A year after Trump's victory, how have markets fared?

10th November 2017 09:41

by Tom Bailey from interactive investor

Share on

One year ago, the US electorate shocked most pundits and commentators around the world by electing Donald Trump to the White House.

While the Trump administration has been wracked by political scandal ever since January's inauguration, for the most part, all has been quiet on the economic front. Wage growth has continued to edge up while job creation has continued apace. At the same time, US markets have continued to rally.

Since Trump's election, the S&P 500 has risen by more than 20% and the Dow by 30%. Just a few days after Trump assumed power in January, the Dow reached a new symbolic high of 20,000 (it has since gone above 22,000).

Trump has been quick to take credit for this rally (and claim it a sign of his own good economic management). "The reason our stockmarket is so successful is because of me," he recently told reporters. "I've always been great with money, I've always been great with jobs, that's what I do."

Rhetoric aside, there is some truth to the idea that Trump has helped the stockmarket's continued climb. Following his election, many commentators accepted that Trump's promised tax reform and fiscal boost from a new infrastructure plans had made investors optimistic, pushing up equity prices.

However, Trump's legislative agenda, for now at least, has largely stalled while markets have continued to rise, suggesting there is more to the bull market than just hope for corporate tax cuts and increased fiscal spending.

The stockmarket's strong performance is part of a broader trend. Markets started to head upward after bottoming out during the 2007-2009 financial crisis and have not stopped.

Since then, the Dow has reached a new 'record high' 154 times. The US has also seen a broader economic recovery, stretching back beyond Trump assumed office, with the US's longer ever recovery in job growth starting under the Obama administration.

Optimism is also not just confined to the US. This year has also seen a general upswing in the global economy. Consensus forecasts for global GDP growth have been revised upwards multiple in 2017.

According to Fulcrum Asset Management's monthly report card, global growth is expected to be 3.8% in total in 2017, with Q4 for the year hitting 4.5%.

Better global economic prospects have propelled other financial markets, often providing better returns than the US market.

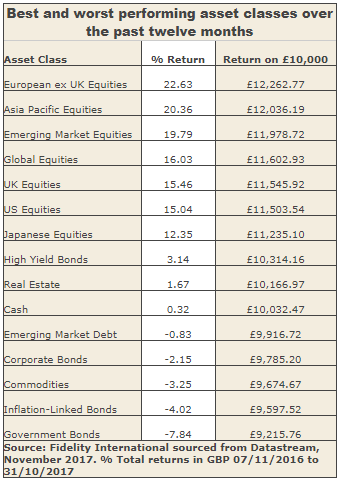

According to Fidelity International, over the past 12 months, a £10,000 investment in US equities would return you 15.04%.

By contrast, European excluding UK Equities would have provided you with a 22.63% and Asia Pacific Equities 20.36%.

However, US equities still performed stronger than Japanese, which saw a return of 12.35% over the same period.

However, while the past year's strong economic and market performance is part of a broader trend, both domestic and global, the trend has continued and doomsday predictions about Trump before his election have not come to head.

How long the US surge in equity prices lasts is anyone's guess.

While some say it's prudent to protect against the inevitable market correction, others warn about losing out on the climb up.

For those who believe between now and next election (and perhaps even after), Trump will finally start to put his legislative agenda into practice, they can gain exposure through two ETFs: Point Bridge Gop Stock Tracker ETF or the EventShares Republican Policies Fund. Both funds take long positions in companies that are set to benefit from Republican Party policies.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.