Five 'value' trusts that invest against the crowd

22nd November 2017 09:18

by Helen Pridham from interactive investor

Share on

There is no perfect way of picking the best shares. Certain investment styles come into fashion and then fall out again. So, when it comes to choosing investment trusts, it is a good idea to hold a mixture of trusts run by managers with different investment philosophies.

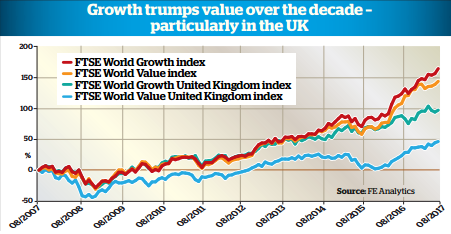

But it is difficult not to be influenced by recent past performance. Since the global financial crisis, growth investing has flourished, while those managers taking a contrarian, value oriented approach have suffered a period of underperformance, even though their long-term records are often excellent.

Now there are signs that the cycle is turning back in favour of the value investment style again, so gaining exposure to trusts managed in this way could pay off handsomely.

There are relatively few trusts run by true contrarian managers. Investing in out of-fashion companies and sectors that the rest of the market doesn't like is not an easy option, and investment managers - as well as investors - have to be prepared to hold their nerve.

However, those trusts that are most frequently mentioned as falling into the contrarian category by investment trust experts at brokers such as Canaccord Genuity, Numis and Winterflood are spread across a number of different sectors.

In the global growth sector, and are mentioned, while in the UK equity income sector the names of and come up.

In the UK all companies sector, is cited as an example, while is mentioned in the UK smaller companies sector.

Taking a global approach

Scottish Investment Trust adopted an explicitly contrarian approach to help set itself apart from other global growth trusts, following the appointment of its new investment managers Alasdair McKinnon and Sarah Monaco in 2015.

They argued that following the herd tends to work against the best interests of investors, so a different stance was required to make profits.

Their stance is that markets have a tendency to concentrate too much on past performance, so that fashionable companies eventually become overvalued and unfashionable companies become undervalued.

In order to avoid this mindset they decided to adopt a contrarian point of view. Their approach is to focus on three types of company.

First, there are those which they describe as 'ugly ducklings' - unloved shares that most investors shun.

These are companies that have been through an extended period of poor operating performance and whose prospects continue to appear uninspiring.

The managers see these companies' out-of-favour status as an opportunity if they believe these businesses can stage a surprise recovery.

Moreover, such companies often have a higher than average dividend yield, which can provide an attractive income in the meantime. A recent example they cited was their investment in .

The second category consists of companies where 'change is afoot'. These are companies that have seen a significant improvement in their prospects, but it has yet to be recognised by the market because investors are unwilling to give credit for the change that has taken place.

Thirdly, there are stocks with 'more to come'. Unlike the first two categories, these companies are generally recognised as good businesses but the managers believe the market does not appreciate the scope for further improvement.

Investment trust commentators have welcomed the clear stance now being taken by Scottish's managers, but as Alan Brierley, head of investment company research at Canaccord Genuity, points out: "It is still early days and the proof will be in the pudding. When you take a contrarian stance, there will be times when it is out of favour. You have to accept periods of underperformance."

But the managers are optimistic. They argue: "A key strength of a contrarian approach is that it provides profitable opportunities in all market environments, as there are always under-appreciated areas of the market."

Looking to the UK for income

UK equity income trust is one of three investment trusts managed by James Henderson, who is classified as having a contrarian investment style by Emma Bird, research analyst at Winterflood Securities.

She explains: "We wouldn't necessarily categorise James Henderson as an out-and-out contrarian investor, but his investment approach tends to lead to portfolios that appear contrarian."

Henderson himself, and Lowland's co-manager Laura Foll, describe their investment style as "mildly contrarian".

They point out: "We often invest at the point at which a company is unloved or out-of-favour, or perhaps just unknown in the case of small companies that are not very well covered by brokers and analysts."

By getting to know companies through meeting the management and making site visits, they find those which they believe will provide strong growth over the long term.

Bird adds: "James Henderson has a notable value bias, looking for good growth opportunities at attractive valuations and focusing on areas of the market that are being ignored by other investors. This has often led to his (portfolios) being positioned in a contrarian way, for example having a significant allocation to mining, basic materials and oil and gas at the beginning of 2016, following a sharp fall in the price of oil and commodities.

"Both and were added to Lowland's portfolio following the suspension of their dividends in late 2015, in anticipation of a recovery in the following three to four years."

Another example of Henderson's willingness to be contrarian is Lowland's focus away from large companies, which is where most income-seekers tend to concentrate their attention. By contrast, Lowland invests nearly two thirds of its assets in small and medium-sized companies rather than stocks.

In the short term this can also affect the trust's performance, but it hasn't damaged its income record.

This year its dividend was increased for the seventh consecutive year. In fact, with one exception - in 2009 when the dividend did not go up due to the financial crisis - Lowland has increased payouts for 41 years since 1975.

is another UK equity income trust with a long record of increasing its income and it now has 33 consecutive years of dividend growth under its belt.

Its manager since 2002 is Alastair Mundy, head of value at Investec Asset Management. He is one of the industry's best-known proponents of contrarian investment.

Mundy's approach to managing the trust is well explained in Temple Bar's annual report and on its website.

He bases his contrarian approach on his belief that a predictable behavioural response among investors is to over-react to bad news which means shares in companies hit by negative headlines tend to drop too far.

By buying them at this stage, his aim is to reap the benefit when the companies' fortunes improve and their share prices bounce back.

Mundy uses three criteria for selecting shares. First, the company must be out of favour and 'friendless', which typically means it has fallen on hard times either for idiosyncratic reasons or due to the market cycle.

He explains: "We come along and try to understand why the shares are out of favour and also why investors were buying the shares three or four years ago and whether the positives they were looking at then could still drive the shares in future."

His second criteria is that the shares must be cheap. He assesses this by calculating what the normal operating profit would be for the company, which enables him to work out a fair share price.

He will only buy a company's shares if he can pay significantly less than this. He typically looks for companies that have seen share price falls of at least 50% relative to the market.

However, Mundy emphasises that it is not just cheapness he wants. His third criteria is that he also wants a balance sheet appropriate for that company. He does not expect it to be pristine or of the highest quality.

"What we want is a balance sheet that will get the company through its difficult periods,"he explains. When the company's shares are fully valued again, he will sell them.

Mundy's strict approach can lead to periods of underperformance as happened in 2014 and 2015 in particular.

In 2016, by contrast, Temple Bar's performance bounced back. Charles Cade, head of investment companies research at Numis, points out that while Mundy has achieved a strong long-term performance record through his approach, "contrarian investing won't always protect you from capital losses", which investors need to bear in mind.

Going for growth

In the case of a UK growth trust, , the clue to its approach is in the name. Alex Wright, who took over the running of the trust in 2012, describes his philosophy as 'value contrarian', which means he is "looking for companies whose potential for share price growth or recovery has been overlooked by the market".

In order to find these unloved, unpopular companies where he believes there is potential for a significant recovery in the share price, Wright looks for businesses on low valuations where there has been some controversy or other issues.

He points out that he is not necessarily looking for the best companies but for those trading below their intrinsic worth where there can be an improvement.

He is also keen to limit the possibility of loss so apart from looking for companies on very cheap valuations, he looks for those with some kind of asset - physical or intellectual - that should prevent their share prices falling below a certain level.

When selecting stock, he says that the first thing he looks for is industry change. He especially likes situations where capital is leaving an industry because returns are poor and profits are bad.

In recent years, he has particularly favoured the financial sector for this reason.

Second, he looks for change happening at an individual company level. He explains: "I particularly like to see new management coming into companies. I think it is very positive for enacting change because it is easier to fix things if you weren't responsible for those problems in the first place."

Once change has come through and a company's valuation is back in line with its peers, Wright will sell out and recycle the money back into more unloved sectors again.

Need for patience

Investors in UK smaller companies generally need to take a long-term view and those investing in , the largest trust in the sector, have needed to be particularly patient over the last three years due to its managers' value style.

But they are sticking to their guns, arguing in a recent report that their "contrarian positioning remains as compelling and as relevant as at any point in the trust's history".

They believe that small UK-quoted companies provide a good hunting ground for value investors as a result of the greater volatility inherent among these companies, the lower liquidity for their shares and reduced information flow.

They point out that valuation anomalies can arise for a number of reasons. It may be the result of temporarily depressed trading due to a weak economy, or poor management undermining an attractive business model or peripheral activities obscuring a strong core business.

However, these forces can be temporary and may be reversed by management action or corporate activity. They are prepared to hold their investments until the value gap closes, which they say takes three years on average.

Aberforth combine their financial and institutional analysis with a valuation approach that focuses on both stockmarket and corporate worth.

In doing so they recognise that flexibility is required when assessing businesses in different industries and that the buyers of these businesses may include other corporates as well as stockmarket investors.

Contrarian value investing has been through a tough time in recent years but the future is beginning to look a lot brighter and investors would be unwise to ignore its potential.

This article was originally published in our sister magazine Money Observer. Click here to subscribe.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.