Should you buy Haynes shares?

1st December 2017 15:23

by Richard Beddard from interactive investor

Share on

I'm thinking of buying my Dad "Haynes Explains: Pensioners" for Christmas, but should I buy the shares?

Interesting question. is an itch I cannot stop scratching. Terrific brand, which is why these tongue in cheek mini-Haynes manuals are popular stocking fillers, but a dying one, surely.

Dying brand? The first thing I did when I bought my first car was buy the Haynes manual…

Me too. But when was the last time you bought a Haynes manual for your car? I can hardly remember the last time my car went wrong. It needs servicing occasionally, but the dashboard kindly gives me the nod, and Mike the mechanic comes to do it.

Cars are more complicated and more reliable so fewer of us roll our sleeves up. Those that still do, meanwhile, are busy telling each other how to fix their cars in Internet forums.

Hmm… I see. The manuals aren't so popular then?

Generally, they're not. Revenue and profit have been declining for a decade at Haynes, although this year, with the help of the weak pound and an acquisition, revenue and profit improved.

Haynes is selling more motorcycle manuals than it was in 2007 too, but motorcyclists are a different breed. For many, motorcycling is a passion that probably attracts DIY mechanics. For most, driving a car is a method of getting from A to B with the minimum of fuss.

What about about the novelty titles? I saw a big display of Haynes Explains in my local bookshop.

Gearing up for Christmas were they? I did too. I went back a week later and it had shrunk to this:

The disquieting thing is, that shelf is one of thousands. It's a massive bookshop, but it is just one bookshop and Haynes sells more books online than it does in shops these days. The Amazon reviews for the titles published in time for Christmas last year are plentiful and positive.

All I'm saying is the novelty titles might be a fad, Haynes shows no indication that motoring is not the future, so I wouldn't bet on it becoming predominantly a publisher of humorous and lifestyle titles.

So that's it, then. Buy the book, forget the stock?

Well, actually, no, at least I can't seem to forget Haynes. There's more to the company than the books. In fact, after a stuttering start, it's embracing its digital future.

Woah. Digital. That's good. But didn't you say people can get instructions to fix their car free on the Internet?

I did. So, I'm a bit sceptical about OnDemand, it's brand new digital platform. £2.99 for a series of step-by-step instructions to do an oil and filter change for example. Friends who own shares in the company think Haynes will get its videos to the top of the search rankings and people will pay the money knowing they are top notch.

Maybe they're right, but I'm sceptical. I don't think many of us are searching for information on oil filter changes for 2013 Ford Focuses. And payment might be a barrier for those that are accustomed to getting that information for free.

This is Haynes' second attempt at a digital platform for mechanics. It wrote off the first one.

You're really not selling Haynes to me. Tell me something good, or this is going to be our shortest conversation!

HaynesPro. That's the itch I can't stop scratching.

HaynesPro is different in every way. It's a different product. It has different customers. It has different suppliers. It's only digital. It's growing.

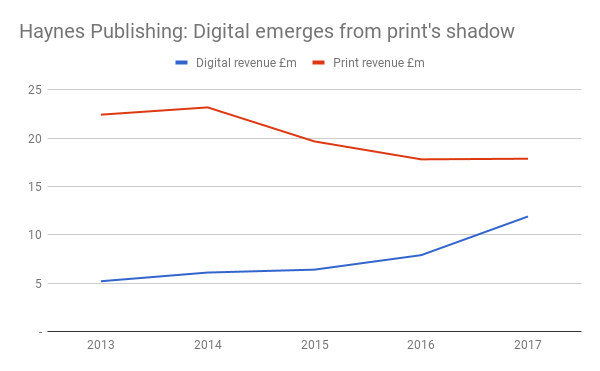

Take a look at this:

Haynes digital, essentially HaynesPro as OnDemand hasn't got off the ground yet, is growing at a compound annual growth rate of 18%.

That's more like it. HaynesPro is growing. What is it?

Workshop data for professional mechanics.

For each manual, Haynes strips down the vehicle and rebuilds it, producing the characteristic diagrams, photos and step-by-step instructions. Professional mechanics must use data from the original vehicle manufacturers, though, to satisfy the warranties. The manufacturers sell the data to aggregators like HaynesPro, who wrangle it into a consistent format and sell it to workshops, as well as parts suppliers who bundle it with their catalogues, and diagnostics companies who bundle it with their tools.

HaynesPro says it's the European market leading repair and maintenance information supplier, and earlier this year it became the only significant challenger to Autodata in the UK when it acquired E-3 Technical.

I see… Haynes has played a clever game. We're more likely to use professional mechanics these days so it's supplying them.

Yep. Haynes has a strong brand in workshops, and once the mechanics have settled on a provider they stick with it.

Aggregating data and matching it to particular vehicles takes considerable effort, which makes things difficult for would-be competitors.

Meanwhile, Haynes has the opportunity to add specialist data sources to its platform, like OATS, a lubricant database, acquired earlier this year. It's marrying the DIY and professional databases, and working with diagnostic companies to incorporate HaynesPro in their tools.

HaynesPro sounds very promising. So what do we think? Is it promising enough

HaynesPro is Haynes' strongest business. It already earns 40% of revenue, and Haynes is focusing investment on it.

Infuriatingly, though, Haynes segments its results by geography. I believe the split between DIY and professional investors is more pertinent to its prosperity.

What we really need to know is how profitable HaynesPro is, but Haynes doesn't say.

Haynes' broker says digital profit margins have always been greater than print profit margins, but there's a lot that's not being said there. Principally, how Haynes and its broker calculate the profit margin.

Since Haynes doesn't tell us tell us how profitable its digital and print operations are, we have to go back to 2007, before Haynes had a digital operation, to see what print margins were. In 2008, it acquired Vivid, the Dutch data company that subsequently became the core of HaynesPro.

Then Haynes earned excellent adjusted operating profit margins of 20%.

So, let's wing it and apply a 20% margin to digital revenue of £11.9 million in 2017 on the assumption that, if digital profit margins have always been higher than print and print have declined from this point on, digital profit margins are probably 20% or higher.

It gives an adjusted digital operating profit of £2.4 million.

That's speculation gone wild, but also potentially significant as it's almost as much as total adjusted profit. If it's true, the print business may barely be breaking even.

I see. Complicated. Should I buy?

You have to believe. A share price of 190p values the enterprise at just over £50 million, or 19 times adjusted profit in 2017. The earnings yield is just 5%. That's a steep price to pay for a company that has shrunk over the last decade.

But let's say you'd be prepared to pay 20 times annual profit for HaynesPro, which has been hidden inside that shrinking company. It is, after all, a digital subscription publisher earning 20% profit margins growing at a compound annual growth rate of 18% for the last five years.

That would value HaynesPro at £47.6 million, about £5 million shy of the current enterprise value of the whole group. That £5 million buys you two businesses, both with uncertain futures: The print publisher, and a consumer video startup for an extra £5 million.

I'm too uncertain. There are too many moving parts, and there is not enough information on them.

And I haven't mentioned the yawning pension deficit, and massive restructuring in which Haynes has outsourced printing and distribution, and sold off property and equipment to fund a digital and much smaller print drive.

It's put a strain on my ability to interpret the accounts, but I'm sure I'll be back next year to scratch that itch.

Contact Richard Beddard by email:richard@beddard.net or on Twitter: @RichardBeddard.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.