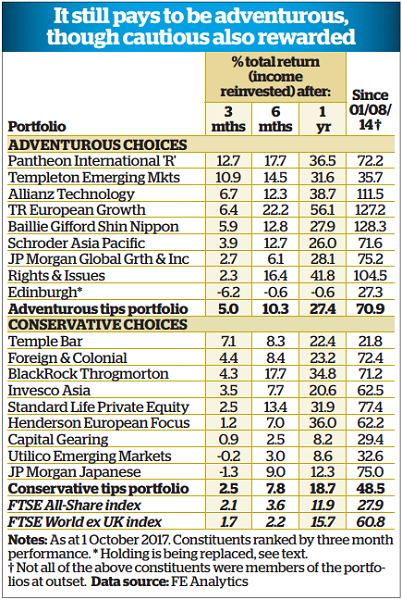

How our 2017/18 investment trust tips are faring

23rd November 2017 11:01

by Fiona Hamilton from interactive investor

Share on

The three months since we introduced our 2017/18 tips ended with excellent news for one of our private equity selections. Not only did report encouraging results, but it also announced proposals to convert its redeemable shares into ordinary shares on a one-for-one basis.

This prompted a rapid tightening of the historically much wider discount on the redeemable shares. As a result their share price total returns have been considerably better than those on PIN's ordinary shares over one and three years, and much the best in the fund of private equity funds sector over the past three months.

We note that leading brokers including Numis Securities, Canaccord Genuity and Stifel all applauded the move, and hope it will lead to a further upward re-rating of the combined ordinary share class.

The structural changes at PIN were all the more welcome because it has been a difficult three months in the market, as evidenced by the and the MSCI World ex UK indices both struggling to hold their own.

Emerging markets have shown some resilience, and our adventurous choice of put in much the best performance of the globally diversified emerging market trusts in terms of both net asset value (NAV) and share price total returns, in no small part due to a greatly increased exposure to technology. The trust continues to look relatively attractive on a double-digit discount.

trust was another top performer in its sector, thanks to a further narrowing in its discount to NAV. Manager Ollie Beckett has achieved exceptional NAV total returns over the past five years and Europe's smaller companies have been reporting greatly enhanced earnings this year.

Elsewhere our better performers included several trusts with defensive qualities, including , and .

Temple Bar is managed with a determinedly valued-oriented approach by Alastair Mundy of Investec Asset Management.

He has found it difficult to find UK equity investments on attractive valuations, which means not only is Temple Bar's gearing entirely off set by holdings of cash and short-dated gilts, but about 5% of shareholders' funds are also in cash.

Mundy expects stockmarkets to be very unsettled as central bankers move to less accommodative policies, but expects any significant increase in bond yields to be a boon for value investors.

, which was our adventurous UK recommendation, had an unhappier quarter. Markets have become very unforgiving when a company disappoints, as a number of EIT's holdings have done, and the trust's relatively high gearing could prove a burden if markets fail to move on up.

We are therefore bringing back as our adventurous UK selection. It is on a similar discount to EIT, has grown its yield faster, and is a useful contrast to Temple Bar because nearly 40% of its portfolio is in smaller companies.

This has helped Lowland to achieve one of the strongest NAV total returns in the UK equity income sector year to date. Managers Laura Foll and James Henderson have been taking profits on successful long-term holdings.

Foll says she and Henderson favour "a mildly contrarian multi-cap approach" and try to avoid value traps.

Around 40% of the portfolio is in companies, headed by , and insurers such as , and . However, unlike many other equity income trusts, Lowland has no exposure to tobacco or consumer staples, almost nothing in telecoms, and a lot in industrials. "We are trying to avoid the potholes and the more expensive areas of the market," Foll says.

This article was originally published in our sister magazine Money Observer. Click here to subscribe.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser