Why bitcoin just crashed by $1,000

10th November 2017 16:36

by Gary McFarlane from interactive investor

Share on

Bitcoin Cash (BCH) has emerged as the undisputed winner following the surprise abandonment on Wednesday of the bitcoin SegWit2x fork to increase transaction block sizes.

Bitcoin, on the other hand, has fallen below $7,000 for the first time since 2 November, currently trading at $6,852 on the CoinDesk bitcoin price index.

Bitcoin Cash - a fork from the legacy bitcoin chain that took place in early August - has an 8MB-block scaling solution in contrast to bitcoin's 1MB size.

The Bitcoin Cash price came under pressure after the 2x announcement, falling to $565 from recent highs above $630, but recovered on the day to trade at $620.

This morning (Friday 10 November) Bitcoin Cash was up a whopping 33%, reaching a record high of $835.

The majority of the BCH buying has been coming from South Korea, a trend seen in previous days.

Miners in Asia are thought to be mining bitcoin, which is more profitable than BCH, and using the proceeds from their effort to buy BCH.

Arguably, Japan, and to a lesser extent South Korea, are viewed as countries with the infrastructure, regulation and consumer mindset most amenable to accepting cryptocurrency as a means of exchange, and therefore there may be more appetite for the potential transactional advantages of BCH with its bigger block size.

How far the convergence in price between bitcoin and Bitcoin Cash will go is hard to tell, but speculative investors need to be aware of BCH's own protocol issues.

Bitcoin Cash has been struggling to compete with the bitcoin chain for the attention of miners.

As a consequence, it has had to adjust its algorithm so that mining difficulty falls if the number of miners working on the network (measured by hashrate) is low.

This has led to erratic times for verifying transaction blocks, which is not exactly an advert for BCH as a means of exchange. A fork is scheduled for Monday 13 November.

The bitcoin 2x software upgrade proposal which was aimed at enabling bitcoin to handle a greater volume of transactions, threatened to irrevocably split the bitcoin community as support for the scaling solution faded.

The failure to increase block size highlights the progress BCH has made in this area, hence the buyers flocking to the bitcoin variant.

Statement triggers rollercoaster ride

Mike Belshe, founder of the BitGo wallet and one of the main movers behind SegWit2x proposal to double block size from 1 to 2MB, wrote in an email published on Wednesday at 16:58 London time: "Our goal has always been a smooth upgrade for bitcoin. Although we strongly believe in the need for a larger block size, there is something we believe is even more important: keeping the community together.

"Unfortunately, it is clear that we have not built sufficient consensus for a clean block size upgrade at this time. Continuing on the current path could divide the community and be a setback to bitcoin's growth. This was never the goal of Segwit2x."

The email statement was signed by Belshe, Wences Casares (Xapo wallet chief executive), Jihan Wu (mining pool Bitmain co-founder), Jeff Garzik (Bloq chief executive), Peter Smith (Blockchain chief executive) and Erik Voorhees (Shapeshift chief executive).

The news triggered a rollercoaster ride for market participants. Bitcoin immediately jumped 11% to breach $7,800, but reversed from that all-time high just minutes later, with $1,000 knocked off its value before it eventually found a bottom at around $6,900.

The price recovered somewhat to trade at $7,191 on Thursday morning, London time, according to the Coindesk bitcoin price index. The recovery, as we have seen, has proven to be short-lived.

The wild gyrations were summed up by crypto commentator Chris Burniske, formerly of venture capital startup ArkInvest, in a post to Twitter: "Epic battle in the #bitcoin markets right now between *traders* selling due to no '$B2X dividend' & *investors* buying due to no #SegWit2x."

In addition to BCH, other altcoins are benefiting from the volatility. Neo, for example, climbed 30%, partly helped by the bug in a smart contract released by wallet provider Parity on the Ethereum network earlier this week that destroyed around $150 million worth of ether, the token that powers Ethereum. Neo is down 4.5% on Friday, currently around $31.16.

Neo, like Ethereum, is a platform for building decentralised applications and the firm behind it is based in China. Ethereum developers have announced there will be a hard fork to recover the tokens affected by the buggy smart contract, helping the price rise 5.5% to $314.

Confusion and losses

Returning to bitcoin, it was feared that the so-called hard fork in the protocol, potentially the third this year, would have led to confusion because of the likely creation of yet another forked coin vying to be the 'real' bitcoin.

The now suspended fork was also a security risk because of the lack of replay protection in the new code, which could have meant coins could be spent twice, once on the SegWit2x chain and again on the legacy chain.

The SegWit2x fork was being pushed by some of the big corporate players in the industry and attracted the suspicions of developers and those in the community seeking - as they saw it - to safeguard bitcoin's decentralised network.

That sentiment was in evidence in the thoughts of self-styled cypherpunk entrepreneur Francis Pouilot who rejoiced at the suspension of the 2x scaling efforts.

"Segwit2X died the same way it was born: an edict signed by an elitist group of distant CEOs following a closed-door agreement," he railed on Twitter.

Those trading SegWit2x Futures will have been hit by big losses with the price collapsing 77% from highs just a few days ago above $2,000, to currently sit at $280.

The price hasn't gone to zero because some holders of the contracts presumably hope SegWit2x is truly just a suspension until greater 'consensus' is built in the community.

The removal of the uncertainty surrounding the SegWit2x fork could be positive for the price in the medium term, helped along by the growing interest in the currency, and the fact that it seems to be able to survive software disputes and the regulatory attentions of governments, notably China's clampdown on cryptocurrency exchanges and initial coin offerings.

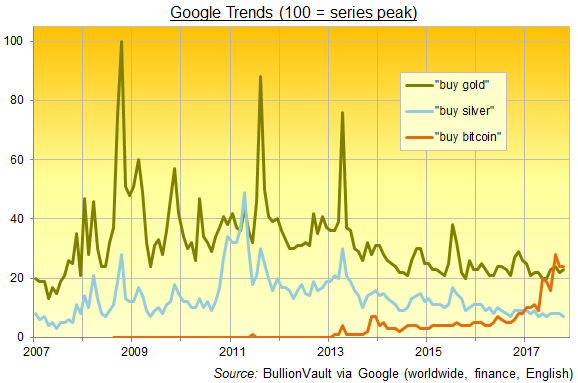

One sign of the bitcoin's burgeoning popularity is the fact that searches for bitcoin are ahead of gold for the first time in Google search trends, according to gold dealing and custody platform Bullion Vault.

Food for the bulls

The pro-bitcoin sentiment was also reflected in research by US venture capital company Blockchain Capital, which found that 30% of millennials (18 to 34-year-olds) would prefer to invest $1,000 in bitcoin rather than government bonds or company shares.

However, the study, based on 2,000 people, discovered that 42% of them were "somewhat familiar" with bitcoin and only 4% of millennials have owned or currently own bitcoin.

If only a small fraction of that 30% enters the market it suggests the current 'mania' - as many financial commentators describe the interest in the new crypto asset class - has much further to run.

Although Blockchain Capital has a commercial imperative to attract consumers to cryptocurrencies, the findings ring true when considered alongside the evidence of young people turning to crypto trading and investing on the new breed of apps such as Trading 212 and Bux and on crypto exchanges.

The positive view of bitcoin and other digital currencies among millennials reflects the well-documented lack of trust in banks, and other financial institutions, by a generation that has grown up in the shadow of the 2008 financial crisis.

The crypto naysayers in financial services may well be missing a trick by foregoing the chance to lock in the loyalty of this important segment of the population.

At the time of writing the author had a long position in Bitcoin Cash and a short position in bitcoin.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.