it'll be bumpy along the way and the share price probably reflects that.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.