Why we are getting out of China

1st December 2017 17:00

by Ceri Jones from interactive investor

Share on

The UK has had its first rate rise for 10 years, reversing the 25 basis point reduction following the Brexit referendum. Interest rates are always a crude tool, and the Bank of England says it is looking at the potential for inflation rather than the actual level.

It is concerned about wage growth, which in the private sector has topped 3% while the national living wage is impacting the low-paid.

This is a finely tuned call, at a time when a policy mistake linked to the end of quantitative easing and monetary policy normalisation seems the most likely trigger to set off a market correction.

Fortunately, the Bank's Monetary Policy Committee (MPC) is keen to emphasise that monetary tightening will be gradual. Even so, the impact of rising mortgage payments for homeowners could have dire consequences, particularly when the uncertainties of Brexit are added to the mix.

Retail sales fall, debt up

Although November began with some good manufacturing data, the rate rise was no surprise to the City, which was more focused on looking at what the BoE's statement would reveal about future policy.

What is interesting is that nothing much had changed since the MPC last met, apart from retail sales dropping at their fastest rate since the financial crisis, and stores such as issuing warnings about the coming months.

This demonstrates the pressure there already is on UK households - and the rate hike is set to squeeze consumer spending further just as the vital Christmas period gets underway.

The build-up of household debt is worrying. Families now have £1.13 of debt for every pound of savings.

Although it's true that the last time the Bank raised rates, in the summer of 2007, the comparable figure was £1.44 of debt for every pound of savings, the current situation is still fragile.

As usual, the poorest households are more stretched and yet they are the ones who tend to spend on the high street.

The significance of the reversal of monetary easing becomes clear if you look at the scale of the global central bank balance-sheet accommodation.

Since the start of 2008, some $13 trillion of capital has been pumped into markets around the world. The bull run has been a direct consequence of this stimulus.

Low interest rates have paved the way for merger and acquisition activity, capital expenditure and buybacks, which all drive up shares.

In the US, the earnings season has so far confounded most forecasts, with corporations on track to post 10%-plus earnings growth this year and next, sustaining the market's momentum.

The S&P 500 stock index is now trading at 18 times its projected earnings, high but still short of the 30s multiples seen in the dotcom boom.

Many fund managers are therefore ruling out a major collapse, arguing that even a 20% rise this year does not necessarily mean there's a bubble that must of necessity eventually burst.

However, even a rapid 5% fall would equate to carnage for most investors. One danger is that the boost from potential tax cuts by the Trump administration could evaporate very quickly if those cuts fail to materialise.

Happily, president Trump has chosen Jerome Powell, a candidate who is likely to go for a gradual unravelling of monetary easing, to chair the Federal Reserve. As a law graduate, he has not tied his colours to the mast of any one theory, and is likely to take a consensual approach that should result in a gentle hiking.

In the UK, anticipation of the rate hike and its strengthening effect on the pound has already created a shift towards domestically exposed companies at the expense of more international sectors of the market.

One anachronism creating opportunities is that since late 2015 correlations among stocks have been falling, making it easier for active managers to outperform.

In the exchange traded fund market, this has manifest as a boost to smart beta equity strategies that have a skew to an investment theme or valuation metric.

While the market isn't nearly as euphoric as in 2000, there has been the melt-up that typically occurs just before a bull market reverses.

According to Bank of America, in recent weeks global fund managers' cash levels fell to just 4.7% of total assets as they boosted their allocations to stocks to over 55%.

China tightening risk

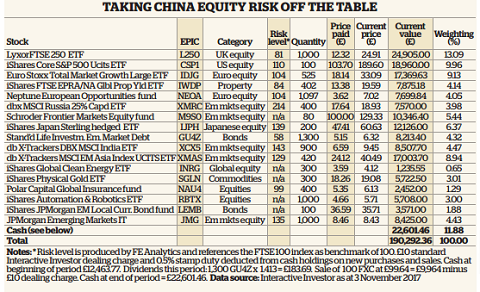

The Chinese economy in particular can ill-cope with tighter credit conditions as its policymakers attempt to contain its overheating housing market, and this could have a knock-on effect on commodity markets around the world.

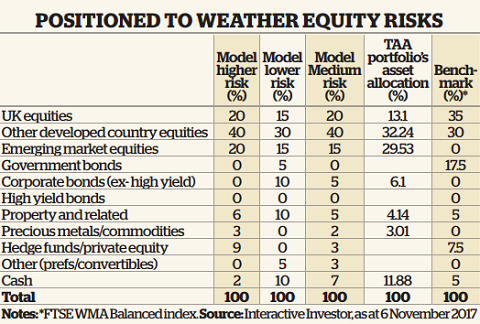

Our portfolio is heavily invested in general emerging markets funds that include big exposures to China, so we are taking profits on our holding.

The 'very gradual' rise in borrowing costs over the next three years signalled by the BoE and the prospect of Jerome Powell at the helm of the Fed could create a short-term opportunity in long-dated bonds, which have priced in faster rate accelerations, but if Trump's tax plan goes through, many more bonds will have to be issued.

Another idea is to invest only in the most liquid investment grade corporate bonds via Goldman Sachs' smart beta ETF, which uses a screen based on operating margin and leverage.

The GS Access Investment Grade Corporate Bond ETF screens out bonds of less than $750 million (£571 million) outstanding or with an issuance size below $2 billion, and sorts the remaining bonds by sector, operating margin and leverage, choosing only the highest-ranking securities. With an expense ratio of just 0.14%, GIGB may be worth considering for the future.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.