10 most popular funds - October 2017

10th November 2017 16:18

by Jamila Smith from interactive investor

Share on

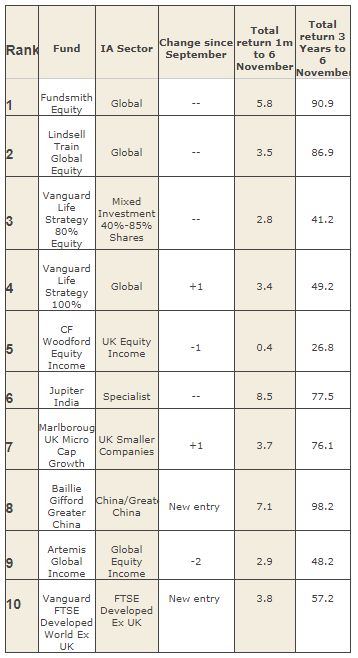

Terry Smith's has once again taken top position in our most-bought funds league table.

Smith has over the past five years returned a handsome 179%, well ahead of the average global fund return of 90%.

Fundsmith Equity is by far the most-popular fund with users on Interactive Investor with the number of purchases in October nearly twice as many as its nearest rival in second place: Lindsell Train Global Equity.

In third position is the passively managed fund. As such, there has been no change in the top three rankings in our most-bought funds league table since September.

Lindsell Train Global Equity, which occupies second position for the fifth consecutive month, was launched in 2011 by Michael Lindsell and Nick Train.

Their aim is to run their clients' money in the same way they would run their own.

They place an emphasis on the long term, investing in established franchises and businesses that have demonstrated steady success over time. Over the past month the fund has returned 3.5%, and over the past three years has posted gains of 86.9%.

Vanguard LifeStrategy 80% Equity fund has remained in third position in the table for the second month running.

The tracker fund, as the name suggests, holds 80% of its money in shares, with the remainder in bonds and cash.

Following close behind, has ascended to the fourth position. This shift has pushed Neil Woodford down by one place. His has had a summer to forget after suffering one disaster after another. The majority of fund analysts, though, are keeping the faith.

Vanguard LifeStrategy 100% Equity completes the top five. On a three year timescale the passive fund has enjoyed the upper hand over the majority of active funds, returning 49.2% versus the average global fund return of 47.1%.

Jupiter India has remained in sixth place since July, with a total return of 8.5% over the last month, and 77.5% on a three year view. The fund manager at the helm - Avinash Vazirani - follows the 'Garp' (growth at a reasonable price) style of investing.

Moving up the table into seventh place is Marlborough UK Micro Cap Growth. The fund, overseen by Giles Hargreave and Guy Field, invests in companies that operate in niche markets, those that are market leaders and do not have too many competitors to worry about.

Ranking eighth is . This fund is not only a fresh sight at eighth place, but a new appearance in the table itself. Over the past month, Baillie Gifford Greater China has had a return of 7.1%, and over the past three years has returned 98.2%. This is the highest return over three years out of all the funds in this month's table.

, managed by Jacob de Tusch-Lec, has dropped by two places since September. In an interview with our sister magazine Money Observer, de Tusch-Lec explains why he is betting big on bank shares returning to form ten years on from the financial crisis.

Completing the top 10 is , another new entry. The fund has 60% of its assets in US shares, a market that has enjoyed a stellar run over the past year since US electorate shocked most pundits and commentators around the world by electing Donald Trump to the White House.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.